At the quiet office meeting that changed everything, South Korean internet giant Naver agreed to acquire Dunamu Inc., the operator of the country’s largest cryptocurrency exchange, Upbit, in an all-stock deal valued at approximately $10.3 billion. This landmark transaction, announced on November 26, 2025, marks South Korea’s biggest fintech consolidation and represents a strategic masterstroke in the battle for the future of digital finance.

The deal, structured as a share swap with Naver’s fintech arm Naver Financial issuing 2.54 new shares for every Dunamu share, would create a combined fintech powerhouse valued at around 15.1 trillion won ($10.3 billion). What makes this deal particularly noteworthy is that it brings together two complementary giants: Naver, with its vast digital ecosystem spanning search, e-commerce, and payments, and Dunamu, with its dominant position in cryptocurrency trading and blockchain technology.

The crown jewel: Why Upbit was the prize

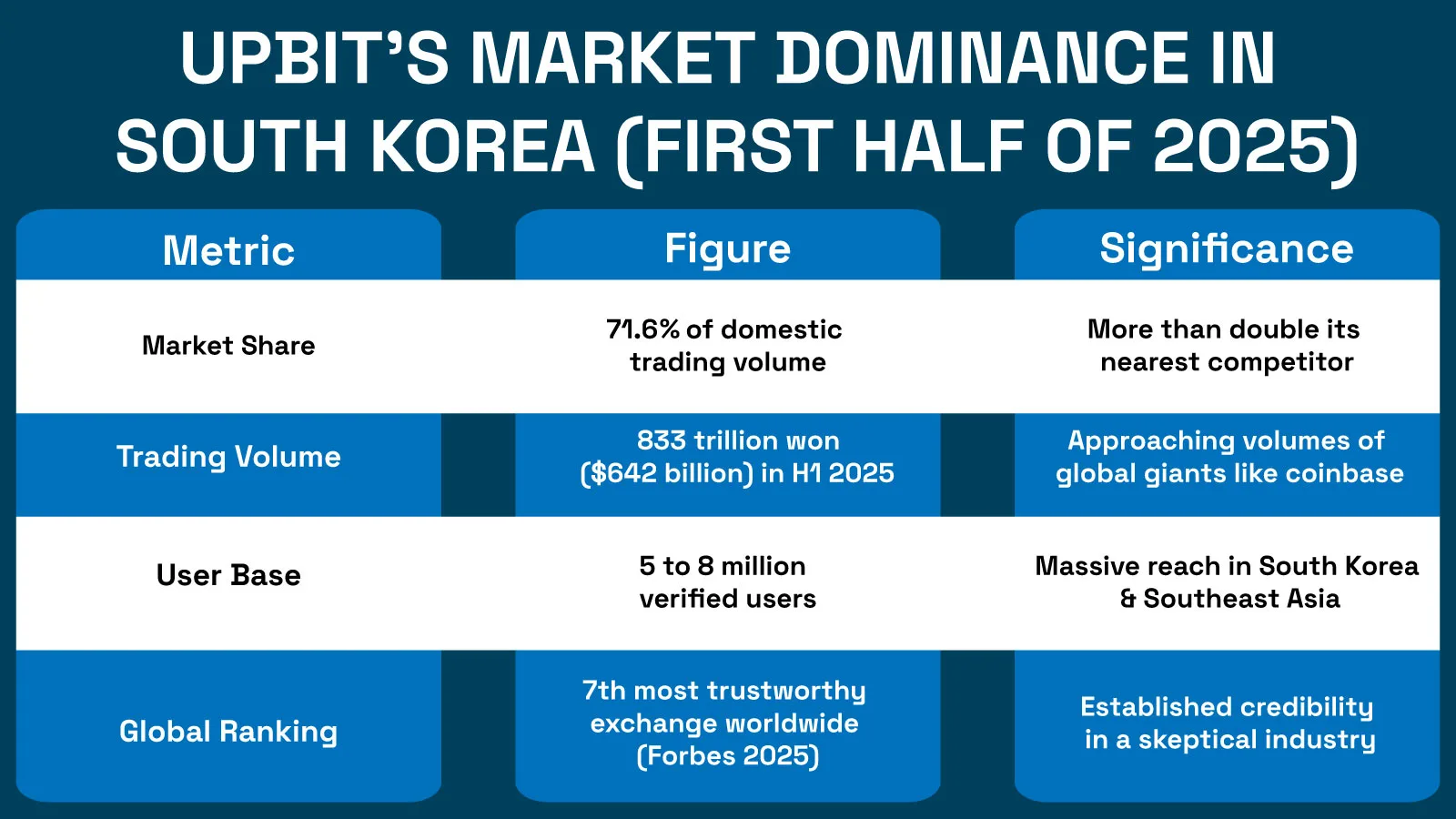

To understand why Naver acquires Upbit in such a monumental deal, one needs only look at the exchange’s commanding market position. Upbit isn’t just another crypto platform; it’s the undisputed leader in South Korea’s vibrant digital asset market.

This overwhelming market presence means that when Naver acquires Upbit, it isn’t just buying a crypto exchange; it’s acquiring the primary gateway for South Korean investors to access digital assets.

The numbers tell a stark story of market concentration: while Upbit processed 4.6 trillion won in daily trades, its closest competitor, Bithumb, managed just 1.6 trillion won, with smaller exchanges like Coinone and Korbit becoming virtually irrelevant with just 100 billion and 30 billion won, respectively.

The grand vision: Weaving crypto into everyday life

The strategic rationale behind the decision that Naver acquires Upbit extends far beyond simple market dominance. Naver envisions creating what industry insiders call a “super app,” a single platform where users can search, shop, communicate, pay bills, and now trade digital assets seamlessly.

Think of it this way: soon you might buy groceries through Naver’s e-commerce platform, pay with Naver Pay, and earn cryptocurrency rewards that can be instantly traded on Upbit, all without leaving the Naver ecosystem. This integration represents perhaps the most ambitious attempt yet to bridge the gap between traditional e-commerce and the emerging world of digital assets.

