A very common point of confusion in the crypto industry is that the words ‘coin’ and ‘token’ imply the same thing. To the surprise of individuals new in the space – they actually do not. While the two terms sound similar, they refer to two different concepts in the crypto space.

The only thing common between coin and token is that they both exist on the blockchain and represent a single unit of a digital asset. Besides this, the two serve different purposes within the blockchain ecosystem. For anyone investing or trading in the crypto space, it is critical to know the difference between coins and tokens.

What exactly are crypto coins?

Put simply, a crypto coin is a digital currency that operates on its blockchain. Usually, crypto coins perform the function of money or ‘gas’ on the native network, in that they are used to pay for transactions, as a unit of account, or as a store of value. For example, Bitcoin is the native coin on the Bitcoin blockchain, functioning as its unit of account and settlement.

Another example is ETH, the native coin of the Ethereum blockchain. The coin is used to pay transaction fees – also called gas – and execute smart contracts. However, the Ethereum blockchain also has hundreds of thousands of ‘tokens’ that operate on it.

So what really are crypto tokens?

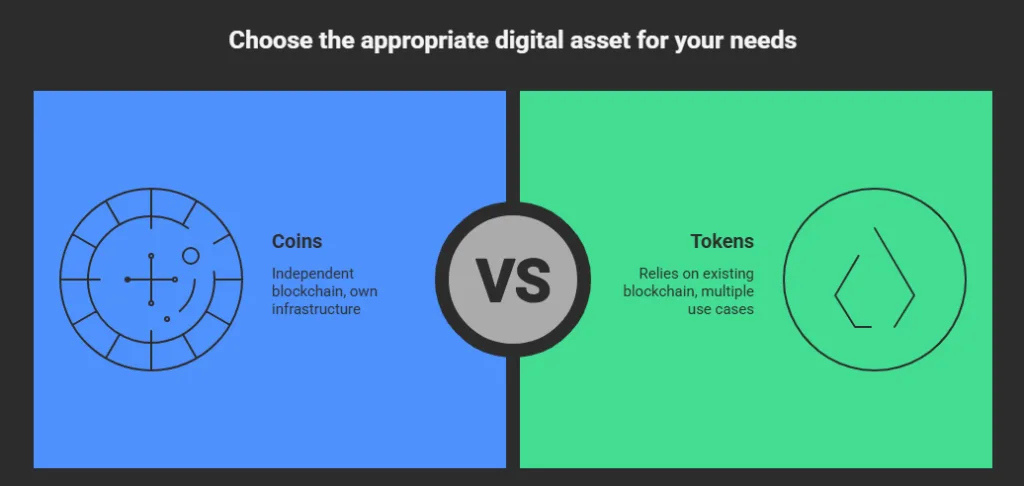

Unlike coins, tokens are digital assets that are created on top of an already existing blockchain project. They differ from coins in that they do not have their own independent blockchain. Rather, they rely on the infrastructure of another blockchain, such as Ethereum, Binance Chain, Solana, and others.

Tokens can represent multiple use cases, ranging from offering utility on a smart contract network to working as a governance instrument to execute on-chain decisions for a decentralized project. For instance, leading decentralized exchange Uniswap has its native token UNI, which helps the community members vote on various on-chain governance proposals aimed toward enhancing the protocol.

ERC-20, ERC-721, and ERC-1155 standards

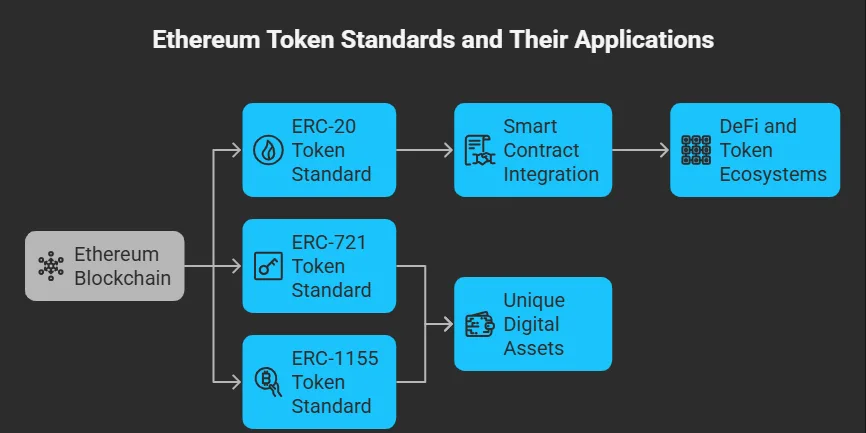

Without diving too deep into the nitty-gritty of Ethereum-based token standards, let’s check some of the leading ones that are responsible for the majority of token activity on the leading smart contract protocol.

