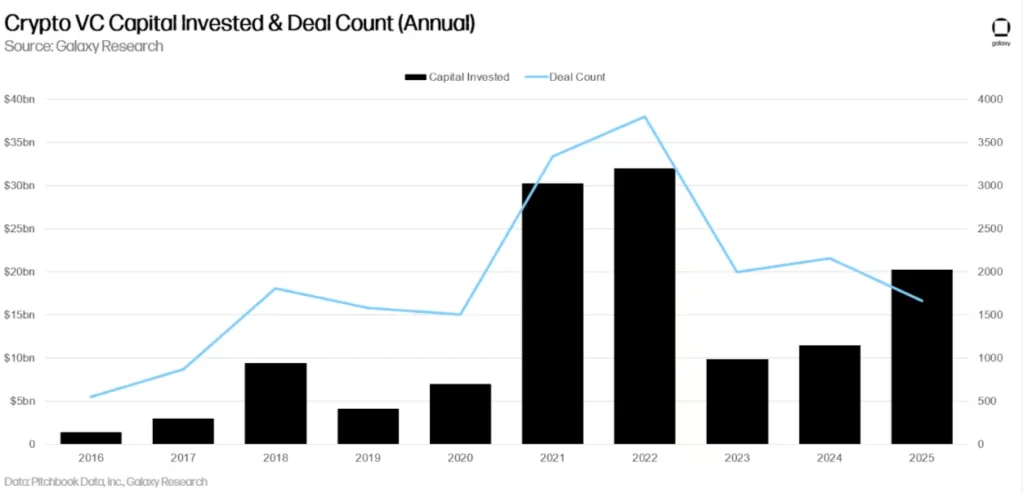

Venture capital firms (VC) were barely able to break even, as 85% of the token launches in 2025 were underwater. With no fresh capital flowing, VCs are rolling house money from 2022, and the trend of hyping a token launch and dumping on retail has subsided, exposing real projects.

Onboarding VC is not huge catalyst

Venture capitals play a huge role in hyping a token launch, and “back in the day, having a ‘Top VC’ on the cap table was a huge catalyst, but not anymore,” stated market analyst Galaxy Research.

When a top VC onboards a project, it gives the investors the impression that the project is legit and will grow. Investors are affirmed, as a VC stamp of approval is a signal to the market and other investors that the project is credible.

To a project, adding a VC means it comes with advisors, other investors, exchanges, and strategic partners, and also helps in partnerships, liquidity listings, and governance advice. However, in recent times, many scam projects onboarded VCs and pretended to be genuine only to rug the investors.

Analyst Lavneet Bansal stated that for a long time in crypto, narrative was enough. If you had a hot theme and a top VC on the cap table, the market rewarded you before the product was even tested. That dynamic is breaking.

He further added that EigenLayer raised hundreds of millions on the restaking thesis, and EtherFi was originally built on top of Eigen as a liquid restaking protocol. But today, EtherFi, after pivoting toward payments and user-facing products, commands stronger market confidence than Eigen itself.

Capital raised is no longer a good sign

The shift is clear: capital raised is no longer the signal; revenue, usage, and product depth are. The market is starting to reward execution and real business models over capital raised and narrative momentum.

Analyst Lavneet Bansal

With the VC taken out of the crypto project funding equation, many crypto netizens wrote positive comments. One such netizen wrote, “The projects that win are the hardcore bootstrapped ones built in a sane environment without VCs breathing down your neck. We’re taking this path. It is not easy, but at least it’s sane.”