Last week, the crypto market was showing signs of recovery on the charts. From changes in trends to the overall sentiment of the crypto market on the Fear and Greed Index getting better, the market was moving in the right direction. However, as the crypto market had already priced in the Fed rate cut, investors moved to stock markets as it is less volatile and more reliable.

As such the cryptomarket has not moved much during this week. In fact it has lost some of the ground that it gained. But here’s what is interesting, just because the crypto market has priced in the rate cut, it does not mean that a bull run won’t occur. Here’s what happened this week.

Bitcoin drops below $90K

Bitcoin lost the ground it gained above the $90K level and it is still struggling to stay above this level. However, BTC’s new uptrend is still intact, while the Relative Strength Index (RSI) which is also bullish is making higher lows. This shows that the bullish momentum is still strong.

Similar to Bitcoin trying to hold above the $90K, Ethereum was finding it difficult to keep above the $3K level. Currently priced at $3,030 the coin is still holding its uptrend shape just like Bitcoin. The next biggest hurdle that ETH has is the 50-day Moving Average (MA) which is at $3,321.

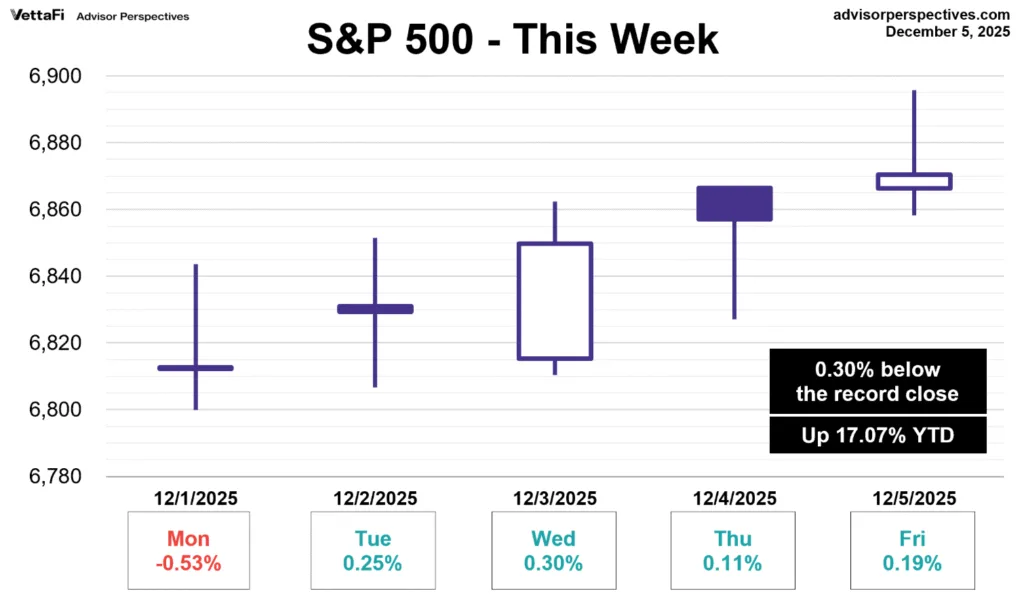

So why is crypto struggling? Crypto is struggling as the investors are more interested in the stock market rather than in crypto. The Standard and Poor’s Index 500 (S&P 500) was up by more than 17% year to date. It fell short by just 0.30% from making a record close. The Dow Jones Industrial average rose by 0.22% while NASDAQ composite rose by 0.31%.

Why did the investor migrate to stocks?

The crypto markets seemed to have already priced in the Fed rate cut which is supposed to happen on the 10th of this month. This left the investors with no reason to put their money on crypto which has no fuel for a rally.

But with stocks, when the cost of borrowing goes down, companies have lower debt servicing costs, which means they have more leftover cash and higher net profit. In addition, stock valuations are based on discounted cash flows (DCF).

This means future profits are “discounted” back to the present using an interest rate. When interest rates fall, the discount rate drops, while future earnings become more valuable today and thereby stock valuations mathematically increase.

In the coming week the Federal Open Market Committee will gather to decide on the interest rate. Since the crypto market has already priced in the rate cut, there will not be much excitement and no huge spikes. It’s going to be just another ordinary day in the crypto market.

However, just because the crypto markets will not respond to the rate cuts, it does not mean that there won’t be a rally. Bitcoin and ETH are still holding their uptrend despite all the market has gone through.

According to the above chart, Ethereum is getting stronger against BTC and a crypto analyst expects a winter rally. The crypto analyst spotted a broadening wedge which occurred just before the summer rally and that same set up is once again appearing on the charts. This positions the ETH/BTC pair for a huge rally in the coming weeks.