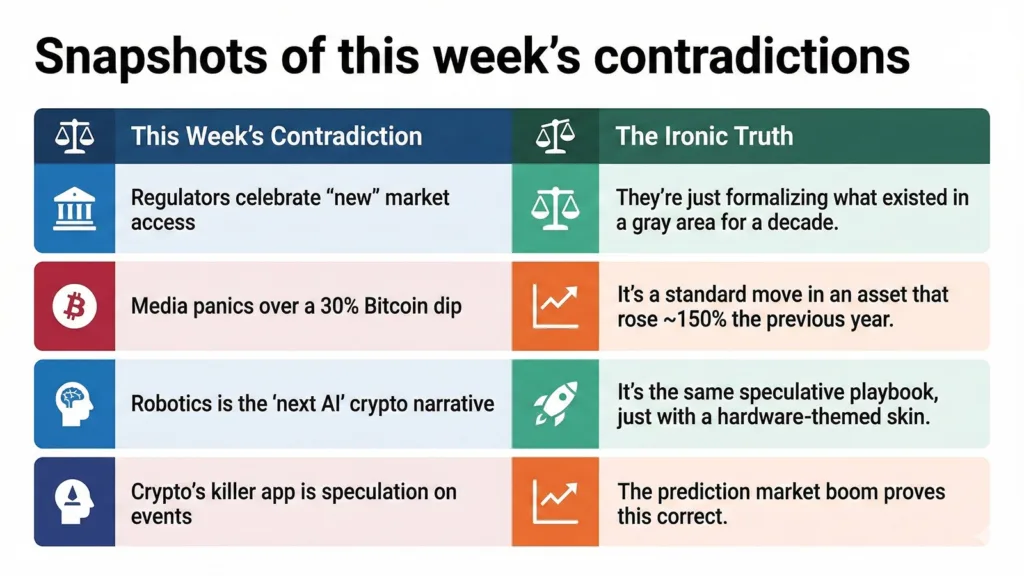

Welcome back, digital pilgrims, to another seven-day cycle where hope, hype, and bureaucratic paperwork collide. This week, regulators practiced their best impression of “doing something,” while the market collectively forgot how to read a chart. Let’s dig in.

The CFTC declares a sandbox, a historic marketplace

The U.S. Commodity Futures Trading Commission (CFTC) triumphantly announced the “first-ever” listed spot crypto trading on federally regulated exchanges. The financial press dutifully penned headlines featuring the words “landmark” and “breakthrough,” while seasoned traders squinted at their screens and asked, “Wait, isn’t that just what we’ve been doing on other screens?”

The subtext, of course, is a frantic game of regulatory “Capture the Flag with the SEC.” It’s less about building a new arena and more about two parents arguing over who gets to drive the family car while it’s already rolling downhill. The immediate impact was a market-wide shrug of such magnitude that it briefly lowered the gravitational pull in downtown Miami.

The market “dips” because math is apparently hard

After flirting with the heady heights of ~$126,000 in October, Bitcoin spent this week reminding everyone that numbers can, in fact, go down. The resulting ~30% pullback was breathlessly reported as a “crash,” a “crisis,” and “proof crypto is dead (part 4,217).”

In reality, it was a standard-issue correction in a notoriously volatile asset, magnified by the leveraged dreams of gamblers who found out that 100x works both ways.

The real story? The once-rebellious crypto market now marches in near-perfect lockstep with tech stocks. So much for being an uncorrelated “hedge.” Your portfolio isn’t diversified; you just bought the same volatile tech bet with a different, more confusing wallet.

The “narrative carousel” spins to robotics

With the AI-token hype cycle showing faint signs of engine fatigue, the chatterati needed a new shiny object. Enter: Robotics. The catalyst? A vague report that the U.S. Commerce Secretary is “all in” on the sector. Overnight, crypto Twitter was awash with geniuses “connecting the dots” between blockchain and machine coordination, urging followers to “DCA into robotics-linked tokens.”

This is the crypto innovation engine at its finest: hear a buzzword in Washington, find a token with a vaguely related name, and declare a financial revolution. It’s a strategy of breathtaking simplicity, utterly devoid of any need for actual product-market fit.

Stablecoins: The boring, useful engine everyone ignores

While everyone chases robotic memecoins, the actual transformation of finance continues silently. Stablecoin transactions are now measured in the trillions, and a record $406 million was spent via crypto-linked cards in November alone.

This is the paradox: the most revolutionary adoption, using crypto to actually buy things, is considered too mundane to fuel a 100x narrative. A crypto card user processing a $5 million day is a footnote; a blogger shilling a robot coin is front-page news.

Prediction markets bet on their own success

In a beautifully meta trend, prediction markets themselves became the hot trade. One platform, Opinion. Trade saw a staggering $1.5 billion in weekly volume, briefly becoming the kingmaker in the “what will happen?” casino.

The sector is now in a “volume war,” with even Trust Wallet integrating prediction tools for its millions of users. The entire space is essentially a bet on humanity’s addiction to betting, which, frankly, is a bet with historically strong odds.

To wrap up

This week was a masterclass in distraction. While the foundations of digital finance grow stronger through stablecoin regulation and real-world spending, the crowd’s attention is auctioned off to the next narrative, backed by nothing but a politician’s soundbite and the collective desire to get rich tomorrow.

While the circus is in town, there is significant construction work taking place outside the tent. Tune in next week, where we’ll explore whether “quantum-resilient blockchain” narratives will take off after a scientist uses the word “qubit” on a podcast.