Ethereum-focused digital asset treasury (DAT) firm FG Nexus shared its Q3 2025 results yesterday. From a crypto perspective, what stood out is that the firm liquidated almost 11,000 ETH to finance a major share buyback program.

FG Nexus dumps ETH to repurchase shares

According to an announcement yesterday, Nasdaq-listed DAT firm FG Nexus has initiated buying back its common shares, as promised earlier in the year.

Consequently, the firm sold a significant portion of its Ethereum holdings – 10,922 ETH for approximately $10 million. The proceeds from the sale, along with $10 million in borrowed funds, were used toward repurchasing the company’s shares.

To date, the company has bought back a total of 3.4 million common shares, at an average price of $3.45 per share. Notably, the firm’s total ETH holdings have slipped from 50,778 ETH to 40,005 ETH.

FG Nexus also holds close to $37 million in unencumbered cash and USDC stablecoin. Commenting on the development, Kyle Cerminara, Chairman & CEO of FG Nexus said:

Since commencing the buyback, we have repurchased 8% of our shares outstanding at a substantial discount to our net asset value while maintaining a strong ETH and cash balance.

It should be noted that just a few weeks ago, another Ethereum DAT ETHZilla sold about $40 million worth of ETH to fund its own share buyback program. The trend highlights a worrying theme of DATs liquidating their crypto holdings to support their share price.

While share buyback programs provide some temporary breathing room to a company’s shares, their viability often becomes a point of contention. Following FG Nexus’ ETH liquidation, the leading altcoin is down 10.7% over the past 24 hours.

Ethereum ETFs continue to bleed

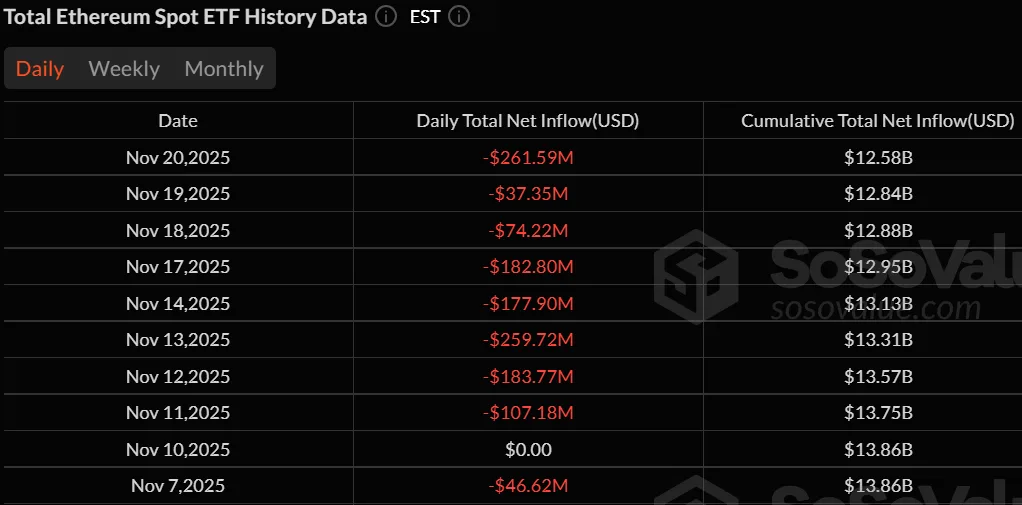

Meanwhile, US-based spot Ethereum exchange-traded funds (ETFs) continue to witness strong outflows. According to data from SoSoValue, ETH ETFs are currently on a nine-day streak of capital outflows.

That said, there are some positive developments in the industry that should keep the bulls optimistic. For instance, crypto entrepreneur Tom Lee recently predicted that ETH may follow Bitcoin’s (BTC) ‘supercycle.’

Similarly, a recent survey found that the majority of young US-based investors are considering increasing their allocation to cryptocurrencies over the next 12 months.