Meme coins hold a new and unique place in the cryptocurrency market. While most coins or tokens earn traction due to their utilities or supply scarcity, meme coins gain adoption purely based on social media hype and virality. Essentially, meme coins’ popularity is largely dependent on the prevailing market mood.

While this characteristic of meme coins may help them produce extraordinary gains in a short period, it can also work as a double-edged sword; hype can also last for so long. It’s extremely difficult for a token to sustain itself for long without real-world utility, except for exceptions like Dogecoin (DOGE) or Shiba Inu (SHIB).

Since the movement of meme coins is largely sentiment-driven, the key to making a successful meme coin trade becomes more about risk management than about higher user adoption or new features. As a result, it’s imperative for investors to know where risk originates and how it evolves throughout a market cycle.

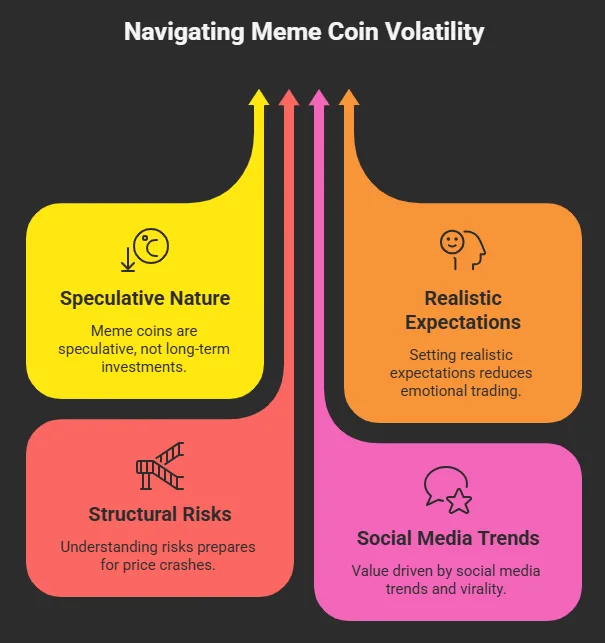

Understanding the structural risks of meme coins

The first step when trading meme coins is to think of them purely as speculative instruments rather than long-term investments. This helps set realistic expectations and reduce emotion-driven decision-making for investors.

By recognizing the structural risks of meme coins, investors are better able to anticipate and prepare themselves for any unanticipated price crash or market rout. As mentioned earlier, meme coins generate value through social media trends and virality, instead of any technological innovation.

Due to this, the price discovery of meme coins is inherently unstable. While such cryptocurrencies can inflate in value rapidly through sustained high capital inflows, they can deflate and fade into irrelevancy just as fast as the community and large holders move on to the next meme coin gaining momentum.

Managing capital risk and position sizing

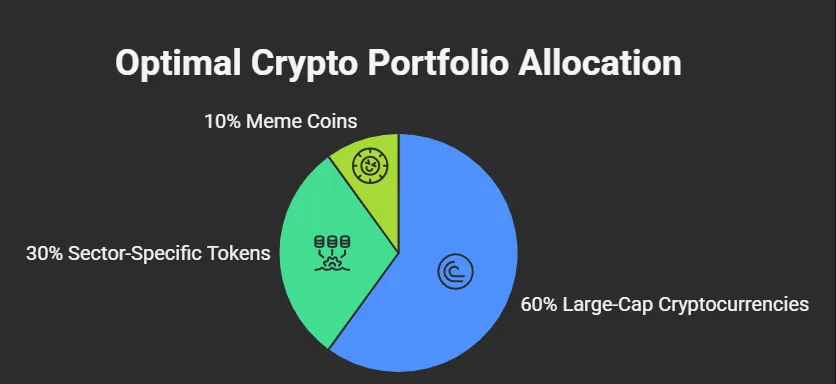

Another key factor to consider when trading meme coins is to see how much capital out of your portfolio you’ve allocated to such digital assets. A healthy portfolio should have minimal exposure to meme coins, perhaps only as high as 10% of the total portfolio value, as their high volatility makes them unfit for high portfolio allocations.

