The crypto industry is no longer just limited to digital assets. Over the past few years, a new sub-class of assets has emerged in the industry – real-world assets (RWAs). In simple words, RWAs are blockchain-based, digitized versions of tangible assets such as real estate, gold, silver, and commodities.

These RWAs bridge the gap between traditional finance and decentralized finance (DeFi) in that they unlock liquidity for a range of assets that are otherwise highly illiquid, such as real estate. At the same time, they function better than mere tokenization of assets since they also offer the benefits of blockchain technology.

Understanding RWA tokens

As mentioned above, RWAs can be thought of as digital representations of real-world assets on the blockchain. Each RWA token can be used interchangeably with one unit of the underlying asset, which can range from a fraction of a real estate unit to a portion of a company’s revenue stream or a precious metal like gold.

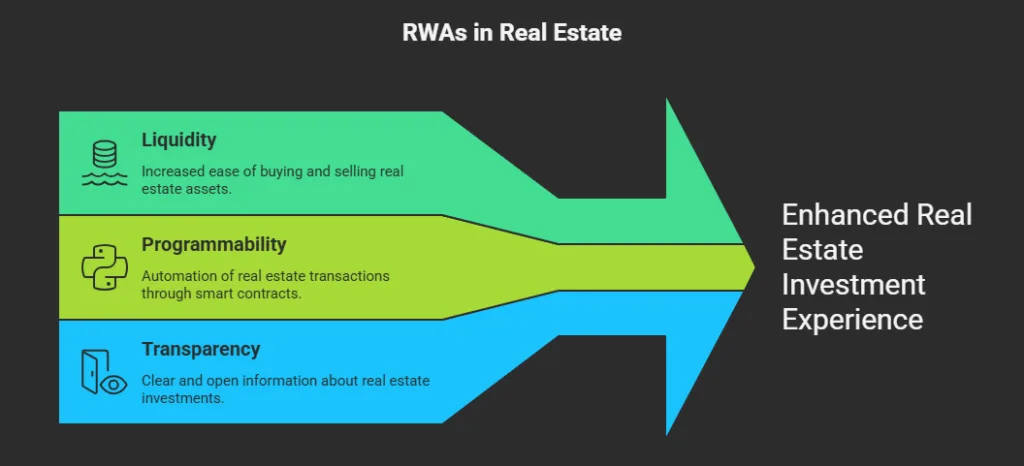

RWAs offer three major value propositions – liquidity, programmability, and transparency. Real estate, as an asset class, often suffers due to its subpar liquidity. Further, real estate-based financial transactions can be slow and opaque, with high barriers to entry for retail investors due to the enormous costs associated with them.

However, by tokenizing a real estate unit, small investors can gain exposure to this asset class without having to face any of the typical challenges. Investors can buy, sell, or trade fractional shares of the underlying real estate.

RWA tokens can be integrated into DeFi protocols, enabling investors to unlock more liquidity by using these tokens for yield farming, providing them as collateral for loans, and other similar uses.

Key reasons behind the popularity of RWA tokens

There are several reasons that can be held responsible for the rising popularity of RWAs. All these factors pertain to the enhanced liquidity, transparency, and programmability that RWA tokens offer that make them more attractive than the illiquid underlying assets.

Bridging the gap between CeFi and DeFi

An increasing number of institutional investors and asset managers are looking for regulated ways to enter DeFi. RWA tokens offer these investors exposure to a familiar asset class, with the advantages of blockchain technology.

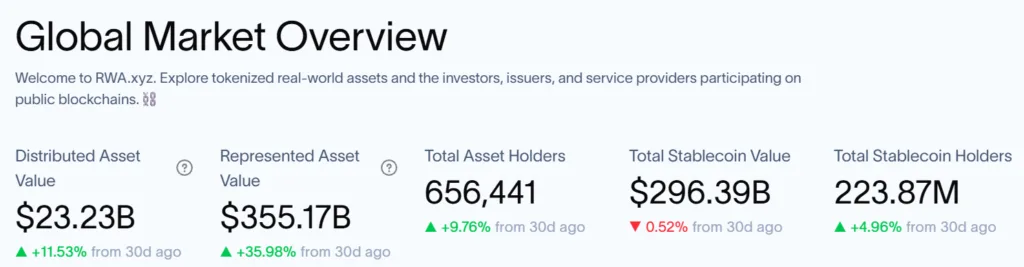

In this way, institutional investors can participate in decentralized markets without disrupting compliance or worrying too much about regulatory oversight. According to the latest data from rwa.xyz, an on-chain RWA token data analytics platform, there are currently more than 650,000 RWA token holders.

Various on-chain yield opportunities

As said earlier, several DeFi platforms are now accepting RWA tokens as collateral for lending or borrowing money. By staking or lending RWA tokens, investors can earn interest or fees, sometimes even higher than traditional savings accounts or bonds.

