There’s a comforting story gaining traction that the crypto market recovery is beginning now in December. This might not necessarily be the case. What we are seeing is not a recovery but a fragile pause, a bounce in a bearish trend that remains dangerously vulnerable.

Coinbase Institutional’s recent note, suggesting conditions are ripe for a December reversal, has provided hope to a battered market. Their argument hinges on improving macro liquidity and the high probability of a Federal Reserve rate cut.

However, focusing solely on these external tailwinds ignores the stark, unresolved weakness within the crypto ecosystem itself. To declare a true crypto market recovery, we need to see healed internal wounds, not just the promise of external medicine. That healing has barely begun.

The price action tells a story of drawdown, not revival

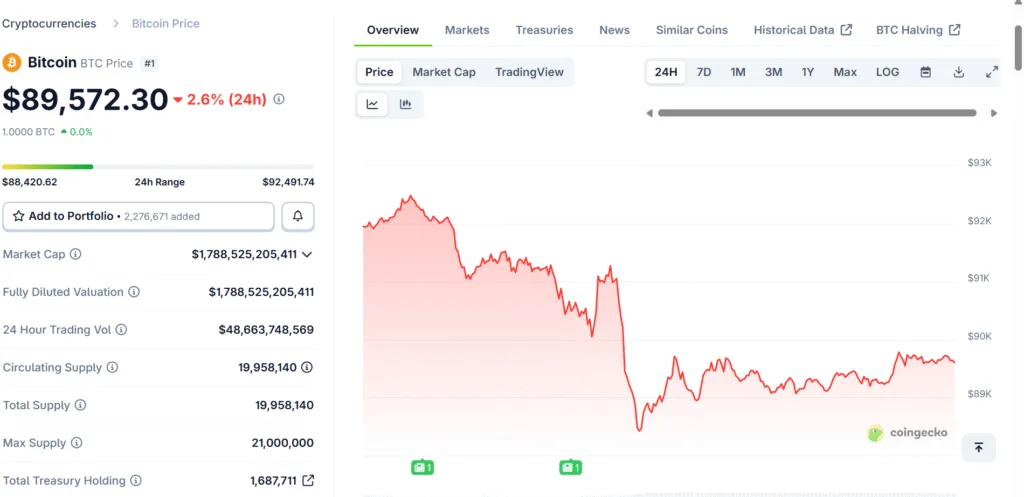

Bitcoin, the market bellwether, suffered a violent collapse from its early October peak above $126,000 to an intraday low near $80,500 in late November. That represents a loss of over 35%. As of early December, it has clawed back to the low $90,000s, a move that looks more like a dead-cat bounce than a sustainable reversal.

A brief stabilization is not a trend change. The market has shed over $1 trillion in value since October, and despite a modest rebound, the total crypto market cap remains hundreds of billions below its former highs. This price action fits the classic profile of a market finding a temporary floor after a panic, not one embarking on a new uptrend. For context, here is a snapshot of Bitcoin’s recent performance:

Liquidity: A tale of two conflicting signals

Coinbase correctly identifies that global macroeconomic liquidity is improving, a potential long-term tailwind. However, crypto-native liquidity, the lifeblood of daily trading and sentiment, is telling a dire story.

The most damning evidence comes from the spot Bitcoin ETF arena, the flagship conduit for institutional capital. BlackRock’s iShares Bitcoin Trust (IBIT) has been bleeding for weeks, experiencing its longest outflow streak since launch, with over $2.7 billion withdrawn in just five weeks. November is on track to see record monthly outflows from crypto ETFs globally, shattering previous records. This isn’t the “new capital allocation” that fuels a bull market; it’s a retrenchment.

Simultaneously, the largest Bitcoin “whales” (holders of over 1,000 BTC) have been distributing coins at a notable rate. This selling from the most steadfast hands creates a persistent overhang of supply that any rally must absorb. While some mid-sized buyers have stepped in, this looks more like a redistribution of assets during uncertainty than a wave of new, confident buying.

A supportive ceiling, not a foundation

The bullish macro narrative rests on two pillars: the “AI bubble” and imminent Federal Reserve rate cuts. Both are shaky foundations for a crypto market recovery in the immediate term.

While the continued strength in AI equities may support general risk appetite, it also competes for speculative capital. More critically, the Fed’s potential pivot is now almost universally expected. Markets are pricing in a high probability of a cut in December. The problem with universally expected good news is that it’s already reflected in prices. If the cut occurs, it may trigger a “sell the news” event. If, against the odds, the Fed pauses, it could spark a violent negative reaction in an already jittery market.

Furthermore, other central banks, like the Bank of Japan, are moving in the opposite direction, which could tighten global liquidity conditions and complicate the narrative.

The path to a genuine crypto market recovery

A real crypto market recovery will be signaled not by a hopeful X post but by clear on-chain and flow data. We need to see:

- Sustained Positive ETF Flows: The record institutional outflows must not only stop but reverse convincingly.

- Recapturing Key Levels: Bitcoin must reclaim and hold above critical technical resistance, such as the $95,800 level identified by on-chain metrics, to shift from a precarious to a stable position.

- Strength Beyond Bitcoin: A healthy recovery requires broad-based participation, where major altcoins demonstrate sustained strength and defend their key levels, not just a shaky bounce in BTC.

The current moment is one for cautious observation, not exuberant celebration. The market is showing early, fragile signs of stabilization after a historic drawdown. To mistake this event for a confirmed crypto market recovery is to confuse a respite with a rescue.

The patient is off the emergency room table, but it remains in the ICU, connected to monitors and dependent on a steady flow of supportive macro medicine. The road back to health will be long, and declaring victory now is not just premature, it’s dangerous for any investor mistaking a relief bounce for a new bull run.