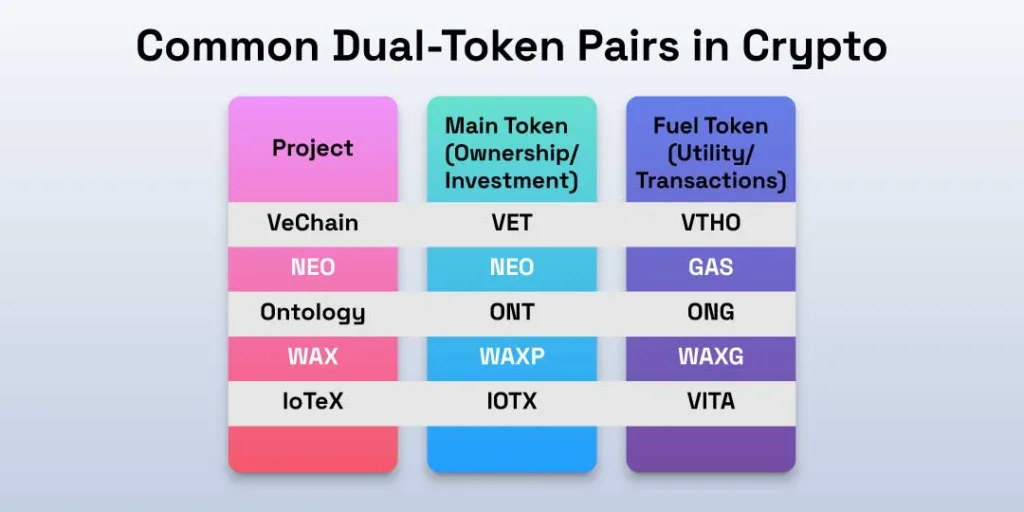

Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have been the usual suspects. But then again, you see token pairs like VET/VTHO and wonder, what are these, and what do they even mean? Don’t worry! It’s not as hard as it looks.

Think of it like a car. One token is the car itself; it holds long-term value. The other is the gas; it’s used for everyday actions like making transactions or running apps.

Many investors only look at the first token. But that’s a mistake. The second token, often called the “utility” or “gas” token, is what powers the network. If the blockchain gets busy, demand for this second token can rise. In many cases, holding the first token even earns you the second one over time, like a reward for being a supporter.

If you’re only paying attention to the main token, you are leaving money and opportunity on the table. Let’s break down why.

Your key to understanding token pairs

Imagine the token pairs as your favorite theme park. You buy a season pass. This is your golden ticket to the club. It’s a long-term investment that says, “I’m here, I belong, and I believe in this place.” This is your first token.

But! You can’t just flash your pass and hop on the biggest roller coaster. For that, you need tickets. These are what you use for every single ride, game, and snack. They keep the lights on and the rides running. This is your second token.

And that, right there, is the secret sauce behind crypto’s dynamic token pairs.

The Season Pass Token: This is your key to ownership, governance, and investment. It’s your stake in the future.

The Ride Ticket Token: This is the workhorse! It’s spent to power transactions, run apps, and fuel the entire ecosystem every single day.

One is for buying in; the other is for using. It’s a perfect partnership

Real-world examples: It’s not just theory

Major projects have built entire ecosystems on this foundation, and not just some abstract concept.

- VET and VTHO

Take VeChain (VET/VTHO). VET is the ownership token. Holding it is like believing in the future of VeChain’s global supply chain technology. But the network doesn’t run on VET. Every time a company verifies a product or moves data, it pays a fee in VTHO. Holding VET automatically generates VTHO for you, the holder. It’s like your deed pays you in a steady stream of ride tickets.

- NEO and GAS

Then there’s the classic, NEO (NEO/GAS). Often called the “Chinese Ethereum,” NEO represents your stake in the network. But to deploy a smart contract or make a transaction? You need GAS. By simply holding NEO in a compatible wallet, you earn GAS over time. Ignoring GAS is like owning a dividend-paying stock and throwing the dividend checks in the trash.

Why the “utility token” demands your attention

This is where most retail investors make a critical error. They see the second token as an afterthought. I see it as the pulse of the network.

- Utility Drives Demand: The value of the utility token is directly tied to network usage. If a blockchain like VeChain sees a surge in enterprise adoption, the demand for VTHO to power those transactions will skyrocket. This can happen independently of the price of VET. It’s pure supply-and-demand economics in its simplest form.

- It’s Free Cash Flow: In many of these systems, holding the primary token generates the utility token passively. This is a real yield, paid in a native asset that the network itself needs to function. It’s a powerful incentive mechanism for long-term holders.

- Divergent Price Action: The two tokens can have completely different price movements. While the main token might trade on broader market sentiment, the utility token can spike based on a sudden surge in on-chain activity. This provides a unique hedging and profit opportunity within a single project you already believe in.

The bottom line: Don’t read half the story

The token pairs are a proven, effective design showing that the crypto world is filled with innovative economic models. Projects like Ontology (ONT/ONG) and others continue to use this model for its clarity and efficiency.

When you evaluate a project with a two-token system, you must look at both assets. The first is the visionary, the bet on a future. The second is the workhorse, the proof of that future happening right now.

Understanding this relationship is what separates a casual observer from a savvy investor. In my years, I’ve learned that the biggest profits often come from seeing the value that everyone else overlooks. And right now, that value is frequently hiding in plain sight, in the second token.

Always remember: This is not financial advice. It is essential to do your own deep research before making any investment decisions.