Crypto investors chase altcoins lured by their potential to change fortunes overnight. Indeed, the world has heard countless stories of a dog-themed memecoin turning someone’s $100 into $1 million in a matter of weeks. Or a smart contract token skyrocketing by 400% in two days, courtesy of the project’s partnership with a tech giant.

However, not all altcoin stories have an enviable end. In fact, the vast majority of altcoin chronicles end in misadventure, leading investors to lose a significant chunk of their portfolio when an altcoin’s price collapses. In 2025, the number of altcoins in the market ranges in millions, across several verticals such as smart contracts, real-world assets (RWAs), decentralized finance (DeFi), non-fungible tokens (NFTs), and others.

In this Learn article, we will delve deeper into what makes for a well-diversified altcoin portfolio. A diversified altcoin portfolio can be the difference between an underperforming bag of coins versus coins that can offer extraordinary returns in a short period of time.

Understand your risk profile

The first step is to estimate your propensity for risk. Are you someone who seeks risk? Or are you a risk averse investor? If you enjoy trading volatility, how much volatility is excessive for you? If not, are you fine with average gains?

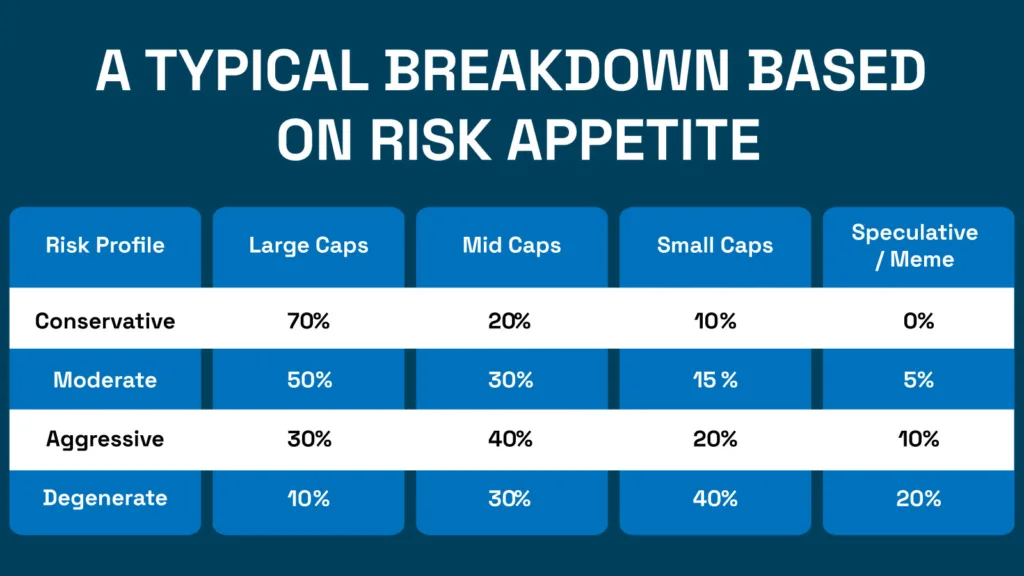

Investors can be divided into four categories based on their risk appetite – conservative, moderate, aggressive, and degenerate. If you’re a conservative investor, only invest in large-cap altcoins such as Ethereum, XRP, Cardano, Solana, and the like. Moderate investors can consider adding a couple of mid-cap coins such as Avalanche, Sui, and Uniswap.

Things start becoming riskier once you enter aggressive investor territory, as these portfolios typically include fewer large-cap coins and are mostly concentrated into mid-cap coins and a few small-cap coins. One way to identify small-cap coins is to look at the coins list on websites like CoinMarketCap or Coingecko. Coins with a market cap of less than $100 million qualify for small-cap coins.

Finally, there is the degenerate or speculative class of investors. At this point, you’re essentially gambling with your money, so only put the amount you’re absolutely fine with losing. These investors spend most of their time on Discord servers of new projects or parlaying their USDT on decentralized exchanges, hoping to catch the next Shiba Inu in its infancy.

Invest across different domains

To achieve diversification in your altcoin portfolio, having altcoins from different industry verticals is essential. Envision your final altcoin portfolio as a freshly-baked pizza with layers of toppings.