Before jumping into specific token standards, let’s first understand the significance of standardized token standards. Token standardization frameworks are essentially frameworks that allow the underlying tokens to interact with wallets, exchanges, and dApps.

The most common token standard on the Ethereum blockchain is the ERC-20 standard. This token standard defines a set of rules for fungible tokens that allows tokens to be traded, swapped, and exchanged for one another, like USDT or LINK.

All tokens developed with the ERC-20 token standard can be easily integrated into smart contracts. As a result, this token standard dominates the Ethereum DeFi and token ecosystems.

Similarly, non-fungible tokens (NFTs) use the ERC-721 and ERC-1155 token standards, as they are compatible to represent unique digital assets such as collectibles, artworks, and in-game items. Unlike ERC-20 tokens, NFTs are one-of-a-kind tokens, since they are ‘fungible’ in that one unit of an asset cannot be exchanged for another.

What are the differences between coins and tokens?

There are some points of difference between coins and tokens. The major difference between them is in how they are developed and the way they interact with the blockchain on which they are built.

Smart contract coins such as ETH and SOL are native to their original blockchains. It means they are produced through mining or other consensus mechanisms. In addition, these coins also work as payments for network transaction fees to incentivize miners and validators.

On the other hand, tokens are issued through smart contracts on an existing blockchain network. For example, consider the ERC-20 tokens created on the Ethereum blockchain using standardized protocols. These kinds of ERC-20 tokens – such as LINK – and others, can be integrated with crypto wallets and decentralized applications.

Why the distinction matters?

Understanding the differences between coins and tokens is not just a matter of being academically correct, as it also has several practical implications. It’s important for investors to know that coins generally carry a broader risk as they power the entire blockchain network. In contrast, it’s possible for tokens of projects to fail individually while the rest of the blockchain thrives.

Even from a regulatory standpoint, tokens representing financial instruments face stronger scrutiny compared to coins like BTC. Similarly, knowing the differences between coins and tokens is of importance from a development perspective, as it prepares them to better allocate resources, foresee the complexity involved, and plan for scale, if necessary.

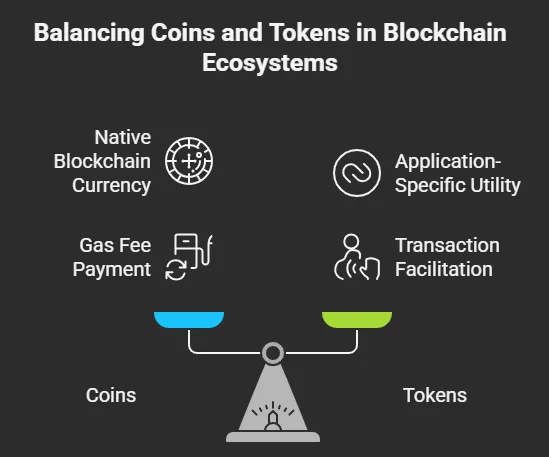

Interdependence between coins and tokens

Even though coins and tokens serve different purposes, there is a layer of interdependence between the two. Tokens such as UNI, SUSHI, and others require the coin of their native blockchain – in this case, ETH – to function since transactions on the network require the native coin to pay for gas.

Let’s go through a quick example. To transfer an ERC-20 token like Chainlink’s LINK would require the user to have some amount of ETH to pay the network fee on the Ethereum blockchain.

In a similar way, trading a token on the Solana blockchain would require the concerned user to have some amount of SOL in their wallet – such as Phantom Wallet – to pay the network fee.

This relationship between a coin and a token enables coins to function as a core layer of the blockchain, while tokens expand the range of applications, resulting in the creation of a more complex and versatile ecosystem.

Final thoughts on coins vs tokens

For anyone exploring the crypto ecosystem, recognizing the distinction between coins and tokens is important. Coins like ETH, SOL, and TRX form the foundation of the underlying blockchain network, while tokens allow for enhanced uses that allow users to interact with dApps, buy and sell NFTs, and benefit from decentralized finance (DeFi).

Whether someone is investing, trading, or just trying to explore the cryptocurrency industry, it is important for them to understand the differences between coins and tokens to make better-informed decisions that will help them navigate through the complex and ever-evolving crypto landscape.