In a recent post on X, CoinGecko shared its list of the top 10 crypto protocols by revenue in 2025, offering insight into where meaningful economic activity is emerging across the digital asset space. Unlike rankings based on token prices or market capitalization, the list focuses on protocol level revenue generated throughout the year 2025.

Rankings are based on total protocol revenue generated between January and December 2025. Revenue includes earnings and protocol fees, but not base layer blockchain revenue. CoinGecko gets the data from Token Terminal and DeFiLlama, puts it all together, and shares it.

Tether

According to CoinGecko’s 2025 Annual Crypto Industry Report, Tether made about $5.2 billion in protocol revenue in 2025, making it the most profitable crypto business of the year. The figure represents 41.9% of revenue across 168 tracked protocols, reflecting strong demand for USDT as a settlement and liquidity asset. According to CoinGecko data, USDT held around 60.1% of the global stablecoin market, or roughly $187 billion of the $311 billion total supply.

In 2025, Tether increased its exposure to real-world assets beyond stablecoins. For example, Reuters confirmed that the company bought a lot of gold. This includes XAUT, Tether’s gold-backed token that shows that you own physical gold that is being held in custody. But estimates of XAUT’s $2.2–$4 billion market cap and its reported dominance in tokenized gold are based on issuer disclosures and aggregated market reports, not on independent verification.

Circle

Circle strengthened its profile in 2025, following its NYSE debut under ticker CRCL, where it raised over $1 billion at a $31 opening price, according to public SEC filings and NYSE disclosures. The company reported about $740 million in revenue and reserve income, according to its Q3 2025 earnings release, while USDC circulation climbed to roughly $73.7 billion and on chain transaction volume reached trillions, reflecting broad usage beyond trading.

Circle also grew the Circle Payments Network to include institutional settlement rails and benefited from clearer U.S. stablecoin rules under the GENIUS Act. This strengthened its position as a regulated stablecoin issuer and payments infrastructure provider.

Hyperliquid

Hyperliquid ranked third in 2025 as protocol revenue surged alongside record perpetuals trading activity. The total amount of trading volume reached $3.6 trillion, and the amount of open interest peaked at about $16 billion, generating over $800 million in revenue per year. According to industry reports, fee-funded HYPE buybacks and burn proposals directly tied trading activity to sustained revenue growth.

Pump.fun

Pump.fun generated substantial fees in 2025 from meme-token launches, but revenue momentum weakened as legal pressure intensified. Several class-action lawsuits accused the platform of selling unregistered securities and manipulating the market, raising concerns about how trading activity and fee revenue might look in the future. However, growing regulatory pressure is now putting its future revenue in question.

Ethena Labs

Ethena Labs saw steady revenue growth in 2025 as USDe adoption expanded across major distribution channels. Fees from yield products and stablecoins climbed as Total Value Locked or TVL topped $13 billion. Incoorporate Binance and the TON ecosystem increased the protocol’s recurring revenue.

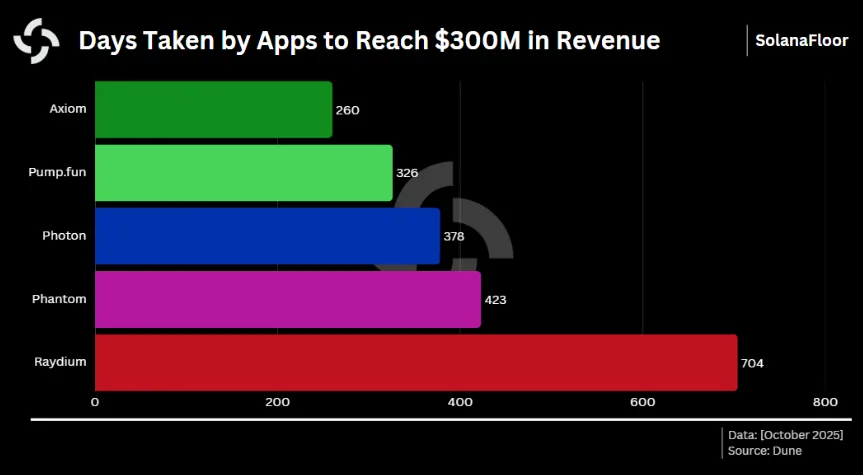

Axiom Exchange

Axiom Exchange had a revenue pump in the year 2025. Becoming one of the fastest platforms to cross $300 million in cumulative fees. High-volume Solana trading activity drove rapid month-over-month revenue acceleration following launch. SolanaFloor says that Axiom’s high fees in the Solana ecosystem were mainly driven by the high volume of daily transactions.

