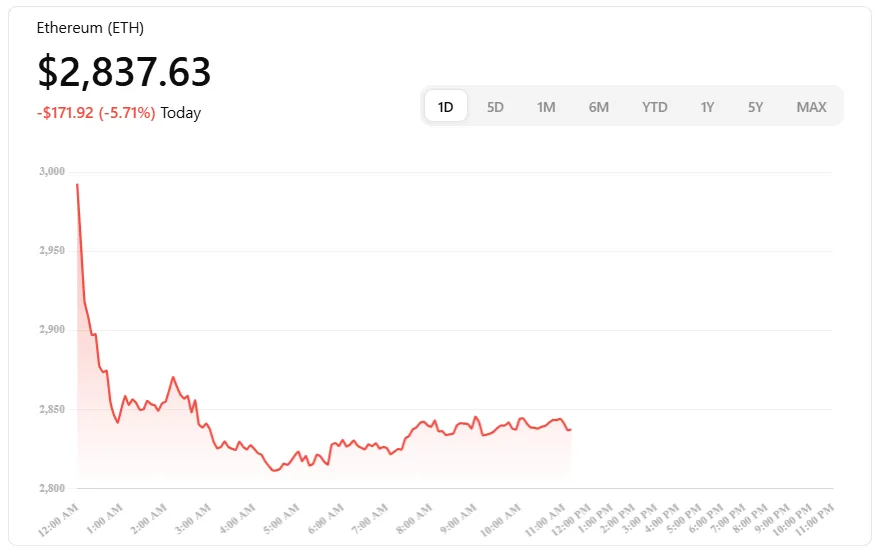

Ethereum is gripping a precarious ledge just around $2,900, reeling from a market quake that obliterated close to $20 billion in leveraged bets across crypto. This isn’t just a routine pullback.

The current Ethereum price correction, roughly a 35% slide from October’s peaks near $4,700, represents a brutal stress test, one that pits formidable institutional conviction against the crypto market’s own ingrained fragilities.

For everyone watching, the question is stark: can relentless Wall Street buying defend this crucial line, or will the wreckage from overleveraged speculation finally trigger a deeper collapse?

A fractured technical landscape: Ethereum’s uphill battle

Right now, Ethereum is finding a fragile footing near $3,038, desperately guarding that vital $2,800 to $2,960 support zone. Traders widely see holding this ground as the bare minimum for any chance at a rebound toward $3,100. But the path up is littered with traps.

A dense thicket of leveraged long positions is stacked just above at $3,050, meaning any price rise could instantly activate a wave of automatic selling. It’s a frustrating paradox: the momentum to climb exists, but the market’s own speculative machinery is actively working against it.

As usual, Bitcoin called the tune. Its sudden plunge below $90,000 dragged the entire complex down in a torrent of billion-dollar liquidations. But after that, things start to go wrong. Both assets fell hard, but their recovery patterns and underlying health signals are starting to tell different stories.

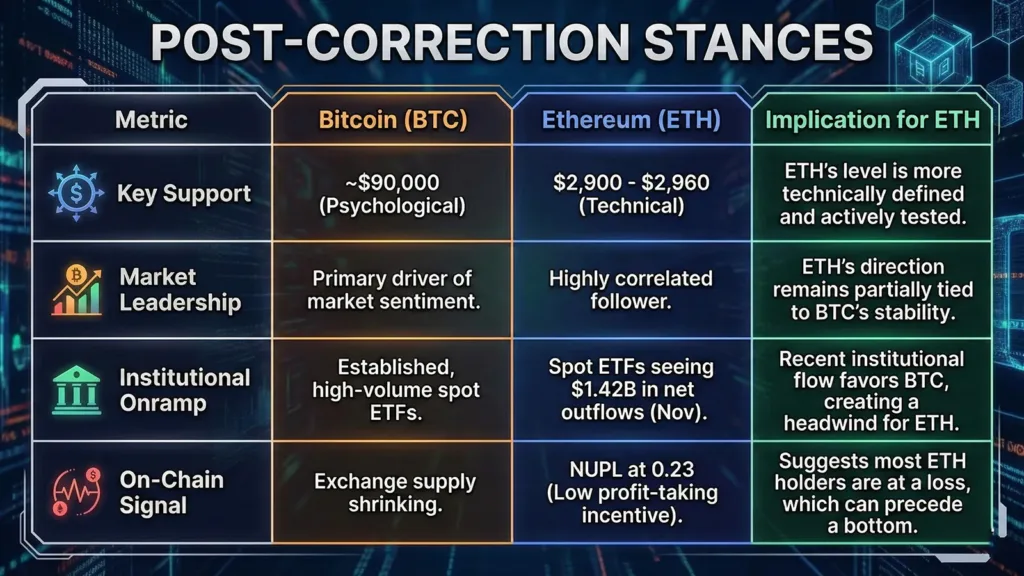

Consider the posture of each:

- Key Support: Bitcoin leans on a psychological level near $90,000. Ethereum’s defense, however, is a more technically precise band between $2,800 and $2,960, which is being tested in real-time.

