From more than $200 million in liquidations to stablecoin supply doubling on the Ethereum chain and the market becoming neutral, a lot is happening in the crypto arena. Especially with the Federal Reserve’s vital decision of interest rate cuts upcoming, the markets could wane either way, so here’s a dose of what’s happening today.

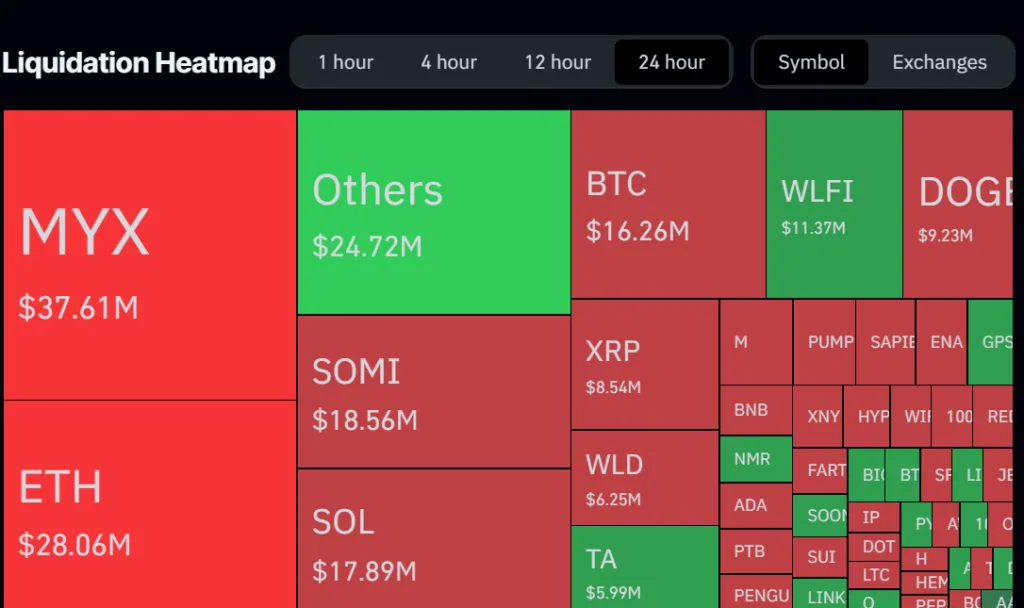

$200+ million of crypto positions liquidated in 24 hours

According to Coinglass, the total crypto liquidations during the past 24 hours were $228 million, which included $77 million in longs and $151 million in shorts.

When it comes to the biggest coins or tokens liquidated in the past 24 hours, MYNX’s $37 million worth of positions were liquidated, which include $33 million shorts, and only $3.6 million worth of longs were wiped out. While Ethereum took second place with $28 million liquidated.

Solo Bitcoin miner hits the jackpot, earns $350K

A solo Bitcoin miner wins the jackpot and gets $350,000.

A single Bitcoin miner has done something amazing: they mined an entire block and got a reward of 3.129 BTC, which is worth about $347,980 at the moment.

It is thought that the chances of a single miner solving a block are less than 1 in 10,000, which is about as likely as winning the lottery. Today, most Bitcoin blocks are mined by huge mining pools with a lot of computing power. This means that solo miners have a very small chance of success.

This win shows that the Bitcoin network is still decentralised, and that even small participants can make a difference and be rewarded. It also reminds us that even though large-scale mining is the most common type of mining, smaller miners are still an important part of the ecosystem..

