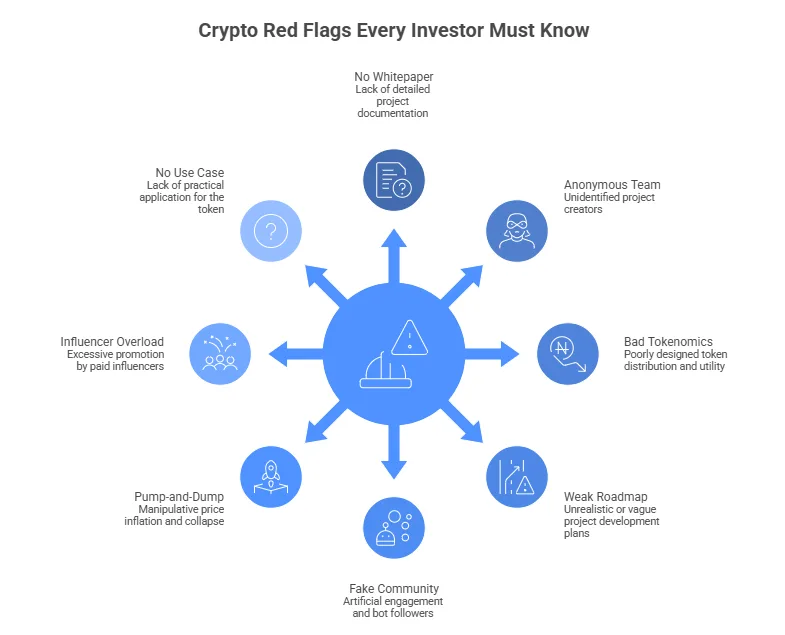

In the crypto world, FOMO is a powerful weapon. New crypto projects launch every day. When a new token is developed, the social hype feed is buried in “To the Moon” emojis. While some projects are useful and genuine, many exist to scam the investors.

For a newbie, everything, the hype, the guarantees, will look promising at first. This is exactly why understanding the top red flags will keep you away from bad investments. Here are the top warning signs that a project is a certified “no-go.”

No whitepaper or just the buzzwords

A whitepaper is what gives clarity to users. It should clearly state what the project is, what problem it is solving, and how it works. Not having a whitepaper should be a clear no, an actual project can easily state what it is building.

A whitepaper is not supposed to be filled with jargon or code. A lack of clarity in a whitepaper is a warning sign. This includes no in-depth explanation and the use of vague or unclear language.

Anonymous Teams

While the Bitcoin founder stayed anonymous, the “anonymous era” is mostly a tool for rug pullers in 2026. If the founders are just cartoon avatars with no LinkedIn, and you can’t verify the history, red flag. Most legit projects have a team that you can actually follow on LinkedIn.

Bad tokenomics

Tokenomics can make or break a project. It’s just a fancy word for how the coins are distributed. You need to check the supply distribution and who owns the most supply.

If the creators or early investors own 50% of the supply with no vesting period (a lock-up time), they can dump their tokens the second the price spikes. Low circulating supply vs. massive total supply is a big red flag from the start.

The roadmap to nowhere

A roadmap shows a project’s schedule, where the project is heading, and how it plans to get there. If the roadmap is just “Phase 1: Launch, Phase 2: Marketing, Phase 3: Moon,” you’re looking at a hype train, not a business.

If they promise to “fix the world’s economy” in three months, they are over-promising to get your money. Projects that are truly building tend to share progress regularly, rather than constantly overpromising their goals.

Fake community building

An X profile of a project reveals all of it, accounts that have changed usernames multiple times and have gained a large number of followers overnight are mostly pretending to be credible.

This is a common tactic for scammers, they buy bot packages for X (formerly Twitter) and Telegram to look “legit.” Engagement with a profile proves it all wrong. If a profile has 100k followers but only 5 likes per post, those are bots.

Aggressive pump-and-dump tactics

If the project feels like a “get rich quick” scheme, run. Projects that focus on price movement over product development mostly rely on hype, not on fundamentals.

Legit projects focus on building value, not shouting about how the price is going to 100x by next Tuesday. Sudden price pumps with no real updates are often followed by a dip, leaving late buyers loose while insiders exit with money.

KOL overload

When a project’s visibility is fully based on influencers promoting, that is a caution sign. When you see 20 different “KOLs” (Key Opinion Leaders/Influencers) tweeting the exact same script at the same time, it’s a paid campaign. These influencers are given free tokens, which they dump on you as soon as their followers start buying.

No clear use case

A project should solve a real problem or serve a clear group of users. Ask yourself: “What problem does this solve?” If a coin exists only to be traded and has no actual utility – like being used for a service or a game – its value is based entirely on hype. Once the hype dies, the price goes to zero.

In crypto, the best and only way to play safe is DYOR (do your own research). Most crypto projects don’t look like a scam at first, they look exciting, hyped up, and full of potential.

That’s what makes these red flags important. Making decisions based on fundamentals will help you in the long term rather than going with the hype. In crypto, patience and research matter more than speed. Missing an opportunity is far better than losing capital to a project that was never built to last.