- Market Role: Bitcoin is still the clear leader in driving sentiment. Ethereum is powerful, but it still mostly follows Bitcoin, which means that ETH’s future is partly linked to BTC’s stability.

- Institutional Flow: Bitcoin has been the most popular choice lately. Spot BTC ETFs see consistent interest, but spot Ethereum ETFs have seen large net outflows, which is a big problem for ETH.

- Holder Sentiment: Ethereum’s on-chain data shows that most addresses are currently holding at a loss. In the past, a lot of pain like this could come before a market bottom because it made sellers less likely to leave.

The silent bullish tide: Institutional accumulation

Beneath the chaotic price charts, a profound, slow-motion shift is underway. Since mid-May of last year, a stunning demand shock has gripped Ethereum. Spot ETPs and public corporations have collectively scooped up about 2.83 million ETH, a staggering $10 billion haul that dwarfs new supply by a factor of 32. Companies like Bitmine are making huge, public bets that they will own more than 5% of all Ethereum.

This isn’t speculative day trading; it’s strategic positioning rooted in utility. Ethereum forms the backbone of modern decentralized finance, hosting over $102 billion in stablecoins and commanding more than half of the entire tokenized real-world asset (RWA) market.

To institutions, it represents a dual-advantage asset: a stake in a proliferating digital economy that also pays a 3-6% yield through staking. This fundamental migration of ownership from retail hands to institutional vaults is a slow-burning fuse beneath the price.

Diagnosing the crash: A $20 billion leverage reset

To grasp the violence of the drop, you need to identify its trigger. This was a structural purge, not a fundamental rejection. As Anthony Georgiades of Innovating Capital notes, nearly $20 billion in leveraged positions vaporized in a matter of hours as prices tumbled. The core issue wasn’t Ethereum price correction or its technology; it was a market drowning in risky, borrowed money.

Once prices began to slip, margin calls and forced liquidations on offshore exchanges ignited a self-feeding “feedback loop,” with virtually no liquidity to cushion the fall. Ethereum’s central role as the primary collateral across DeFi protocols made it uniquely vulnerable. A big drop in the market will automatically cause ETH to be sold all over the system. The purge, no matter how brutal, was a necessary way to get rid of this systemic excess.

The road ahead: A promise that isn’t worth much or a long pain?

It all depends on which side wins: the strong case for value or the stubborn technical overhead.

The Undervaluation Thesis: Data from companies like CryptoQuant suggests that Ethereum may be worth much less than it is. Several models, including those based on network adoption (Metcalfe’s Law) and the total value secured in its Layer-2 ecosystem, suggest a fair value between $4,600 and $4,800, roughly 60% above current prices.

The cautionary view

The market must first escape its immediate technical prison. That ceiling of long liquidations near $3,050 caps upward movement. Most analysts agree that until Ethereum can decisively reclaim and hold above $3,650, the broader structure leans bearish. A lone, contrarian voice, the “Revenue Yield” model, even suggests potential overvaluation based on network fees, citing a far lower fair value target near $1,300.

The prevailing sentiment is that Ethereum is now muddling through a “bottom-building phase.” Expect messy, indecisive trading as the market absorbs the recent leverage flush and awaits a clearer macro or catalytic signal. The upcoming Fusaka upgrade on December 3rd, focused on network efficiency, could potentially provide that spark.

Ethereum price correction: The bottom line

This Ethereum price correction has laid bare the crypto market’s volatile adolescence. It’s a system in transition, moving from a speculative arena to an institutionally owned utility network, and the journey is inherently rocky.

Ethereum’s critical test: Can $2,900 support hold against a $20b leverage purge? The answer will be decided by this clash between deep-pocketed, long-term accumulation and the lingering poison of excessive leverage. For investors, patience is non-negotiable. The fundamental case is solidifying, but the market’s technical wounds are still very much in the process of healing.