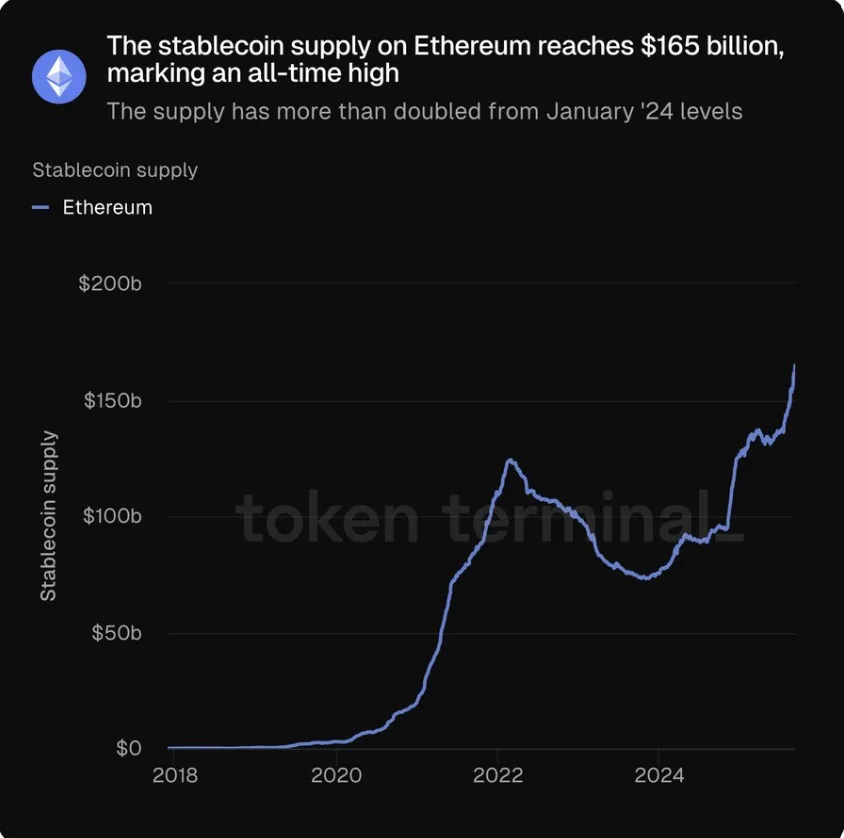

Stablecoin supply on Ethereum doubled, reaching $165 million

The stablecoin supply reaches its all-time high of $165 million. Since January 2024, the supply has doubled. An increase in stablecoin supply on Ethereum signals growing liquidity, higher DeFi demand, and potential buying power waiting to enter risk assets. Traders often see it as a leading bullish indicator for ETH and the wider crypto market.

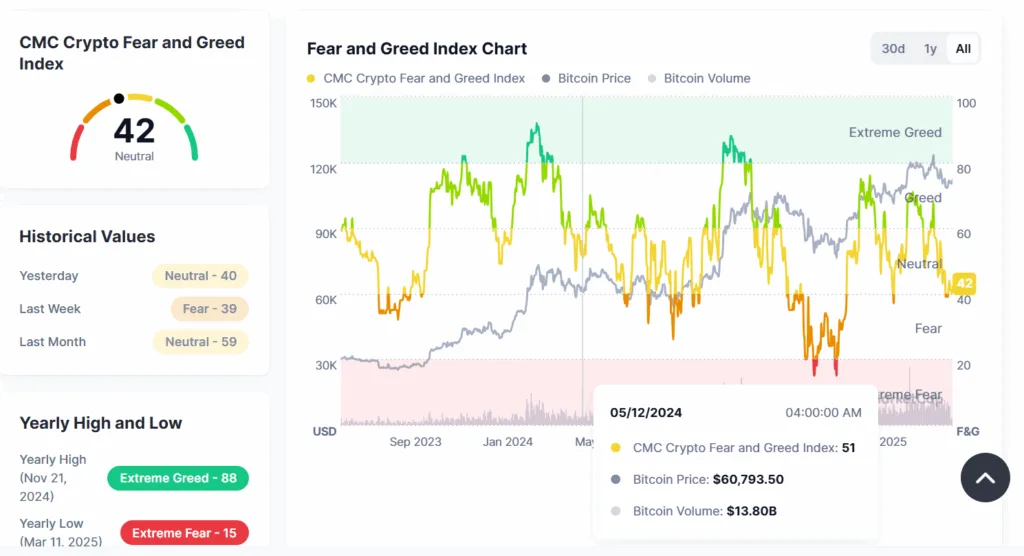

CoinMarketCap’s Fear and Greed Index comes back to neutral

CoinMarketCap’s Fear and Greed Index is back in the neutral zone after it was on the verge of falling into the fear zone. Reading 42 on its scale, the Fear and Greed Index recovered from falling into the fear zone.

If the CMC Fear and Greed Index drops into the fear zone, it means the market is cautious and leaning bearish in the short term — but for long-term or contrarian traders, it can also flash a potential buying opportunity.