A portfolio’s odds of survival largely depend on how much capital is invested in what kind of assets. In crypto’s context, the majority allocation should ideally be toward large-cap cryptocurrencies like Bitcoin, Ether, and Solana. This can be followed by sector-specific tokens like Chainlink, Render, BNB, and others. Finally, allocate just about 5% to 10% to meme coins.

Such a portfolio composition ensures that a loss in a single cryptocurrency’s price doesn’t have an outsized impact on the performance of the overall portfolio. Essentially, the goal is not to avoid losses altogether but to minimize their impact in such a way that it doesn’t hinder an investor’s ability to continue trading.

Meme coin liquidity risks

Liquidity often goes unnoticed under the radar when investors consider putting money into a meme coin. Since most meme coins have a relatively short shelf life, they trade on thin liquidity and order books, where slightly large buy or sell orders can lead to large price swings.

As a result, an illusion of strong momentum arises during rallies. However, when the meme coin crashes along with the rest of the market, it declines harder than the large-cap altcoins, with price pullbacks as high as 40% fairly common in 24 hours.

Before entering meme coin trading, it’s important for traders to assess the token’s trading volume, liquidity, and order books. By knowing these metrics better, investors can differentiate between a meme coin that may become the next SHIB and one that fades into obscurity.

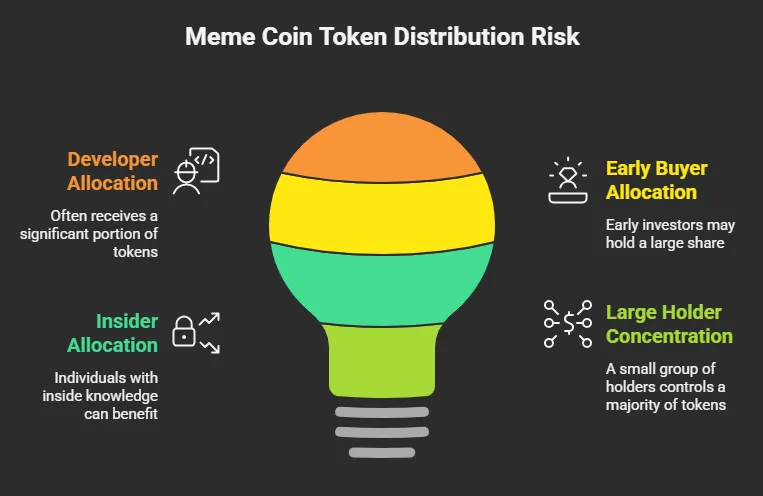

Token distribution risk

Token distribution risk is real when it comes to meme coins. Since most meme coin launches are fairly recent, they tend to have heavily skewed token allocations, often benefitting developers, early buyers, and insiders. As a result, the concentration of meme coin ownership among the so-called large holders is high.

As a result, meme coin prices can crash in an instant if a large holder liquidates their holding. Due to thin liquidity, price movements can be extremely erratic, leading to enormous losses for holders if they’re not vigilant enough to track token movements across large holders’ wallets.

Further, new meme coins tend to face rapid price appreciation after launch, followed by a prolonged period of continual price decline or consolidation once they get listed on centralized exchanges. Consequently, traders or investors who enter a meme coin trade later end up facing higher risks.

