The US Consumer Price Index (CPI) for November, released last week, hit the headlines as it came much softer than expected. However, the crypto prices did not reflect this, as the political conditions have disturbed the technical setting of the charts.

November’s CPI was 2.7%, softer than the expected 3.1%, which typically signals easing inflation and raises expectations that investors may soon have spare capital to deploy into risk assets. However, this time it failed to lift crypto prices because softer inflation alone does not translate into immediate liquidity.

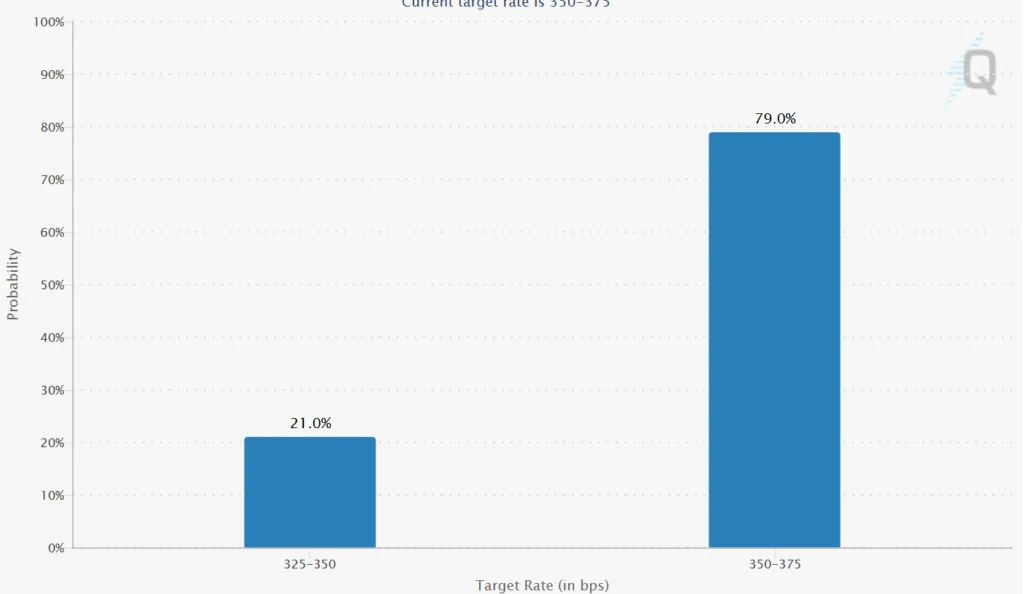

The data did not materially change expectations around Federal Reserve policy, and short-term Treasury yields actually rose, signaling that financial conditions remain tight and markets still price in a “higher for longer” rate environment. With cash and money-market funds continuing to offer attractive yields and no clear confirmation of Fed easing, investors chose to stay cautious rather than rotate into high-volatility assets like crypto.

Although Jerome Powell, the exiting Fed Chair, made promises of further cuts for 2026, investors did not listen to his promises, as his position as the chairman going into 2026 was questionable. Powell’s position as the Fed chairman was always at risk, as he was either late or did not listen to Donald Trump.

Since Powell failed to satisfy Trump’s demands, the president is now attempting to remove the chair from his position and has already proposed a few new candidates to lead the Fed. No matter what Powell says, the people won’t take it seriously, as he may lose his position soon, and on top of that, his 4-year tenure is also nearing completion in May.

Apart from politics, the total crypto market cap is still below the $3 trillion mark. The market cap crashed with the announcement of the CPI. But on the good side, following the CPI announcement, the market is gaining value and reaching new highs as shown below. The rise is a positive sign that investors are showing some interest.

Meanwhile, the Fear and Greed Index, which gauges market sentiment, is now aligning more toward the neutral zone. Investors are slowly coming out of the fear that kept them bound. The new uptrend on the Fear and Greed Index shows that the market has a better approach.

Although the political condition, which has an impact on the crypto prices, is murky, the technicals of Bitcoin look very bullish. As shown in the chart, BTC is establishing a new uptrend, and the RSI is also supporting this trend. It is crossing above the RSI-SMA, which shows that the coin is performing above par.

On top of that, Bitcoin is closely correlated with the Russell 2000, a U.S. stock market index that tracks the performance of 2,000 small-capitalization companies. When the Russell 2000 breaks out, BTC follows. Currently, the Russell 2000 has broken out, and a Bitcoin rally will follow.

And that’s not it; the altcoin season, where the altcoins outperform BTC, is also about to kick off. The 100-day Simple Moving Average (SMA) has crossed the 100-day Exponential The Moving Average (EMA) served as the primary indicator for various altcoin seasons. With this intersection happening, the altcoin season could kick off any moment.

However, once again, political developments might interfere and disrupt the technical setup on the charts. How? Well, the Federal Reserve is supposed to be an independent body that makes decisions that are best for America based on the economy and is not influenced by people of power.

However, Trump’s close friend Kevin Warsh is in a close race with Kevin Hasset for the Fed Chair position, with the lead fluctuating constantly on prediction markets. Hasset said that Warsh is a loyal friend of Trump and that he would not disqualify Warsh for being a close friend.

As the market lies at the mercy of Trump and the next Fed reserve, there could be further rate cuts going into 2026, but whether it will actually improve crypto is questionable. If the Federal Reserve continues to cut rates, inflation will rise, money will lose its purchasing power, and investors might invest in crypto to hedge against inflation based on conditions.

However, if inflation accelerates too quickly, markets begin to expect central banks to reverse course with tighter monetary policy. Those expectations push bond yields higher, attract capital into dollar-denominated assets, strengthen the U.S. dollar, and ultimately reduce the appeal of risk assets like crypto.