As the United States of America awaits the release of the July Consumer Price Index (CPI), the crypto market is in a state of greed, according to the Fear and Greed Index indicator. Addressing the prevalent status of the market, Cattea, a play-to-earn, NFT-based game platform, posted some key insights and BTC price levels to watch out for. The expert stated in the X post, “The U.S. CPI release today is set for 12:30 UTC, and the first few minutes after can see sharp price spikes in either direction.”

Expecting the prices to fluctuate wildly just after the release of the CPI data, the platform gave some key levels to keep an eye on. Cattea suggested taking a cautious long position, provided that the BTC prices hold calmly in $117,000 Zone. However, if BTC hits $118,500, “take some profit or tighten stops,” advised the post. Finally, it stated that there was a gamma wall or large concentration of contracts at $120,967, which might cause the prices to consolidate or move slowly.

So what exactly is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a key economic indicator that measures the average change over time in the prices consumers pay for a fixed basket of goods and services. This basket typically includes items like food, housing, transportation, clothing, medical care, and entertainment.

When the CPI (Consumer Price Index) is high, it means that the average prices of goods and services that consumers buy are increasing at a faster rate than usual. This is called inflation, where money loses its purchasing power.

During high inflation times, the Federal Reserve usually increases the rate. When the interest rates are increased, borrowing money becomes more expensive. When loans cost more and borrowing is harder, overall spending drops and investment in risky assets like crypto drop. Higher rates make saving money in banks more attractive, so people are less likely to spend quickly.

When fewer people are investing in crypto, it means less money is flowing into the market. Crypto prices are heavily influenced by supply and demand — if demand drops but the supply stays the same (or even increases, as holders sell off), the price naturally falls.

Will the FED cut interest rates?

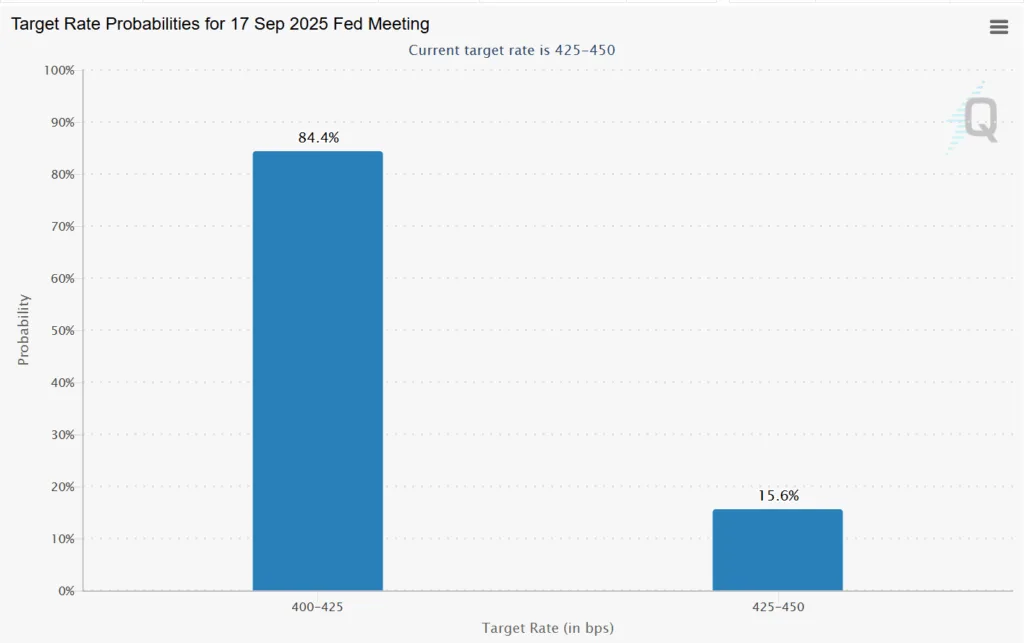

Well, according to the market expectation, 84% think that there will be an interest rate cut, while just a fraction 15% believe there won’t be cuts during the September 17 meeting. The target rate probability has been quite accurate with its calls. During the past FOMC, 95% predicted the interest rates to be unaltered, and the Fed did not change the interest rates. Since 84% expect a rate cut this time around, the Fed will consider cutting the rates, which will be good for the crypto market. With lesser interest rates, there will be more money circulation and more money inflow to risky assets like crypto.

On top of that, U.S. President Donald Trump has been urging the Fed Chairman Jerome Powell to cut interest rates since the beginning of the year, but Powell has never moved a digit. Livid with Powell’s stubborn attitude, Trump has threatened to fire the Chairman. With his job at jeopardy, Powell might go for rate cuts. Once the interest rates are lowered, the money supply in the market will increase and traders will be better positioned to invest in crypto, pushing the prices higher.