This has gained attraction from both retail and institutional investors looking for yield in a low-interest-rate environment, especially in the vast majority of developed economies.

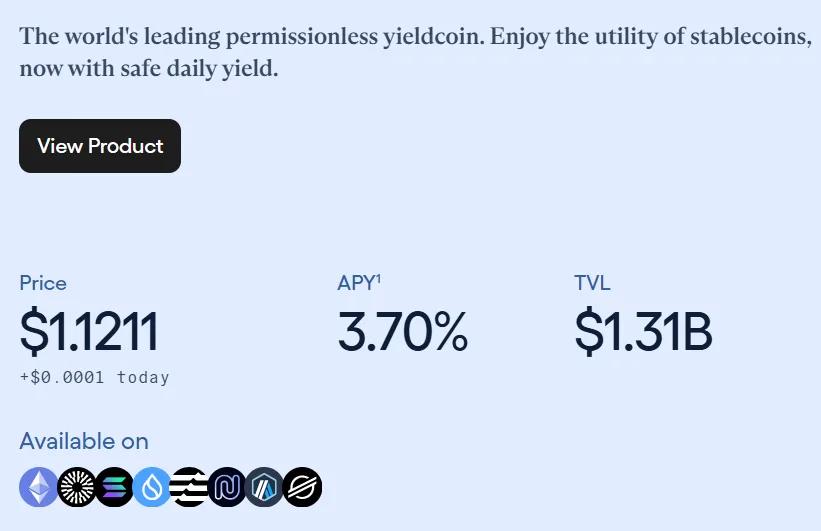

For example, Ondo Finance offers an annual yield of 3.70% on USDY – a freely transferable, yield-bearing token secured by US Treasury bills. In comparison, US-based Chase Bank offers a yield of 0.01% per annum on its standard savings account.

Diversification benefits

The crypto market is notorious for its volatility. There have been countless instances of a token pumping 1500% in a day, only to crash 70% the very next day. The latest addition to this list is the Penguin token, which has skyrocketed by 1400% over the past eight days.

However, by adding RWA-based tokens in an altcoin portfolio, investors can benefit from portfolio diversification. By incorporating assets linked to real-world economic activity, investors can protect themselves from the volatility of the crypto-specific market.

Innovating tokenization platforms

RWA-focused DeFi protocols like Centrifuge, Maple Finance, and Goldfinch are finding new, innovative ways to onboard more RWA tokens into DeFi. These platforms offer infrastructure for tokenizing invoices, real estate, and other similar assets.

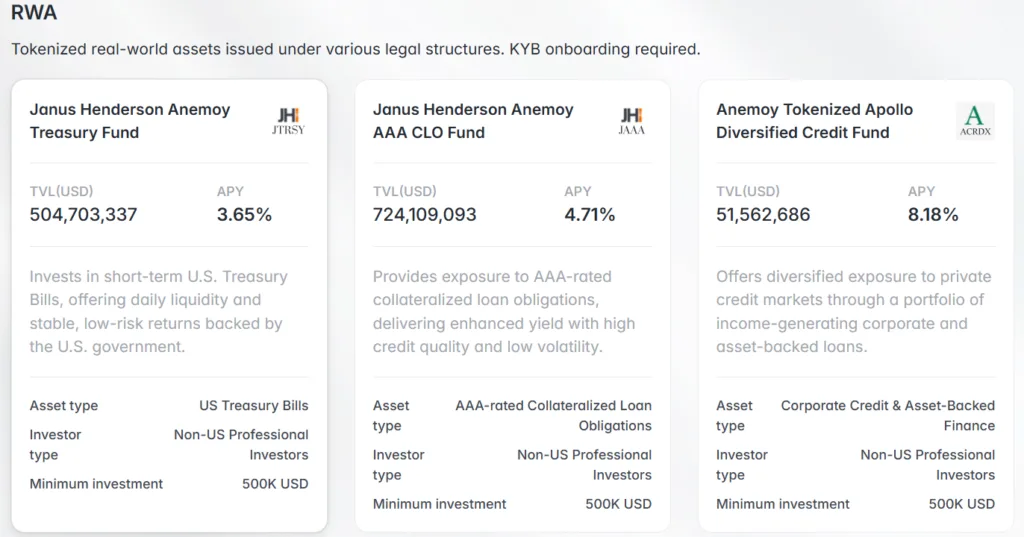

Let’s dive into some of these platforms a little deeper. Centrifuge’s website shows several RWA tokens that give investors exposure to some of the leading Treasury Funds, including the Janus Henderson Anemoy Treasury Fund.

