My journey in crypto began in early high school, when I was just a kid chasing dreams I didn’t understand. This is my story, raw and real, from stumbling into the world of red and green lines to finding my footing in the wild crypto space, balancing work, losses, and a growing passion to build something meaningful.

The spark in early high school: Chasing the lines

Back in early high school, I had no clue what crypto, Web3, or decentralization were. All I saw were people hyping up charts, those red and green lines and then trying to learn it from the youtube that seemed to promise quick money. I was hooked by the thrill, not any real knowledge. I wanted in, so I jumped into trading without a plan.

My first venture wasn’t crypto, it was gold futures. I thought I was buying digital gold, something simple. Futures contracts? No idea. Shorting? That confused me on how could I bet against something I didn’t own? Wasn’t that gambling? Then came the wake-up call: I lost $4,300 in a single day trading gold futures, using money from my uncle, who was excited to help me trade. For a high schooler, that was huge and my uncle remained relaxed about the loss, as he’s knowledgeable about the market and never asked me to repay it.

No discipline, just challenging the market out of immaturity. It pushed me to pivot to crypto, where I hoped to find my footing.

Learning through losses

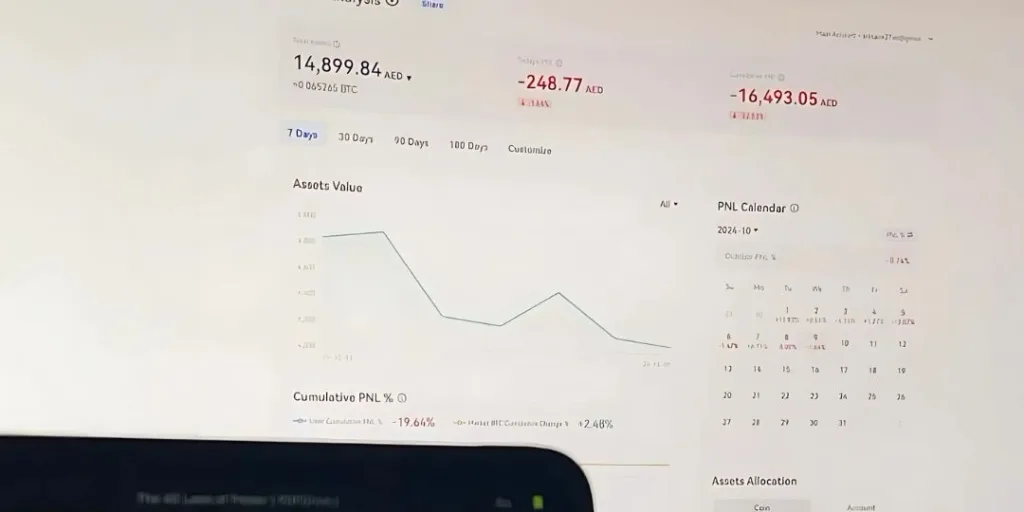

You only learn when you lose, and I learned that the hard way. In crypto, I made plenty of profits but also racked up countless losses, too many to tally precisely, but each one taught me something. I dove into technical analysis, studying charts, patterns, and indicators, building my own strategies to predict market moves. Losses stung, but they sharpened my skills. I was clueless about crypto’s bigger picture-what it is, what decentralization means, or how blockchain works. But I was determined to learn.

I started a Twitter (now X) account to connect with the crypto community, and that’s when things shifted. I landed a role at a web3 crypto gaming company, guided by a CEO and founder who became my mentors. My “beloved bosses” changed my perspective entirely. They taught me about decentralization, blockchain, and crypto’s true potential knowledge worth more than my paycheck. I started with small tasks but soon moved to blockchain analysis, managing profit and loss without any tools back then, handling company tokens and NFTs, creating content, and managing communities. It was a crash course in crypto.

The work phase: Trading, memecoins, and hard lessons

After high school, I focused on working full-time in crypto. I kept trading, ditching futures after the so much of disaster and sticking to spot trading on centralized exchanges (CEXs). I didn’t know decentralized exchanges (DEXs) existed until my boss showed me, opening a new world.

