Imagine the most frenetic, noisy casino in the world. Now, picture a single, silent vault in its basement, door sealed, through which fortunes flow based not on dice rolls, but on the slow, tectonic shift of belief. This is not a metaphor. It is the reality of a single crypto wallet, a digital container holding $729 million in pure Ethereum, watching the chaos from a place of profound stillness.

While traders scream into headset microphones and memecoins are born and die by the minute, this vault, linked to Ethereum creator Vitalik Buterin, does nothing. It simply exists. Its value swings by tens of millions in a week without a single trade being made. It receives both multi-million dollar grants and absurd, three-dollar “tips” from strangers. It is, perhaps, the quietest and most eloquent argument in crypto: a monument to patience in a temple devoted to speed.

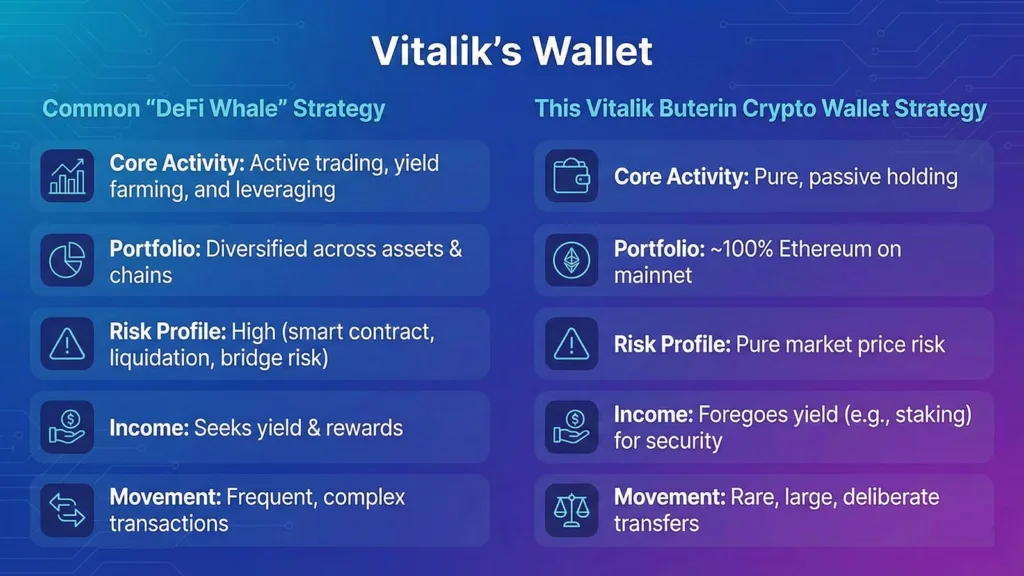

An analysis of this Vitalik Buterin crypto wallet reveals a philosophy of wealth that is both shockingly simple and profoundly revealing about what real, lasting crypto capital looks like.

The glacier: A wallet that barely moves

When you examine the numbers, the behavior is almost old-fashioned. Nearly every dollar in the wallet sits in ETH. Not “ETH plus some clever yield strategy,” not “ETH and a sprinkle of risky altcoins,” but simply ETH. The wallet uses a Gnosis Safe, so moving anything requires multiple signatures. It is designed for hesitation, not heat-of-the-moment decisions.

Since mid-2022, only a handful of large transfers have taken place. The balance slid gently from a little over 320,000 ETH to 240,004 ETH today. These weren’t panic dumps after bad news or sudden rallies. They look more like scheduled responsibilities, the kind of slow administrative work that comes with running a foundation or funding research.

Perhaps the most astonishing part is what doesn’t appear: there hasn’t been a single exchange deposit or withdrawal in more than 1,400 days. Not one. If Vitalik trades, he does it elsewhere. This wallet is something different. It behaves like long-term savings tucked away and rarely touched.

The side show: $30 million weeks and $3 tokens

The dynamics of this vault defy common trading psychology. In the week leading up to December 6, 2025, the wallet’s value increased by $30.2 million without a single new token being added. The gain came entirely from ETH’s price appreciation from about $2,938 to $3,038. Conversely, when ETH dips, the paper value evaporates by similar magnitudes. This is the reality of whale-scale holding: fortunes are made and lost by sitting still, tied irrevocably to core belief in the asset.

Amid this serious wealth, the wallet is constantly peppered with absurdity. Its transaction history is cluttered with unsolicited airdrops of memecoins like WOJAK and MEMERICA and micro-tips of a few dollars’ worth of ETH.

Someone once sent 0.0005 ETH (about $1.55) from an OpenSea account, likely an NFT royalty or a simple gesture. It’s a bizarre juxtaposition: a vault managing hundreds of millions simultaneously functions as a digital bulletin board where people throw promotional tokens and spare change, hoping for attention.

The ultimate critique: Billions on the sidelines

For a wallet of this size, the absence of activity is the actual story.

- No lending

- No borrowing

- No staking

- No liquidity pools

- No leveraged bets

- No cross-chain adventures

It skips every trend the rest of the industry obsesses over. ETH could be staked for yield, and yet it isn’t. It could be placed into complex protocols, but that would introduce risk, and this wallet wants none of it.

There is a reason wealthy families keep their core assets boring. The more you have, the less you want to be exposed to unnecessary experiments. This wallet behaves exactly like that.

Whales in a changing sea: Context from the broader market

Across the market, large wallets have become less reliable as indicators. Even weeks of steady Bitcoin accumulation didn’t stop BTC from sliding below $90,000 recently. Meanwhile, investigations continue to show billions in illicit funds flowing through major exchanges. Stablecoins are regularly tied to scams and criminal networks.

Placed in that context, Vitalik’s wallet looks strangely clean. Transparent. Simple. Almost stubbornly honest in its refusal to chase returns.

Here is the contrast in plain language:

Philosophy over finance: The final takeaway

This wallet is more than a balance sheet; it’s a philosophical statement. It answers the question, “Is Ethereum money, technology, or identity?” with a resounding “All of the above.” The ETH here is savings, a store of value so trusted it requires no enhancement.

It represents belief in the foundational technology, separate from the speculative carnival built on top of it. And it embodies a public identity, attracting both serious grants (like a $1.94 million STRK allocation) and the constant, humorous spam of the crowd.

For everyday investors, the lesson isn’t to copy this singular approach but to understand its principles. In a market obsessed with shortcuts and hype, the purest form of conviction, and one of the most successful, can look like doing almost nothing at all. The quiet discipline of this Vitalik Buterin crypto wallet offers a masterclass in the power of patience in the digital age.