A crypto wallet doesn’t really store coins; it stores control. Wallets are not for storing coins like a physical one. Ethereum, Solana, XRP are not stored in your wallet; private keys are stored the keys that control your funds on the blockchain. Yes, you heard it right, that’s it. You lose the keys, every single one of them, crypto gone, forever.

What is a crypto wallet?

A wallet is a tool that secures the private key, which facilitates users to manage digital assets. A crypto wallet is the only way users interact with the blockchain. Now, being the tool to manage your crypto assets, there exist different types of wallets, all used for one purpose: managing your digital assets. Some wallets offer ease and speed, some are based on how secure funds are for long-term holding, and some are for shared control.

Types of wallets?

To know which wallet to choose is very crucial. This difference affects your control over your digital assets.

Custodial wallets

Here, you don’t actually hold your private key; the third-party exchange does. By creating an account on this, similar to any Web2 service, on exchanges we can manage our funds. These exchanges offer convenience, where if a password is lost, we can easily retrieve our funds. Wallets offered by centralized exchanges like Binance, Coinbase, and Kraken are custodial wallets.

Using a custodial wallet is good for frequent trading of small amounts of money. Here, you are placing trust in the third party, who owns the private key to your funds. Trust in the custodian is required. We are not in full control of our own funds. If the exchange holding your funds goes under, you can lose your funds. It does not support the idea of crypto, where “not your keys, not your coins” is a foundational crypto maxim.

Hybrid custodial wallet

It is a mix of a custodial wallet (where the third-party company holds the private key) and a non-custodial wallet (where the user themselves holds the private key). In this type of wallet, ownership of the private key is split by key sharding or MPC (Multi-Party Computation). One part is held by the wallet provider, and the other part by the user.

Non-custodial wallets

Here, users are in charge of the private keys. That means you can access and manage your digital assets with no third party involvment. it offer security and full ownership. This secure ownership of your funds comes with the responsibility of custody of your private keys. If you lose it, you lose access to your funds forever, there is no way to retrieve it.

Types of non-custodian wallet

The two main types of non-custodian wallets are hot and cold wallets.

Hot wallets

Hot wallets are software that works on an internet connected devices. Metamask and Phantom are the top examples. these are wallets free to use and popular among active crypto users.

Because hot wallets are always online, they allow quick access to crypto assets, easy sending and receiving of funds, interaction with decentralized applications (dApps), NFT platforms, and token swaps. this quick access have its own shortcomings. Hot wallets are more vulnerable to hacks, phishing attacks, malware, fake websites, and SIM swap attacks on mobile phones. this makes hot wallets ideal for trading small amount of crypto. large hodlers mostly use cold wallets for better security.

Cold wallets

Private keys are completely offline in cold wallets, it never touch the internet. which cuts down the fear of online attacks, hacks, and crypto funds. Stay safe, since the

keys are not connected to the internet, it offers much stronger protection than hot wallets. cold wallets are mostly used for long term hodling, rather than daily trading.

Hardware wallets

Hardware wallets are physical devices built specifically to store crypto private keys securely offline. The keys are generated and stored within the device and never exposed to the internet, even when the wallet is connected to a computer or smartphone.

Transactions must be physically approved on the device, adding an extra layer of security against unauthorized access. Because of their strong security model and ease of use, hardware wallets are considered the safest option for storing significant amounts of cryptocurrency over the long term.

Paper wallets

Paper wallets are basically a piece of paper where private and public keys are written or printed, since it is never bought online, it’s immune to online hacking. since it is a paper piece storing the most confidential keys, it has a high risk of loss, damage, or theft, and human error when recording. Due to this high risk and better, secure alternatives, it is seen as outdated.

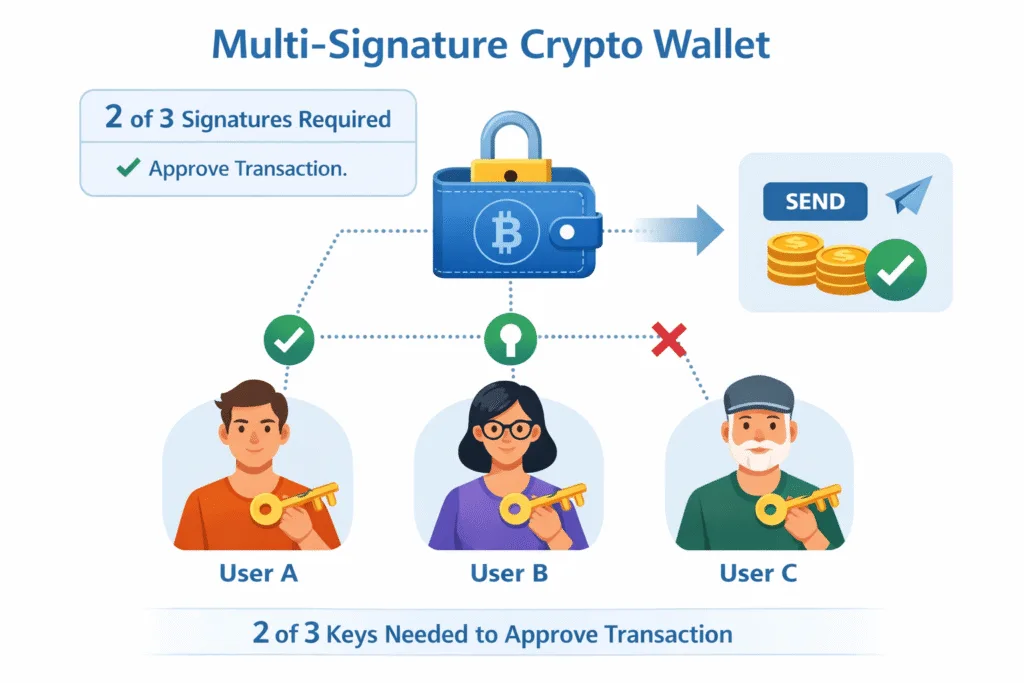

Multi-signature wallets

Multi-signature or (multi-sig) wallets need multiple approvals or signatures before a transaction can be completed. Instead of relying on a single private key, these wallets are configured with rules such as “2 out of 3 signatures required,” reducing the risk of theft, internal fraud, or accidental fund loss.

Multi-sig wallets are widely used by companies, DAOs, and joint accounts where shared control and accountability are essential.