The U.S. employment data will be released today and the crypto market is somewhat cautious or risk-averse. Investors are pulling back from aggressive buying. CoinMarketCap’s Fear and Greed Index which gauges the sentiment in the crypto market has struck 41, falling below the 50 line, showing that the sentiment is neutral or the investors are taking no risks at the moment.

The market has taken a cautious stance since the employment data will be released today, and traders are unsure how it will turn out to be. On Wednesday the Automatic Data Processing, Inc. (ADP), one of the world’s largest payroll processing firms revealed that the private sector employment increased by 54,000 jobs, well below expectations of 65,000 jobs. This is not just a below par number but a big drop from July data of 106,000 jobs.

Analyst expects price action to be mediocre at best

In a following X post to the above post, Kevin, an economist, expressed his thoughts about the current ADP data,stating, “Very low volume and very little liquidity flowing around. Classic August/September behavior while the markets wait for key economic data and monetary policy updates going into Q4. Your main focus should be on the data coming up until the FOMC on the 17th. Price action will likely be mediocre at best until then.”

September-August dormancy nothing out the ordinary

It’s not just caution at play overall, but markets are not at their best behavior in August and September, as traders and funds take vacations, leading to lower trading volumes. In addition, fund managers often trim riskier positions (like tech stocks or crypto) after the summer before the Q4 push. On top of these, many important U.S. economic data points will be released. With a compilation of these factors, the market is quite dull during this time of the year.

So how will the US jobs data have an effect on the Fed’s interest rates?

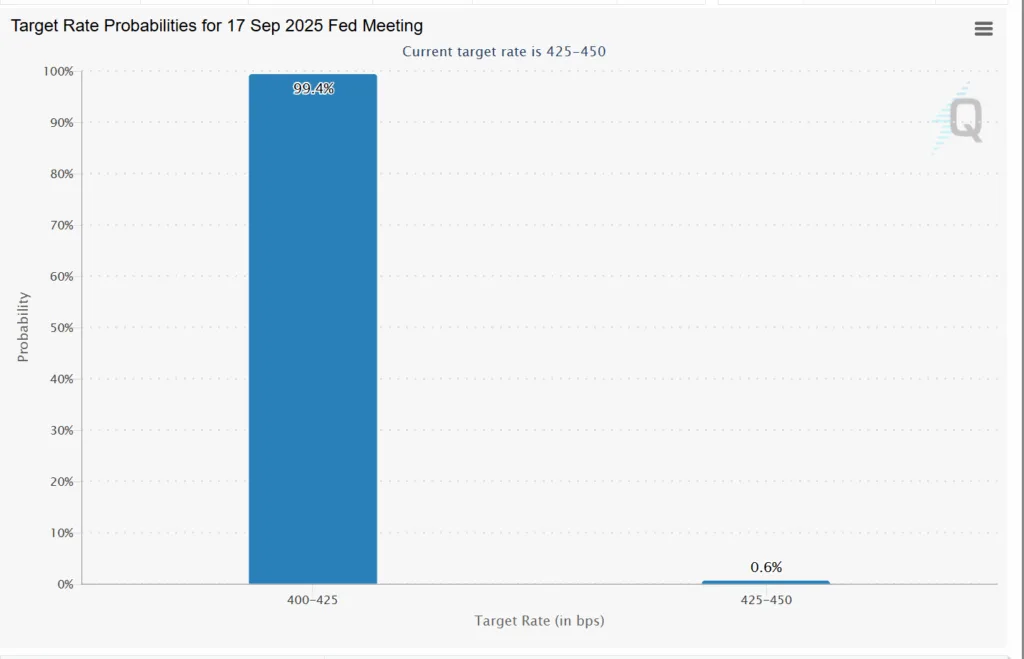

With a dual mandate of maintaining maximum employment and stable prices –2% inflation, the Federal Reserve will have an important decision to make on September 17 at the Federal Open Market Committee (FOMC) meeting, of whether to cut interest rates or keep it unchanged. The U.S. Bureau of Labor Statistics (BLS) report will come today and it will take the poor ADP into consideration. The Federal Reserve will definitely take a note of this weak data when considering interest rate cuts for September. However, the CMEwatch group indicates a 99.4% probability of a rate cut this month.

Probability of a rate cut hits 99.4%

How will the crypto market react?

If the CME Group prediction is right, as it was during the last FOMC, and there is a cut in interest rates this time, the money supply (M2) will increase. When interest rates are lower, investors find it conducive to borrow loans at lower interest rates and invest in risky assets like crypto. This will increase the demand and keep the prices higher.