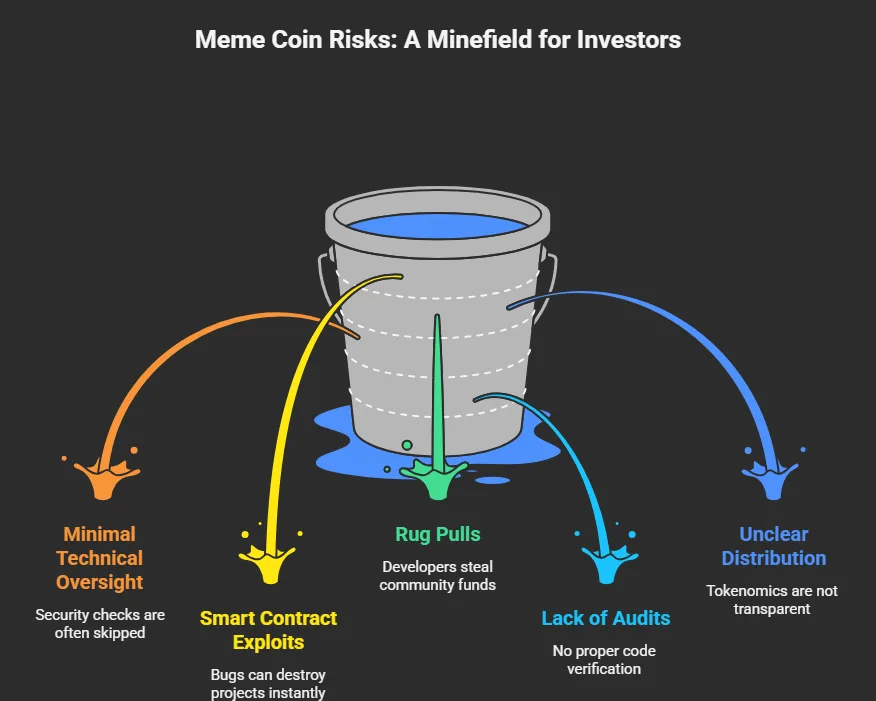

Higher smart contract risks

Unlike infrastructure or smart contract platform tokens that undergo heavy security checks and audits, most meme coins launch with minimal technical oversight. Risks unrelated to market actions, such as smart contract exploits, bugs, and other technical attack vectors, can destroy any meme coin project in an instant.

In addition, rug pulls, or malicious attacks by the developer team on its community, are fairly commonplace in the meme coin space. Investors keen on investing in meme coins should try to understand the project’s underlying smart contracts’ code, check whether they have been audited properly, and check the token distribution schedule.

While smart contract-related risks can never really be totally eliminated, knowing about them increases transparency for investors and helps them manage them effectively. Understanding the technical structure of a meme coin project performs as an additional important layer of protection for investors.

Using trade management skills

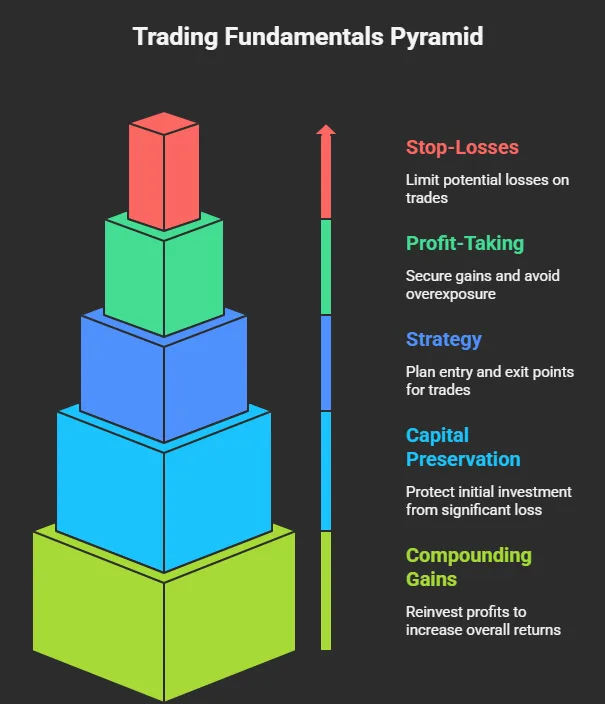

No matter what asset you buy, the importance of trading fundamentals remains the same. The same applies to meme coins. Stop-losses, profit-taking, and having a strong entry-exit strategy help investors stay on course and avoid emotion-driven trading.

Instead of trying to capture the entire price movement, many experienced traders focus on preserving capital and compounding smaller gains over time. In meme coin markets, survival across multiple cycles matters a lot more than maximizing returns in a single trade.