Most of us may have thought everything other than Bitcoin is usually referred to as an altcoin, but you’ve missed something called Ordinals. While the crypto world often calls any non-Bitcoin project an “alt,” Ordinals challenge this by existing within the Bitcoin ecosystem. They’re not a separate coin or chain; they’re an innovative way to add uniqueness to Bitcoin itself. Let’s dive in deeper.

What are Ordinals?

Ordinals operate through a protocol called Ordinal Theory, which assigns sequential numbers (ordinals) to satoshis in the order they are mined. The first Satoshi ever mined gets ordinal number 0, the next 1, and so on, up to the 21 trillion satoshis that will ever exist.

To create an Ordinal, there should be some data inscribed onto a satoshi using a transaction in Bitcoin. This is made possible by Bitcoin’s SegWit and Taproot upgrades, which have increased the amount of arbitrary data that can be included in a transaction (up to about 4MB per inscription). The inscription attaches the data permanently to the satoshi, making it trackable and transferable as part of Bitcoin’s feature called as UTXO (Unspent Transaction Output) system.

How do Ordinals work?

Ordinals operate through a protocol called Ordinal Theory, which assigns sequential numbers (ordinals) to satoshis in the order they are mined. The first Satoshi ever mined gets ordinal number 0, the next 1, and so on, up to the 21 trillion satoshis that will ever exist.

When you send a ready inscribed Satoshi, it moves like regular BTC, but the inscribed data travels along with the BTC. Wallets and marketplaces compatible with Ordinals, such as Magic Eden or Ordinals Wallet, recognize all these inscriptions, allowing users to buy or sell or even hold them as unique items. So, no new tokens are minted; it’s all powered by BTC fees and the Bitcoin network’s consensus rules.

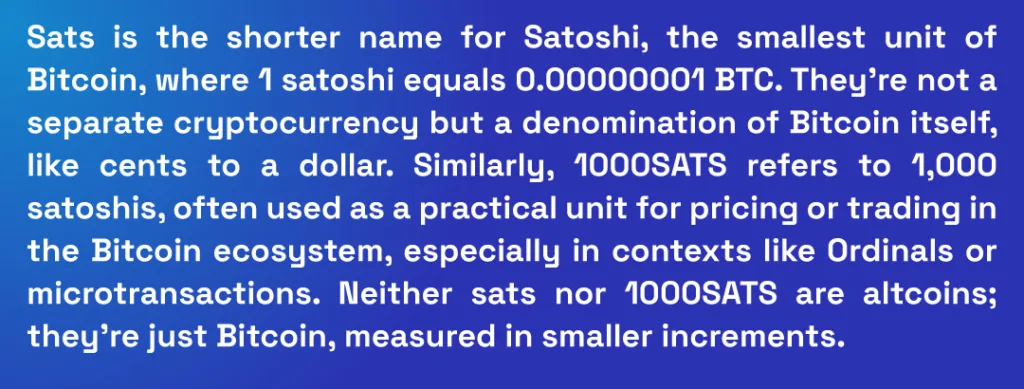

What about Sats and 1000SATS?

Why is it not an altcoin?

Ordinals are not called any altcoin because they don’t introduce as some new crypto or operate on a separate blockchain. They’re fully integrated only within Bitcoin. Altcoins are alternatives to Bitcoin by definition. But protocols like Ethereum, Solana, or Cardano, which have their own native tokens, blockchains, and often different consensus mechanisms, are called altcoins

Ordinals uses Bitcoin for transactions, and it simply relies on Bitcoin’s Proof-of-Work security model. There’s no such thing as an “Ordinal coin” or an Ordinal token; the value and functionality come from enhancing satoshis within the existing Bitcoin protocol. This makes them look like a layer or feature on Bitcoin, without creating an altcoin.