Just one topping is fine too, but it will probably not excite your taste buds too much. To generate huge returns – or taste, if we consider the pizza analogy – volatility is essential. As a result, consider adding altcoins from different verticals in your portfolio.

For example, you can add the leading Layer-1 blockchain coins like Ether, SOL, and ADA. Compliment these with some ecosystem-specific Layer-2 tokens, such as ARB, or OP from the Ethereum ecosystem.

For greater variety, season it with DEX tokens such as UNI, SUSHI, BNT, coupled with AI, infrastructure, gaming, and memecoin tokens for that extra variance that can benefit your portfolio when the industry catches a sector-specific narrative.

Similar to how you approach risk profile, investing across different verticals can also be segregated into various classes, such as conservative (2-3 coins), moderate (4-7 coins), aggressive (8-10 coins), and maxi (10+ coins). Remember to invest in multiple sectors, not just multiple coins.

Evaluate what you are adding

This one is pretty much self-explanatory. Thoroughly research the coins or tokens that you are considering adding to your portfolio. Don’t be tempted by the latest shiny coin in the market that has already surged 1300% in the last 4 days.

Perform some basic checks about the coins’ utility, team background, tokenomics, social media chatter, and the like. Pay attention to whether the industry vertical the coin is targeting is witnessing a higher developer and user interest.

For example, you may lose out on potential gains if you add a DeFi token when the crypto industry is riding the metaverse narrative. To learn more about what factors to consider when researching an altcoin, feel free to check out Altcoin Desk’s previous Learn article.

Rebalance the portfolio when required

A key element of a successful portfolio diversification strategy is not to get attached to the investments. In an altcoin portfolio’s context, it means to not to get too emotionally invested in a single coin or token just because you believe in its ‘potential.’

Always keep your emotional biases separate from the coin or token’s price performance. If one altcoin performs extraordinarily well, consider locking in the profits by selling a portion of the holdings. Rebalancing essentially means to sell a part of your holdings without exiting the market.

Besides securing your profits, rebalancing your portfolio can also help you avoid brutal losses. Consider a scenario where you see an industry narrative like DeFi, NFT, and AI, reaching euphoric levels. If you have a habit of periodically rebalancing your portfolio, then you probably identify the excessive optimism surrounding the narrative and sell the relevant coins at breakeven price or even at a small loss, to avoid a significant loss.

Pitfall to avoid – over-diversification

One of the most common mistakes crypto investors – both newbies and seasoned ones commit is to over-diversify their portfolio. Resist the temptation to buy 10 coins or tokens of the same vertical. While holding too many coins may give an illusion of ‘safety’, it actually ends up diluting your potential gains.

For example, imagine Joe has a small altcoin portfolio of four coins, totaling $100. His holdings include Ether, Solana, Uniswap token and Apecoin, with $25 allocated to each. Now, if the crypto market is following the DeFi narrative, then you may expect UNI to jump by 100% over a month.

Consequently, the value of the portfolio after a month will be close to $125. Now, assume Joe had 8 coins and tokens in his portfolio, each worth $12.5. In this case, despite the price of the UNI token appreciating by 100%, the final value of the portfolio will only be $112.5.

In the above example, we see that Joe lost out on an additional $12.5 by over-diversifying. It proves that merely holding a high number of coins in your portfolio is not necessarily beneficial. More tokens means more maintenance, more research, and more things to worry about, so always focus on quality over quantity.

Conclusion – maintain a portfolio log

Staying true to the strategies discussed above will help you diversify your portfolio to a decent level. An excessively conservative portfolio could be disastrous if one token records a significant price decline. Too speculative a portfolio could lead to greater losses if one sector suffers more relative to others.

Also, do not copy and trade others blindly. Always have your own strategy, and stick to predetermined entry and exit points. Don’t get attached to a well-performing coin for ‘another 2x,’ because it most likely won’t achieve that. Instead of chasing the price, chase your thesis.

Finally, always remember and log the key details of your portfolio. Why did you buy the coin or token that you did? What’s your portfolio thesis? What are the risks associated with the coins and tokens that you hold? What are the coin or token unlock schedules? Do you have an exit plan? To sum it up, plan well, rebalance periodically, and remain focused. In due time, you will be able to turn your altcoin bets into altcoin assets.