The merger specifically positions Naver to challenge rivals like Kakao Pay while accelerating development of a Korean Won-backed stablecoin. Such a digital currency could revolutionize payments within Naver’s ecosystem, which already processes 80 trillion won annually through Naver Pay.

The regulatory maze: Not so fast

Before this vision becomes reality, the deal faces significant regulatory scrutiny. South Korean authorities have expressed concerns about the growing concentration of power in the hands of a few tech giants, and this merger represents the ultimate test case.

The Korea Fair Trade Commission (KFTC) will conduct a thorough review, assessing potential anti-competitive effects of combining Naver’s digital dominance with Upbit’s crypto supremacy. The process could take a year or longer as regulators grapple with unprecedented questions about market concentration across search, e-commerce, payments, and now cryptocurrency trading.

Complicating matters further, South Korea’s financial regulators and the Bank of Korea are currently locked in a debate over stablecoin regulations, with the central bank pushing for banks to hold majority stakes in stablecoin issuers. This regulatory uncertainty creates both challenges and opportunities for the newly merged entity, which would be perfectly positioned to launch a won-backed stablecoin once the framework is established.

The final analysis: A calculated gamble on convergence

The decision that Naver acquires Upbit represents one of the most significant convergences of traditional internet services and cryptocurrency trading in the industry’s history. It’s a $10.3 billion bet that the future of digital finance lies not in standalone crypto exchanges, but in integrated platforms where digital assets seamlessly complement traditional financial services.

The ultimate success of this ambitious venture will depend on Naver’s ability to navigate regulatory challenges, integrate two very different corporate cultures, and deliver on the promise of a truly unified financial super app. If they succeed, they may well define the future of digital finance in South Korea and beyond.