The Fear and Greed Index indicator slipped into an extreme fear level as the crypto market crashed with the surrounding geopolitical conditions. With a major sell-off in play, the traders are following a risk-averse strategy. However, money is not leaving the crypto market. The analyst stated that capital is hanging around the market, ready to be used when the opportunity presents.

Extreme fear rattles market

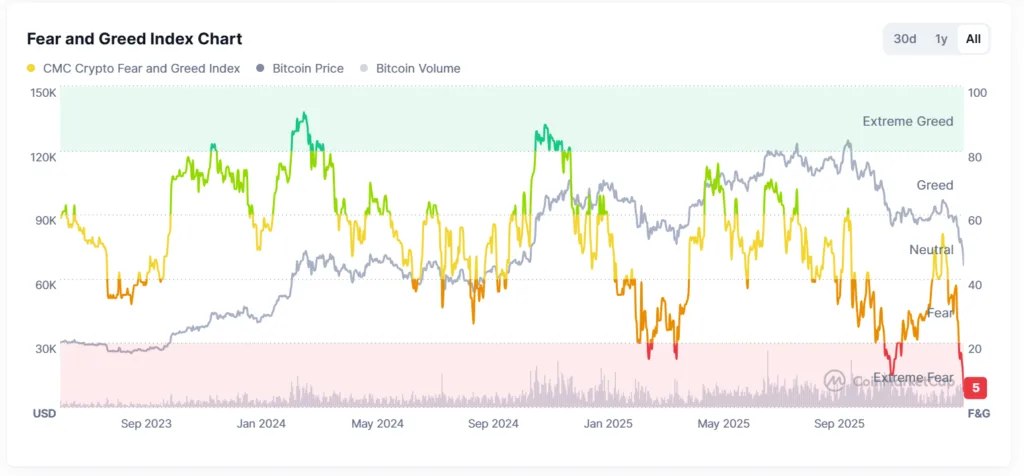

The Fear and Greed Index, an indicator that gives the overall sentiment of the crypto market, crashed to levels unseen during the past three and a half years. The indicator, which has a scale running from 0 to 100, has 5 different categories, which range from extreme fear to extreme greed.

Currently, indicating 5 on its scale, the Fear and Greed Index conveys that the market is in extreme fear. Although the market dipped to an extreme level of fear in recent times, it has not sunk this deep into the extreme territory in the last three and a half years. In the backdrop of the crypto market crashing, money capital is not drawn out of the market. It just lies on the sidelines waiting for the time.

Investors bide their time

The weekly inflows into stablecoins doubling show that the investors are biding their time, waiting for the perfect opening to enter the market. When considering the correlation between stablecoin inflow and Bitcoin prices, Bitcoin has always been in sync with the stablecoin inflow. Declining together and rising together.

However, currently there is a diversion, as BTC prices are falling when the inflow is increasing. When the stablecoin inflow hits a threshold, the Bitcoin prices will once again start to appreciate.

Rising stablecoin inflows suggest traders are building dry powder, positioning for volatility rather than expressing directional conviction. Capital is staying close to the market, ready to be deployed if larger swings create opportunity.

Analyst Lavneet Bansal

Large stablecoin balances act like stored energy—potential energy—and when sentiment flips even slightly bullish, that sidelined capital can rush back into BTC/ETH quickly, accelerating recoveries and triggering sharp rallies