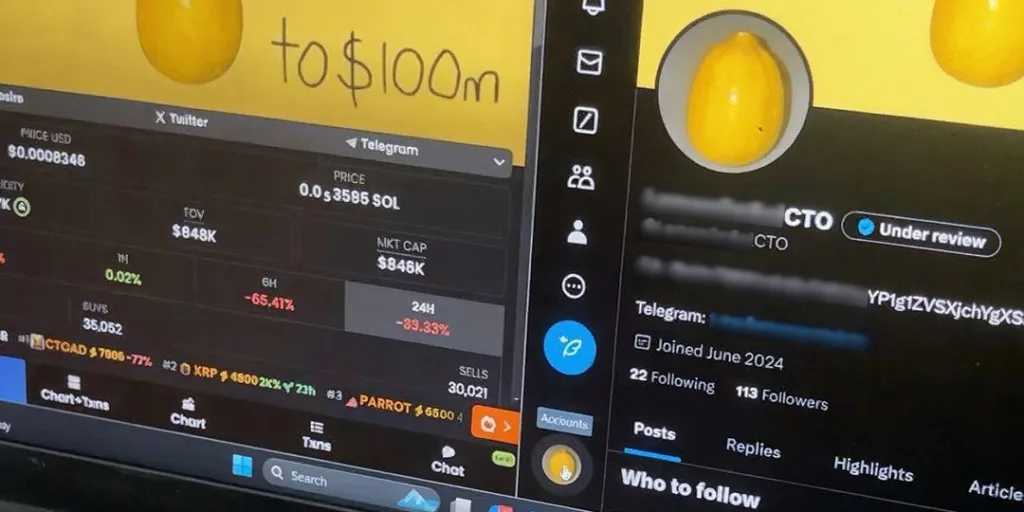

Then came memecoins. On Solana, every coin I touched seemed to deliver at least 1.5x or 2x returns, with some hitting 25x or even 75x profits. I traded them across other chains too. It was thrilling, easy money from hype. But I soon realized memecoins were often worthless, driven by buzz, not value. The highs were fun, but not sustainable

My boss introduced me to airdrop farming. We executed strategies together, making decent money. He helped me build multiple wallets with over 1 million USD in transaction volume to qualify for airdrops. But disaster struck: my wallet got hacked when I entered a wrong domain name trying to sell a coin that pumped hard in a new gaming chain. Lesson learned: Always double-check. Airdrop farming’s mostly dead now; even when opportunities arise, they yield peanuts.

Crypto’s full of wild moments. One time, a coin was pumping, but I held on greedily for more only to get rugged. I tried a community takeover (CTO), even paying for an X subscription to rally support, but it flopped. I didn’t recover my money. Those moments made me question the chaos.

Shifting focus: Seeking value and building for the future

All that hype-chasing started feeling pointless. I couldn’t rely on luck anymore; I wanted projects with real value. Now, I focus on finding solid altcoins for spot trading and long-term investing. It’s tough sifting through the noise takes research and patience.

I currently work at AltcoinDesk, where I collaborate with an incredible team to create content, exchange ideas, and learn. Although it’s not glamorous, it’s rewarding. Although it hasn’t yet significantly altered my life, I think it has the potential to do so. Coin purchases and trading, in my opinion, are secondary sources of income rather than the primary objective.

My real passion is building in crypto. I’ve let go of side projects where I helped people spot scam memecoins and it wasn’t rewarding. I believe combining NFTs with real-world assets (RWAs) could be game-changing, making digital assets practical and fun.

Hope and hustle

This isn’t a big deal story; it’s just the truth about my life in crypto. It’s been a wild ride, from losing money on gold futures in high school to winning and losing a lot of money in crypto, getting advice from others, and wanting to come up with new ideas. Being persistent is important. I want to inspire others to start small, learn from their mistakes, and go after value instead of hype. Crypto has opened up a world of possibilities for me, and I’m determined to make something that matters. I hope that one day it will change my life and maybe yours too. Let’s keep making the future.