The cryptocurrency market is volatile. Although Bitcoin leads the market as the largest digital asset by reported market capitalization, hundreds of thousands of altcoins experience what is called an altcoin market cycle.

These market cycles begin with the creation of an altcoin as a concept in a white paper – followed by its listing on an exchange – and eventually its delisting.

Only a handful of altcoins, such as Ethereum (ETH), Cardano (ADA), Tether (USDT), Solana (SOL), and other similar large-cap altcoins, have managed to survive the brutal crypto market.

For an investor, it is important to understand what separates successful altcoins such as ETH and SOL from the ones that fade into irrelevancy. Factors such as liquidity, investor backing, utility, and others play a significant role in determining an altcoin’s future.

The importance of catalysts

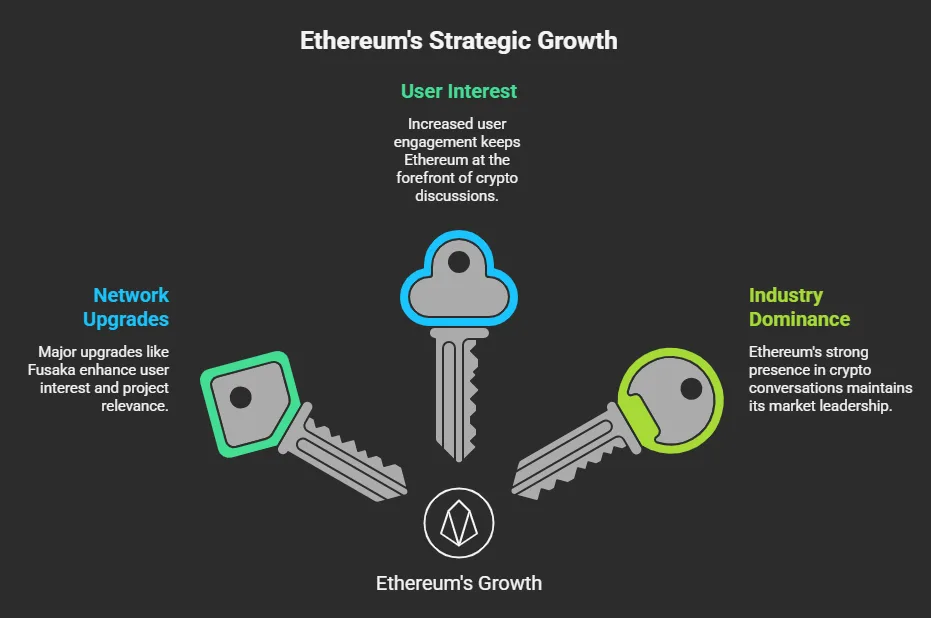

Whether an altcoin’s market cap skyrockets and stays there sustainably or crashes into oblivion depends to a large extent on several important catalysts. These catalysts are typically events or developments that increase user interest in an altcoin, driving the project’s token adoption. Some of the major catalysts include exchange listings, network upgrades, and celebrity endorsements.

Let’s take the example of Ethereum. Major network upgrades – such as the Fusaka upgrade in December 2025 – increased user interest in the smart contract protocol. Although it didn’t translate into any strong positive price action for ETH, it ensured that Ethereum dominated conversations in the crypto industry, keeping the project fresh in everyone’s minds.

In the same vein, meaningful partnerships with high-profile celebrities or endorsements can serve as network validation, indicating that the blockchain project is gaining momentum and undergoing greater user adoption.

Listing on major crypto exchanges – such as Coinbase or Binance – also acts as a bullish catalyst for altcoins. Big exchange listings expose altcoins to significantly higher liquid markets, triggering short-term or, sometimes, even long-term parabolic spikes.

Liquidity cycles in altcoins

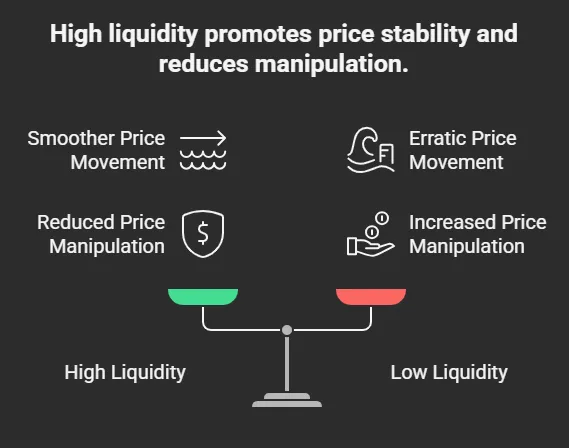

Put simply, liquidity refers to the ease with which an asset can be purchased or sold without significantly impacting its price. High liquidity has a positive effect on an altcoin’s price trajectory, as it smoothens any major buy or sell order, reducing the likelihood of any volatile movement in the altcoin.

