Who’s really driving crypto forward, Wall Street suits or everyday traders in Lagos, Karachi, and Hanoi? The Global Crypto Adoption Index 2025 from Chainalysis just dropped, and the results prove once again that crypto is more than high-frequency traders in New York.

India, Nigeria, Russia, and more top the list, signalling adoption is going grassroots, institutional, and global all at once. But the bigger story might be what’s happening in regions like the Middle East. With the UAE building itself into a global Web3 capital, the question is: when will it break into the index’s top 10?

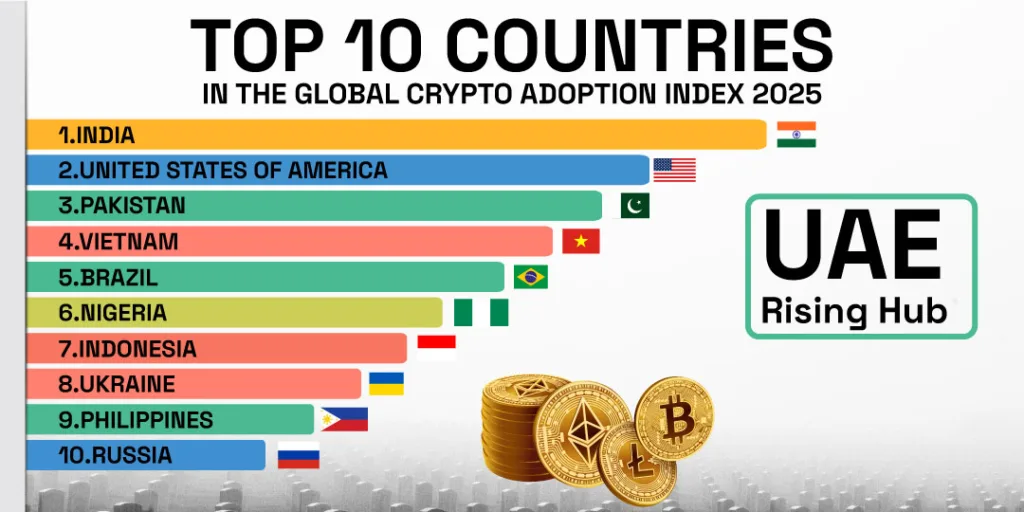

Market overview: Global crypto adoption index 2025

The global crypto adoption index is the industry’s gold standard for measuring where crypto is actually being used, not just speculated on. It combines on-chain value to centralized services, retail activity, DeFi participation, and this year, institutional flows of over $1 million. Weighted by GDP and population, the index exposes a surprising truth: crypto thrives in places where traditional finance often lags.

India holds onto the crown in 2025. The U.S. climbed to number two on the back of ETFs and institutional legitimacy. Meanwhile, Pakistan, Vietnam, Brazil, Nigeria, Indonesia, Ukraine, the Philippines, and Russia round out the top 10. Noticeably absent? The UAE. But if adoption momentum continues, 2026 might be the year it makes its debut.

United States: The institutional giant

The U.S. sits firmly in second place. While grassroots retail adoption is relatively modest compared to Nigeria or Vietnam, the country dominates in institutional flows. Bitcoin and Ethereum ETFs have opened the floodgates for Wall Street and retirement funds. Hedge funds and corporates are allocating billions, transforming crypto from a speculative side bet into an accepted asset class.

For U.S. readers, the index is a reminder: adoption here doesn’t look like peer-to-peer stablecoin transfers. It looks like 401(k) providers, BlackRock ETFs, and Coinbase custody. In other words, crypto has gone corporate. Whether that dilutes its decentralized ethos or ensures mainstream staying power depends on your perspective.

UAE: Rising global hub

The UAE hasn’t cracked the top 10 yet, but it’s impossible to ignore its trajectory. Dubai and Abu Dhabi are aggressively positioning themselves as Web3 and crypto capitals. VARA (Dubai’s Virtual Assets Regulatory Authority) has rolled out clear frameworks, while ADGM in Abu Dhabi is attracting global exchanges and institutional investors.

Global crypto adoption index now shows it is more about policy-driven innovation. From Ripple choosing Dubai as a base for its MENA operations to Binance, Bybit, and Kraken planting regional headquarters, the UAE is pulling in global liquidity. Add the region’s role in remittances (South Asian expats sending billions home each year, increasingly in stablecoins), and you have all the ingredients for a future top-10 placement.

Other movers in the top 10 global crypto adoption index

- India (#1): Massive retail base, fintech adoption, and remittances fuel its dominance, despite regulatory uncertainty.

- Pakistan (#3): Crypto as a survival tool against inflation and currency controls.

- Vietnam (#4): Strong gaming and NFT culture keep grassroots adoption alive.

- Brazil (#5): Fintech integrations and remittances make crypto accessible to everyday users.

- Nigeria (#6): Stablecoins are the lifeline for a young, inflation-hit population.

- Indonesia (#7): Retail adoption and a growing gaming community boost usage.

- Ukraine (#8): Crypto plays a dual role as a donation channel and financial fallback.

- Philippines (#9): Remittances and play-to-earn adoption remain strong.

- Russia (#10): Sanctions and restrictions drive crypto’s role as a workaround.

What it means for the U.S. and UAE

The global crypto adoption index tells two stories. In the U.S., it’s about institutional legitimacy: ETFs, treasuries, and corporate adoption are reshaping the market. In the UAE, it’s about policy-led innovation: a young, tech-forward population combined with progressive regulation is building one of the world’s friendliest crypto ecosystems.

Together, they highlight the two-speed future of adoption:

- Top-down in advanced economies: ETFs, regulations, and corporate buy-in.

- Bottom-up in emerging economies: stablecoins, remittances, and inflation hedges.

For U.S. investors, the index confirms what they already feel: crypto is no longer fringe. For the UAE, it’s a call to action: the ingredients are there; now it’s about scale and grassroots usage.

Final take on the global crypto adoption index

The global crypto adoption index 2025 proves that crypto isn’t a passing fad but a global movement taking shape in very different ways. The U.S. has gone institutional, the Global South leans on stablecoins, and the UAE is quietly laying the groundwork to leap into the rankings.

From Wall Street’s ETFs to Dubai’s skyscraper-sized Web3 hubs, crypto adoption is rewriting money in ways both predictable and surprising. One thing’s certain: whether you’re in Manhattan or Marina, the next wave of adoption is already here, and it won’t wait for permission.