The financial markets are telling a unified story this November: investors are fleeing risk. Bitcoin, once the high-flying darling of 2025, has now wiped out all its gains for the year and is trading around $91,545, a staggering 27% drop from its October high of over $126,000.

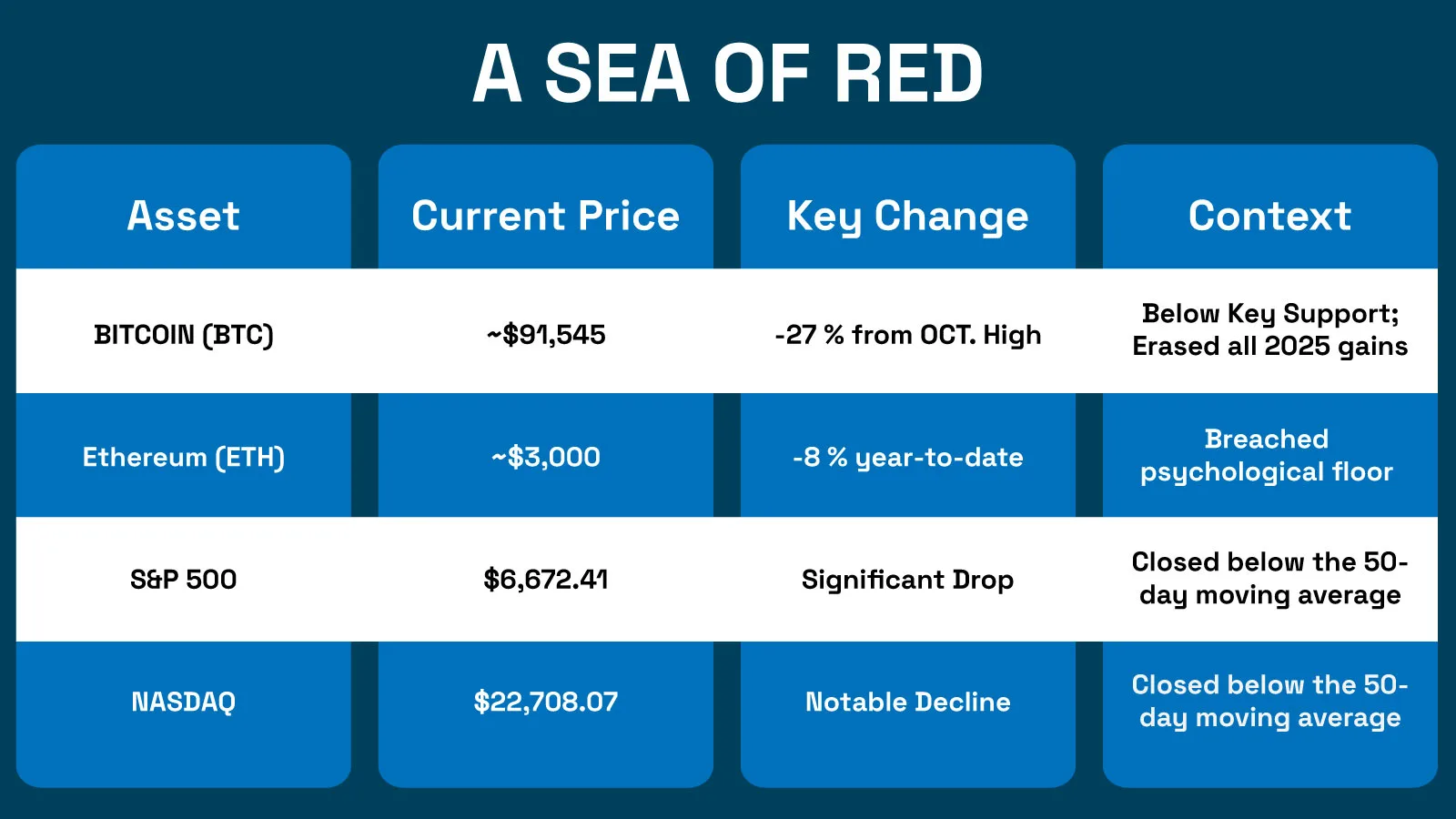

This crypto bloodbath mirrors a simultaneous pullback in the US stock market, with the S&P 500 and tech-heavy Nasdaq both closing below their 50-day moving averages in their worst session in a month. The table below captures the stark picture across major assets:

Market snapshot: A sea of red

The perfect storm: Why crypto and US stock markets are falling

This isn’t a random crash. A confluence of factors is driving the sell-off, creating a perfect storm for speculative assets.