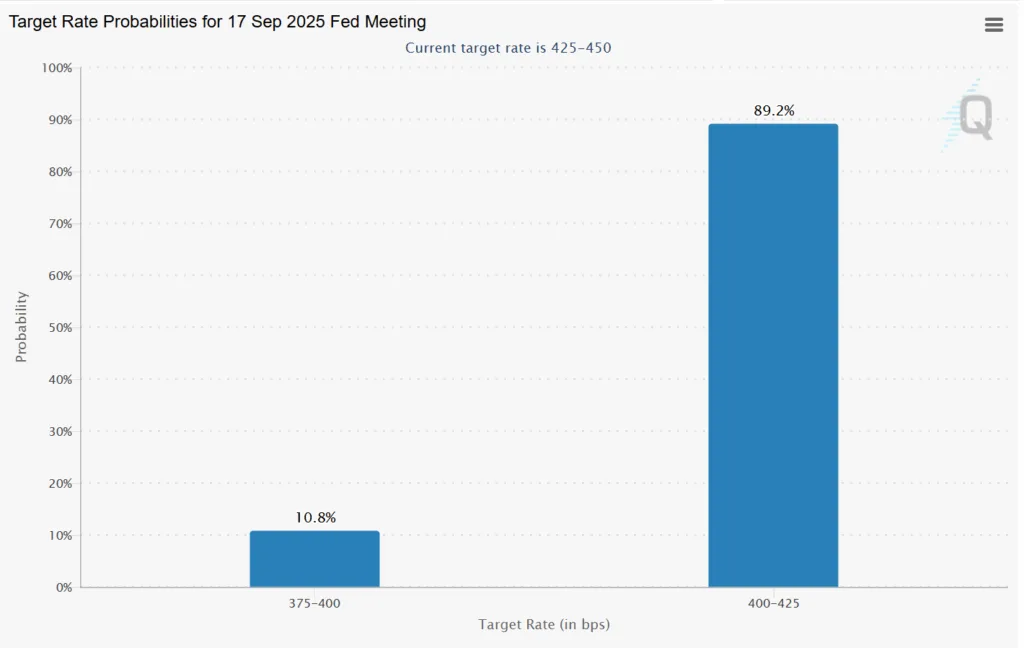

Probability of interest rate cuts for September FOMC touches 90%

As the Federal Open Market Committee meeting scheduled for September 17 draws nigh, the probability of the Federal Reserve Chairman Jerome Powell cutting rates has increased to 89%.

MYX Finance (MYX) appreciated by 260+%. Price manipulation?

MYX Finance (MYX) is a versatile cross-chain DeFi token powering a chain-agnostic trading and collateral platform. Operating on networks like Linea, Arbitrum, and BNB Chain, MYX enables seamless asset utilization across over 20 blockchains without manual bridging. Within the last 24 hours, the token has gained value by more than 260+%, and it is currently trading at $6.75, with a market cap of $1.33 billion. However, analysts believe that this price hike is manipulated.

FTX Europe starts operations in Cyprus

The owner of FTX Europe, the former European arm of the defunct exchange FTX, Backpack EU, is kicking off its operation after settling with the Cyprus Securities and Exchange Commission (CySEC).

Backpack CEO Armani Ferrante said, “After fulfilling our promise to refund former FTX EU customers, we commence our journey to provide one of the first fully regulated crypto derivatives platforms in Europe, starting with perpetual futures.”

Ethereum ETFs leak out $800 million in a four-day streak

U.S. spot Ethereum ETFs faced a sharp downturn last week, with a four-day streak of outflows draining $787.6 million—one of the heaviest withdrawals since their debut.

Grayscale’s ETHE was hit hardest, losing $309.9 million on September 5 alone. Fidelity’s FETH also saw major redemptions, with $216.7 million exiting on September 4. Meanwhile, BlackRock’s ETHA showed volatility, attracting $148.8 million in inflows on September 4 before swinging to $309.9 million in outflows the following day.

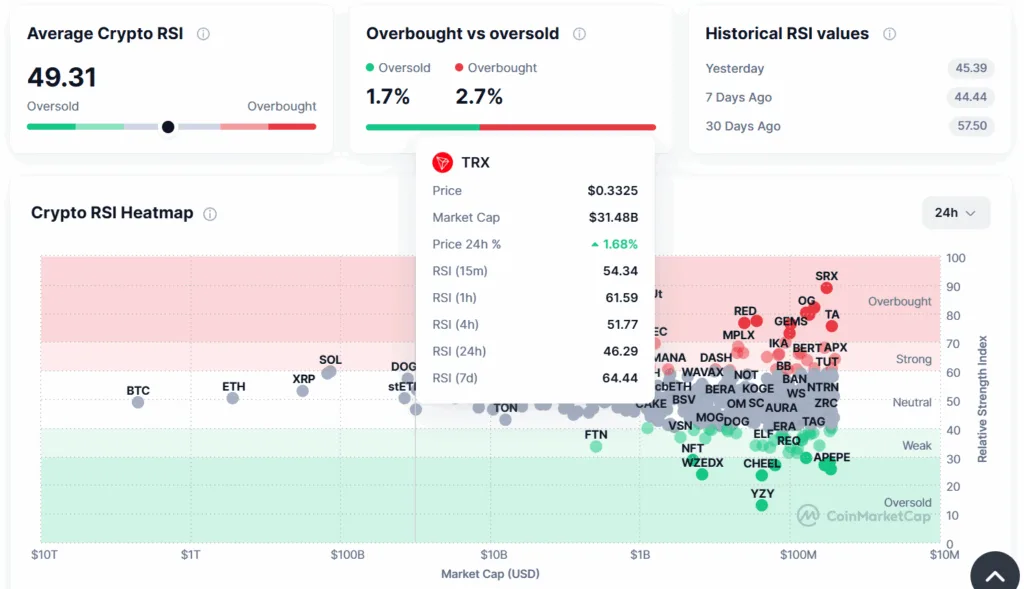

Relative Strength Index indicator signals neutral market

The Relative Strength Index (RSI) is a momentum indicator used in technical analysis to measure the speed and magnitude of price movements. Since the overall average RSI is 49, the market is neutral, which means there is a balance between buyers and sellers.