Sky Ecosystem

Sky Ecosystem earned revenue in 2025 as the USDS supply increased by 86%, surging to nearly $9.9 billion. Global Fintech Series reports that annualized protocol revenue reached $435 million, supporting over $90 million in token buybacks and rewards, all paid for directly from fees. This supports a revenue model that puts sustainability first.

PancakeSwap

PancakeSwap recorded peak revenue levels in 2025 as trading volumes surged across multiple chains. The introduction of Tokenomics 3.0 redirected protocol fees toward buy-and-burn mechanisms, directly linking higher usage to reduced token supply. This connected more use on those limited tokens. PancakeSwap’s official blog says that record monthly volumes led to higher fees being charged in a structural way.

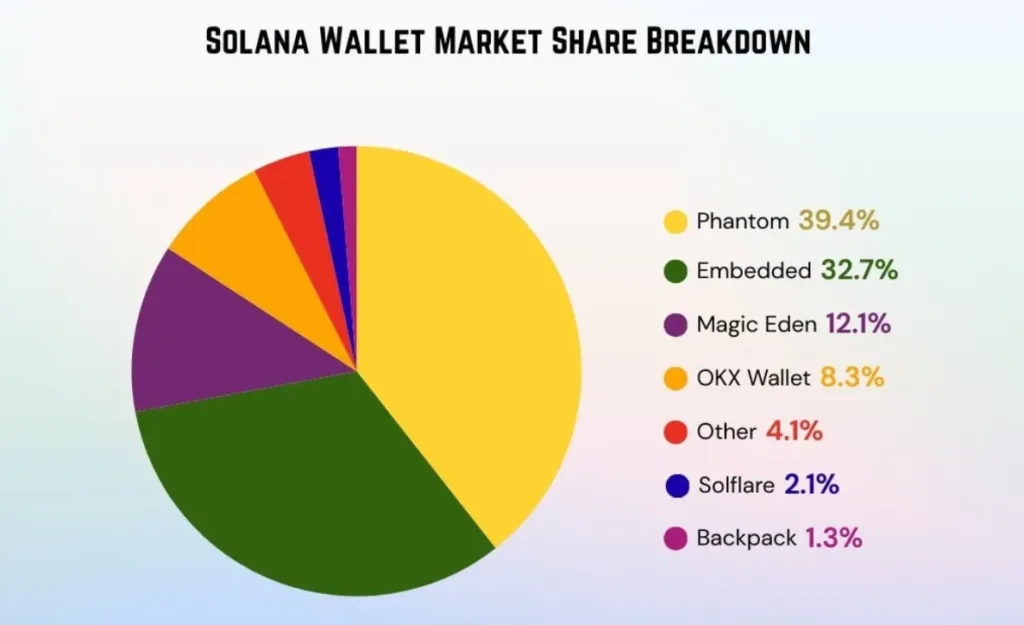

Phantom

Phantom’s 2025 revenue growth was driven by increased in-app swaps and trading activity during Solana market surges. Fee increases happened when users were more active, not just once. According to CoinLaw, expanding trading integrations significantly increased revenue per active user.

Aerodrome Finance

Aerodrome Finance solidified its role as Base’s leading DEX in 2025, as swap fees overtook emissions, helping revenue grow. Buybacks could keep happening, and net revenue could grow because trading volumes and liquidity depth were higher. DWF says that Aerodrome’s dominance on Base led to stable protocol income.

CoinGecko’s 2025 revenue rankings highlight a maturing crypto economy where stablecoins and trading infrastructure form the backbone of on-chain activity. As the industry changes, protocol level revenue is becoming a key way to measure real-world impact, going beyond just market speculation.