In the same vein, Goldfinch Finance offers investors the opportunity to gain exposure to Private Credit Funds, with annual yields as high as 14.4%. Similarly, Maple Finance allows investors to securely lend their syrupUSDC or syrupUSDT liquid-yielding token, which can generate returns as high as 5.1% per annum.

Major challenges faced by RWA tokens

While the rising popularity and adoption of RWAs is undeniable, confirmed by the billions of dollars’ worth of assets tied to them, there are some challenges that this asset class faces due to its infancy.

High regulatory uncertainty

As is the case with any new or emerging technology or asset class, they are usually under close observation by global financial regulators. Things only become more complex when it comes to RWA tokens, since they function in a mixed regulatory environment of finance, and property.

While compliance is paramount, the fragmented nature and constantly evolving rules across jurisdictions make the scalability of RWA tokens a real challenge. For RWA tokens to hit mainstream adoption, industry leaders will have to work closely with financial regulators and ensure there is a standardized regulatory framework for the asset class across the globe.

Valuation and auditing

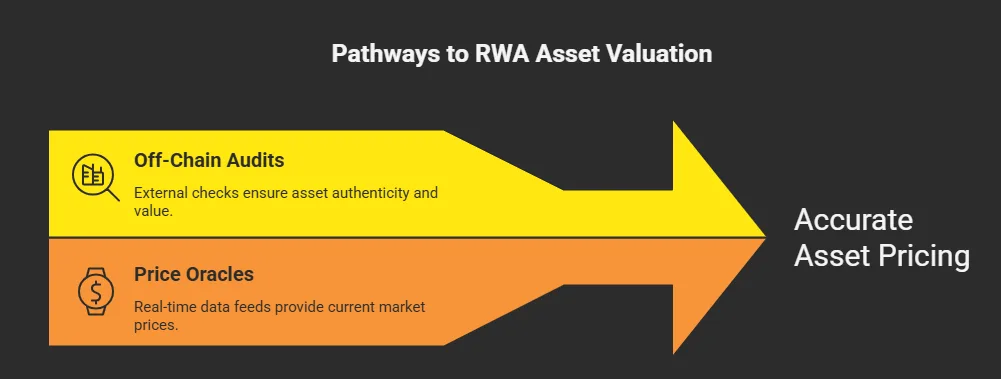

Accurate valuation and auditing of real estate is an enormous challenge in its non-tokenized form, and it only becomes even more challenging when done in the blockchain realm. Investor trust depends to a large extent on the reliable valuation of the underlying asset.

Currently, RWA token issuers primarily rely on off-chain audits and price oracles to know the accurate price of the underlying asset. However, so many layers of checks and balances also bring additional attack vectors.

Liquidity and smart contract concerns

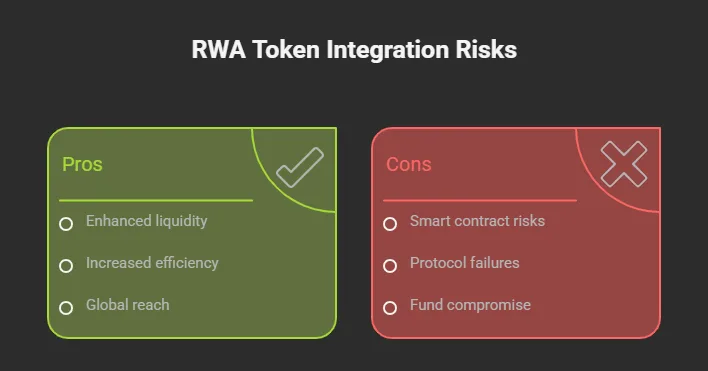

Although RWA tokens are enhancing access to an otherwise illiquid class of assets, they still suffer from low liquidity due to the asset class’ newness and thin market demand. For example, fractional real estate may still face slow settlement times and limited secondary market depth.

Similarly, integration with DeFi protocols exposes RWA tokens to risks typically associated with blockchain-based platforms, such as smart contract exploits, contract bugs, or entire protocol failures. Such mishaps hold the potential to compromise huge sums of funds.

What will be next for RWA tokens?

Despite the above mentioned hurdles, RWA tokens are poised to witness massive adoption in the coming future. Analysts predict that as regulatory clarity improves and tokenization platforms like Maple Finance mature, institutional adoption of RWA tokens will increase in tandem.

At the same time, DeFi protocols are likely to be far more welcoming of RWA tokens, unveiling new, innovative ways through which investors can earn yield on RWA tokens. They will propel further adoption, giving DeFi users a new asset class with which they can borrow and lend synthetic real-world asset products with deeper liquidity pools.

To conclude, RWA tokens show a new asset class that holds the potential to enhance crypto adoption in traditional finance. 2026 and the coming years will see more asset classes represented through RWA tokens, potentially unlocking markets with liquidity ranging in trillions of dollars.