The mood across Wall Street this week feels strangely cinematic, as if the economy is pausing mid-scene to decide what genre it wants to be next. The question gripping everyone from bond desks to crypto traders is deceptively simple: Will the Federal Reserve in December finally pivot? The answer became more intriguing after a batch of labor market data signaled that America’s job engine is cooling faster than expected.

The latest unemployment and payroll numbers triggered a fresh wave of recalibration. Traders shifted sharply, reviving the possibility that the Federal Reserve in December may deliver its first rate cut in months. The more the data sinks in, the clearer the message becomes: the labor market is wobbling, and policy expectations are wobbling right alongside it.

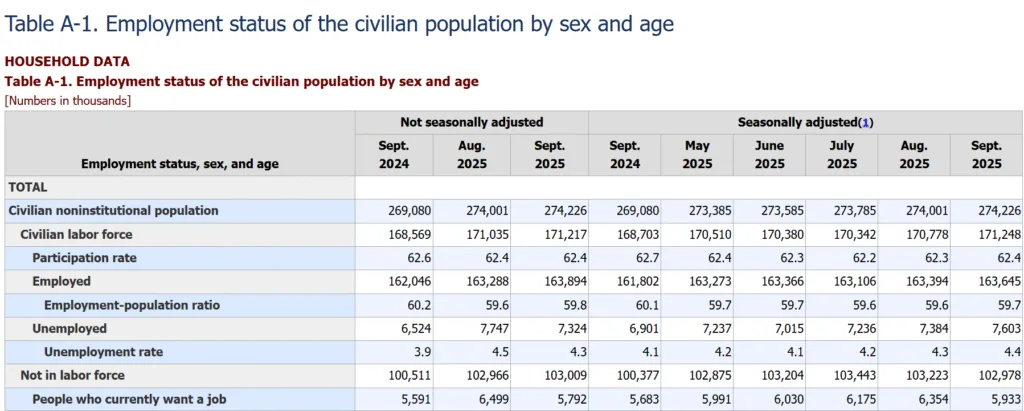

It started with numbers that looked simple at first glance but carried deeper structural meaning. The unemployment rate for September ticked up to 4.4%, higher than both expectations and the previous month’s reading. It was the kind of data point that raises eyebrows across policy circles. Rising unemployment, even at this modest level, suggests that employers are losing confidence at the margins.

Non-farm payrolls added 119,000 jobs, but the revision to August told a more troubling story. What was once reported as a small gain was revised down to a loss of approximately 400 jobs. That kind of backward adjustment tends to signal fragility beneath the surface, momentum that is not holding, and hiring plans that are not sticking.

A labor market losing its shine

Initial jobless claims came in at 220,000, slightly better than expected but elevated when viewed against early-year levels. Taken together, the trio paints a consistent picture: hiring is slowing, confidence is thinning, and the labor market’s resilience is wearing down.

CME FedWatch: The market’s pulse

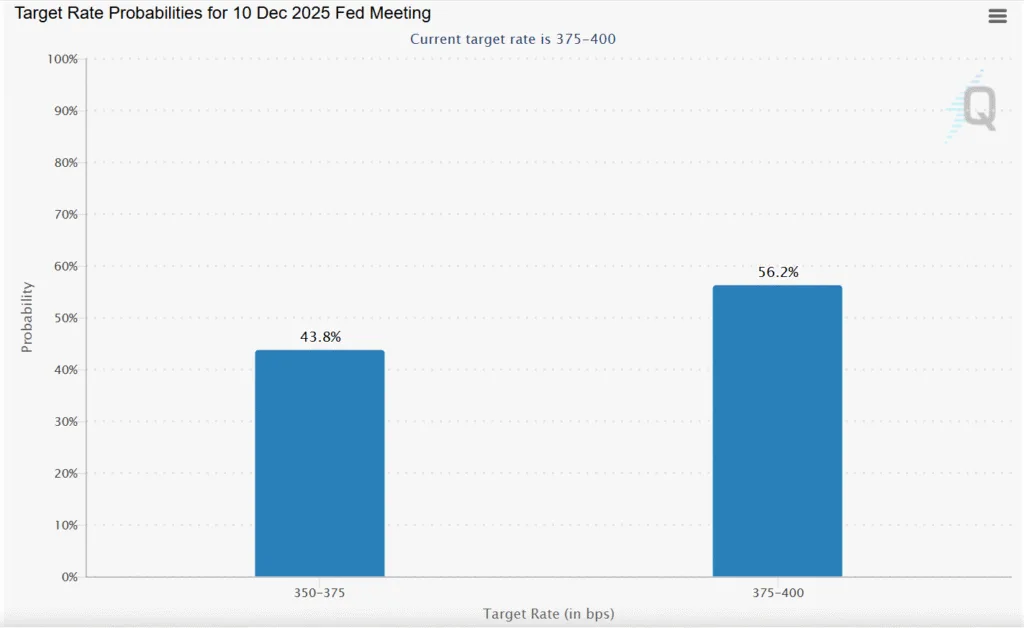

The shift was immediate. According to CME FedWatch data, the probability of a 25-basis-point cut by the Federal Reserve in December rose to 43.8%, up from 30.1% just a day earlier. The likelihood of no change sits at 56.2%, down from nearly 70% the day before. A week ago, the probability was above 50%. A month ago, it was nearly 99%.

It is rare to see such a volatile curve outside of crisis periods. What we have now is a data-driven whiplash, a market listening closely to the smallest clues because the stakes are rising.

A divided committee, an uncertain path

Federal Reserve officials are not walking in lockstep. Some policymakers, such as Governor Christopher J. Waller, have already made the case action, warning that the labor market sits close to “stall speed.” Others believe patience remains the safest option, preferring to see a few more months of data before committing to a cut.

This divergence sets up a dramatic Federal Reserve in December meeting, a policy crossroads where the interpretation of risk matters as much as the numbers themselves.

What this means for crypto and markets

A rate cut would almost certainly lift risk assets, providing a liquidity boost at a moment when both crypto and tech need it. Bitcoin and large-cap altcoins typically respond quickly to shifts in rate expectations, especially when macro uncertainty intensifies.

But investors must also weigh the broader reality: a slowing economy is both the reason for a potential cut and a risk factor in its own right. Liquidity can lift prices, but fundamentals still matter. The Federal Reserve in December will need to balance urgency with prudence, and markets will need to price both outcomes at once.

Everything now points to a pivotal moment. A cooling labor market is forcing the Fed to reassess its stance, and traders are recalibrating in real time. Whether the Federal Reserve in December steps in with a cut or holds its position, one thing is certain: the next move will shape the early landscape of 2026 for every asset class, from equities to crypto.