Conversely, an altcoin with thin liquidity often shows erratic price movement when it receives a massive buy or sell order. Low liquidity can serve as an altcoin’s death sentence, as it makes it more susceptible to price manipulation, which the large holders can benefit from by liquidating small token holders.

An altcoin’s liquidity depends to a large extent on the prevailing macroeconomic conditions. For example, during periods of global dovish monetary policy, there is relatively high liquidity in the economy, making it easier for investors to put money in risk-on assets like cryptocurrencies. On the contrary, during hawkish periods, global liquidity dries up, adversely affecting digital asset prices.

Altcoins with a large circulating supply and low trading volume are particularly susceptible to liquidity shortages. In such cases, a few large buy or sell orders can trigger cascading liquidations, pushing the token into a death spiral.

Venture capital and institutional influence

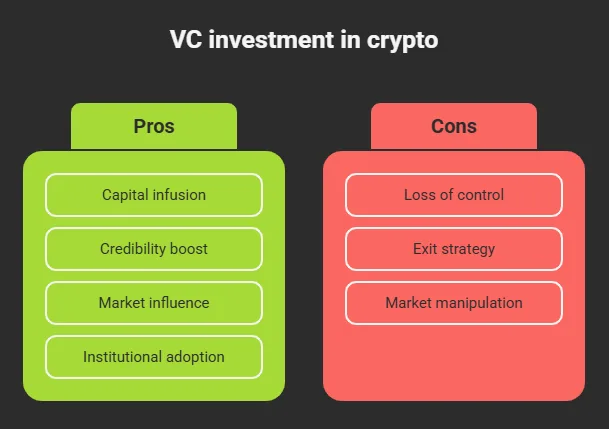

Undeniably, venture capital firms and institutional investors have become a major factor determining an altcoin’s success. VC-backed projects benefit from substantial funding that accelerates the project’s development and community growth.

In addition to the obvious advantage of capital, these investors bring a degree of credibility to the project, a trait that’s most valuable in the crypto industry, which has long suffered due to a lack of goodwill. Many altcoin surges tend to coincide with important VC announcements, seed funding rounds, or inclusion in institutional portfolios.

That said, VC backing can also function as a double-edged sword. For example, VC firms or institutional investors may only be seeking short-term profits, exiting the project once their token unlock is complete and the target market price is achieved. As a result, retail investors may be negatively affected as they see their holdings fall due to large sell-offs.

Impact of market psychology and FOMO

This is one of the most obvious, yet overlooked factors that determine an altcoin’s trajectory. The crypto market is highly susceptible to emotion-driven trading, where fear of missing out – also called FOMO – and panic buying or selling can influence price action more than fundamentals.

FOMO leads to the creation of a self-reinforcing feedback loop. As an altcoin begins to rise, more investors join in, pushing the price higher. Social media hype and influencer endorsements may also create parabolic price moves, totally disconnected from the token’s real utility.

On the contrary, panic selling can trigger rapid collapse in the altcoin’s price. When the price of a token stagnates or makes successive new lows, the project’s community becomes fearful, resulting in mass sell-offs of the token. We saw this phenomenon happen in real-time during the infamous Terra Luna crash of May 2022.

Network effects and adoption

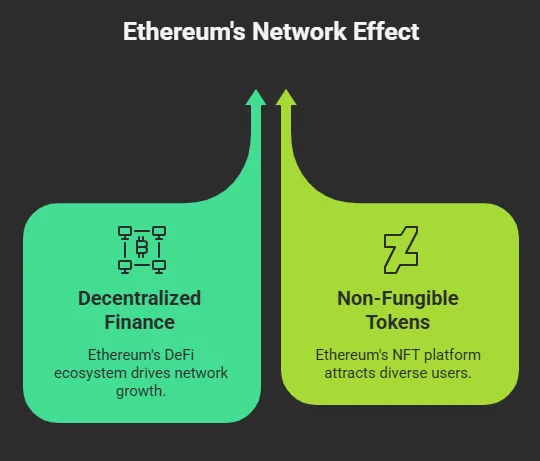

The last factor affecting whether an altcoin will stand the test of time or not, is network effects. Altcoin projects attracting more users and developers end up growing exponentially, as each new user increases the token’s utility and the network’s overall usage.

An example of strong network effects is Ethereum, which boasts a strong decentralized finance ecosystem – with a total value locked of $104 billion at the time of writing. The smart contract platform is also the leading non-fungible token platform – home to top NFT collections like Bored Ape Yacht Club and CryptoPunks.

Altcoins with a small market cap fail to generate network effects, especially if token’s use case is niche or redundant. Without high utility, speculative interest in the token remains low, increasing the risk of the project’s total collapse.

Final thoughts on what makes an altcoin successful

Multiple factors determine the rise and fall of altcoins. Liquidity, positive catalysts, and others play an important role in making or breaking an altcoin.

While speculative behavior drives much of the volatility, projects with strong fundamentals and active communities have a greater chance of surviving market downturns.

Properly understanding the above mentioned factors is crucial for investors looking to navigate the altcoin landscape.