- Federal Reserve Uncertainty: The core issue is a broader shift in risk sentiment. Investors are increasingly worried the Federal Reserve may delay interest-rate cuts, with market data suggesting a 55-60% chance of no cut in December. Higher-for-longer rates make safe, yield-bearing assets more attractive than speculative ones like crypto.

- Profit-Taking and Whale Activity: The selloff is partially driven by long-term holders locking in profits after bitcoin’s meteoric rise. Data from CryptoQuant reveals that large crypto “whales” have been selling, though mostly at a net profit, indicating this is not yet a wave of panic-driven margin calls.

- Technical Breakdowns: The market has been hit with a series of worrisome technical signals. Bitcoin recently saw a “death cross,” where its 50-day moving average fell below its 200-day moving average. More critically, it broke below its 50-week moving average, a key support level that has defined its bull market for the past two years.

- Leverage Liquidation: The downturn triggered a massive $1 billion liquidation of leveraged crypto positions in 24 hours, with over $570 million from Bitcoin bets alone. This created a vicious cycle of forced selling that accelerated the decline.

A crisis of confidence or a growing pain?

The critical question is whether this marks the beginning of a prolonged “crypto winter” or a severe but temporary correction. Experts are divided on the narrative.

Some analysts see reason for caution. “The big level to watch has always been the 50-week moving average. That’s the make-or-break line,” said Luke Lango of InvestorPlace, noting that in past cycles, breaks below this level preceded significant crashes.

However, other seasoned players argue this is a transformation, not a collapse. Louis LaValle, CEO of Frontier Investments, stated, “This doesn’t look like the classic pattern where everybody gives up, prices collapse 70%-80%… What we’re watching in Bitcoin right now is a change in how the asset is owned and traded, a market-structure transition, not a cyclical bear market.”

This perspective is bolstered by bitcoin’s growing maturity as an asset class, evidenced by institutions like J.P. Morgan reportedly accepting bitcoin as collateral, a sign of legitimacy that didn’t exist in previous downturns.

What happens next? Key levels to watch

The market now stands at a critical crossroads. Analysts are watching three major support zones for Bitcoin :

- First Support (~$92,000-$95,000): This area aligns with the cost basis for investors who bought between 6-12 months ago. If these holders capitulate, selling could accelerate.

- Second Support (~$85,000-$90,000): A drop to this band would represent a standard 25%-30% mid-cycle correction, which is common in Bitcoin bull markets.

- Worst-Case Scenario (~$75,000-$82,000): This would mark a 35%-40% decline from the peak, matching deeper historical mid-cycle resets. Some analysts even see a possibility of testing the 200-week moving average near $60,000-$70,000 if conditions worsen significantly.

The bottom line: Navigating the storm

While the mood is grim, it’s worth noting that the current 27% decline, while severe, is not unprecedented. Historical data shows the typical Bitcoin bear market downturn averages around -30.8%, and this drop hasn’t yet matched the 45% plunges witnessed in 2022.

The broader US stock market decline provides crucial context; this is not an isolated crypto event but a system-wide retreat from risk. For long-term investors, periods of “extreme fear” have historically been good opportunities to build positions, though the immediate future remains volatile.

The coming days will be decisive. The market’s ability to hold above $90,000 and reclaim key moving averages will determine whether this is a healthy correction or the start of a deeper bear market. One thing is clear: in today’s interconnected financial world, the fate of crypto and the US stock market is increasingly intertwined.