FEAR: False Evidence Appearing Real

September 26, the last Friday of the month, it ain’t just another Friday on your calendar. It’s a memorable day, such as one of your birthdays or anniversaries. Why? As a crypto investor or a trader, you survived the worst month on the calendar. Kudos! You can now breathe a sigh of relief.

You have just half a week left to close the curses of September, where markets stagnate, trading volume drops, and major economic decisions are made.

Bitcoin opened the market trading at $108K, on September 1, reaching almost $118K by the mid of the month. Now that we are just about to close the month, Bitcoin is back to square one, trading at $109K.

Lest we forget the silver linings of September, let’s recall the Federal Open Market Committee (FOMC) meeting that happened in the middle of this month. It brought the first rate cut for 2025, with weak job data. However, the crypto market remained largely unresponsive to rate cuts, much like water on a duck’s back. With rate cuts already absorbed into the market before it was official, it was no surprise. Even the Fear and Greed Index indicator, which gauges the market sentiment, was neutral.

Fear grapples market

However, today, it’s an altogether different story. The Fear and Greed Index has struck 34, entering into the fear territory. When this indicator approaches this area, it means that the traders are hesitant to enter the market, as they fear a further crash. However, when the faint-hearted see obstacles, risk-takers see opportunity.

Bears mess with Bitcoin’s breakout

But think about it, why is the crypto market fearing, or what is so menacing about it? If you look at the daily chart below, you will find answers as to why the traders are hesitant to enter the market. On the technical side of Bitcoin, a bullish pattern that has been forming since June 2025 has been negated, so the traders expect a further downside.

A bullish symmetrical triangle pattern (Blue dotted lines), which converges and breaks upwards, has been nullified because of excessive selling pressure. With its current price close to $109K, BTC is out of the lower trendline of the triangle (discontinued the pattern). BTC can get back into the trendline if it manages to hold above $106K. Failure to hold above this level will plunge the prices to $104K.

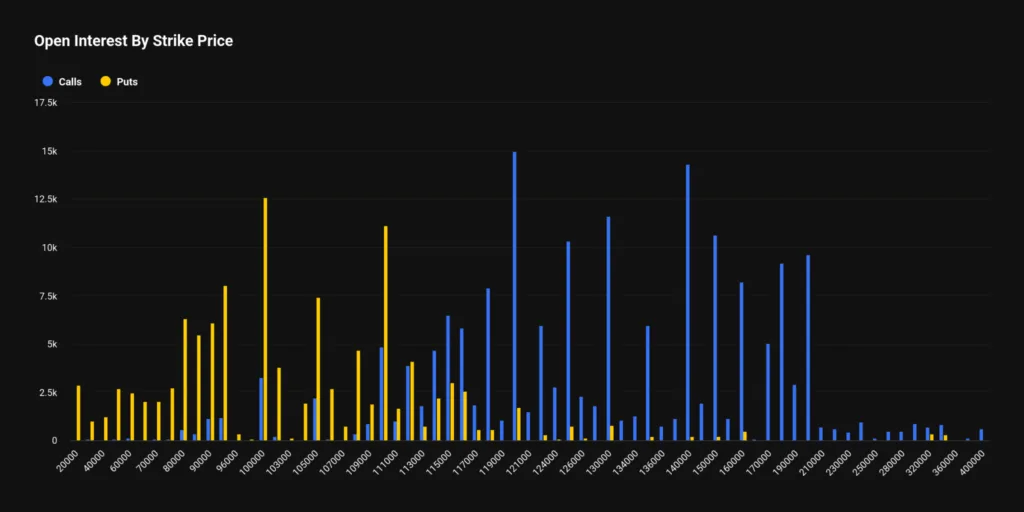

Record-breaking BTC options expire

Around $18 billion worth of BTC options are expiring today. As options contracts approach expiry, traders holding call options may choose to buy Bitcoin if it is above the strike price (in the money), while those holding put options may choose to sell Bitcoin if it is below the strike price. With such a record amount of BTC options expiring today, one would expect the prices to fluctuate wildly.

However, Bitfinex analysts speaking to a prominent media outlet stated that historically large expiries often suppress volatility “leading into the cut-off, then result in a clearer directional move in the 24-72 hours that follow.” So what’s the direction? According to a on-chain market prediction platform, 58% of respondents expect more red candlesticks during the weekend, adding more fear into the hearts of traders.

Ethereum runs dry on exchanges

In addition, despite the Ethereum supply on exchanges running to a nine-year low, the ETH prices did not react positively. The ETH supply tanked to 14 million ETH with increased institutional acquisition and digital asset treasury establishments. So there’s more than enough reason for the market to fear. But let me recall the first line of this article, “FEAR: False Evidence Appearing Real”.

Although BTC might have a few red candlesticks and the momentum might be towards the downside, an on-chain researcher saw something beyond what you and I see on the futures markets. He stated, “Three bearish clusters have formed on futures down to the $113K level – fuel for a new peak has arrived.” It means that it takes three bearish clusters for the next rally.

Ethereum is no different. “ETH is following the same plan. We can see a wick to $3500-$3600 level just to liquidate more longs. This retest means the worst part is almost over, and next we should see ETH pumping to new ATHs in late Oct. Just survive for 15-20 more days, we so close to the parabolic run.”

Altcoins will start to rally

October will be lit up by the approval of SOL staking ETFs, and the price of Solana will take off. Asset managers Franklin Templeton, Fidelity Investments, CoinShares, Bitwise Asset Management, Grayscale Investments, VanEck, and Canary Capital all filed amended documents with the US Securities and Exchange Commission (SEC). Geraci, the president of NovaDius Wealth Management, expects these amended S-1 documents for spot Solana SOL ETFs to be approved in the next week.

Moreover, asset manager Bitwise’s S1 filing for HYPE exchange-traded products also has a high probability of being approved. The exchange-traded product ETP will have HYPE as the underlying asset and give investors regulated exposure to the decentralised futures platform.

Bitfinex analysts said in a market report that they don’t anticipate the altcoins as a whole rally until they see the approval of more crypto ETFs. They don’t expect a “‘rising tide lifts all boats’ environment” until later in the year, when inflows into Bitcoin products regain momentum and new investment vehicles for altcoins are introduced.”

And let’s not forget that Tether minted 1 billion USDT. Historically, when fresh liquidity enters the markets, the crypto market flourishes and traders profit. October will have the ember that was missing in September. So whatever figures and facts that appear on the charts are False Evidence Appearing Real.