As we close June and wrap up the first week of the second half of the year, there are so many things to look at. The growing labor market, Bitcoin hitting $110K, S&P indices reaching an all-time high, and what to expect after the 90-day tariff pause is completed on June 9. In this market wrap, we’ll take a look at all these.

Labor market

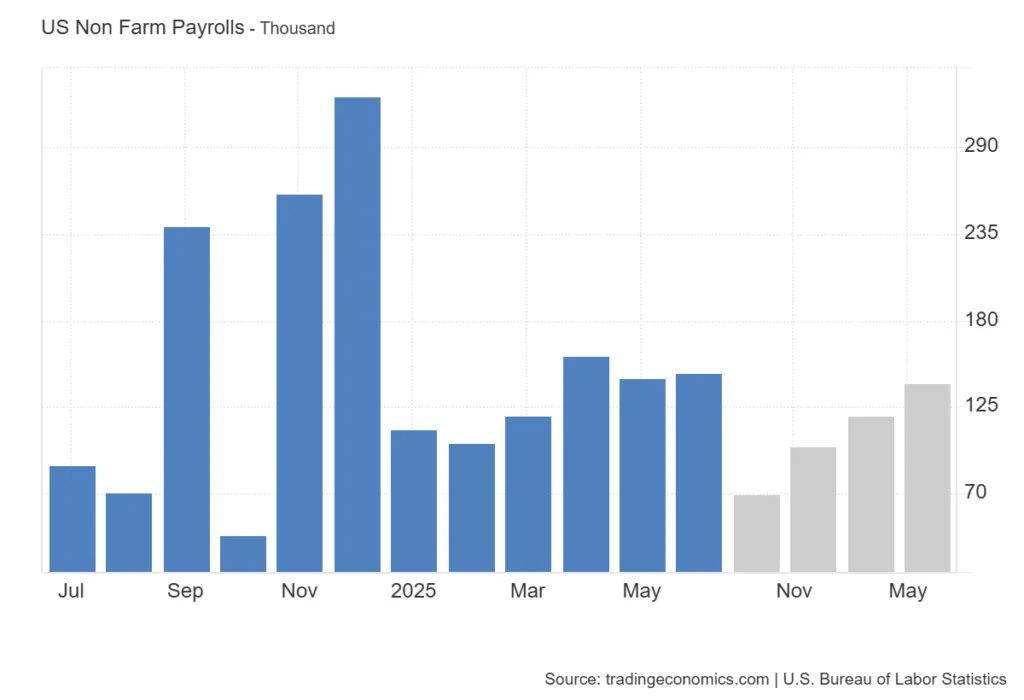

The U.S. job market grew drastically, producing 147,000 non-farm payroll jobs in June, exceeding the expected amount of 110,000. With this growth, the unemployment rate reduced from 4.2% in May to 4.1% in June. This growth could give the Fed more time to think about reducing interest rates.

“Although the overall number of jobs was very strong, the weakness was broad-based across the private sector,” said Eugenio Aleman, chief economist at Raymond James. “The labor market continued to weaken in June, which is in line with our view and should reignite the conversation regarding the Federal Reserve’s interest rate path.”

Stocks and Crypto

Bitcoin traded this week with an opening market price of $107.3K. During the first couple of days of the past week, it struggled to hold above the opening market price. However, later on, the bulls came to Bitcoin’s rescue and helped it hit $110K, the highest price reached in the week. After shedding some value, BTC is currently trading at $108.7K.

This week (ending July 3) saw some broad gains across U.S. equity markets. S&P 500 (SPY) rose roughly 1.7% to close at a new all-time high of 6,279.35 while the Nasdaq‑heavy QQQ surged about 1.6%, supported by strength in tech and semiconductors; and the Dow Jones (DIA) climbed around 2.3%, with small-caps (Russell 2000) shining the brightest, up approximately 3.5%—as market momentum, stellar jobs data, and fading tariff anxiety pushed indexes to fresh highs.

Events that happened

The first spot Solana staking exchange-traded fund, offered by REX-Osprey, was approved by the SEC, and it debuted this week. Shortly after, Solana spiked and reached a weekly high of $157 before falling back to $150. With the launch of the Solana ETF, the crypto market was excited about the approval of other ETFs, for XRP, Litecoin, etc, and this positive sentiment had a ripple effect in the market.

U.S. President Donald Trump’s new reduction in tariffs with Vietnam is another incident that fueled enthusiasm in the market. The president reduced the 46% tariffs for Vietnamese exports to 20%. In exchange, Vietnam agreed to grant duty-free access to U.S. exports, including cars and agricultural goods.

What to look forward to?

The 90-day tariff reciprocal pause will end on July 9. Apart from China, the UK, and Vietnam, the tariff deals for the other countries haven’t been set. On top of a base 10% tariff, the country’s specific tariffs could range from anywhere between 11%-55%. Once the ‘liberation day,’ as Trump calls it, arrives, the remaining countries’ tariffs will be decided upon.

Although some in the market think that the pause could be extended, Trump stated that it won’t be extended. The world is looking forward to the day of liberation, as investors, businessmen, and traders pray that there are no excessive tariffs, that could dismantle the whole equilibrium.