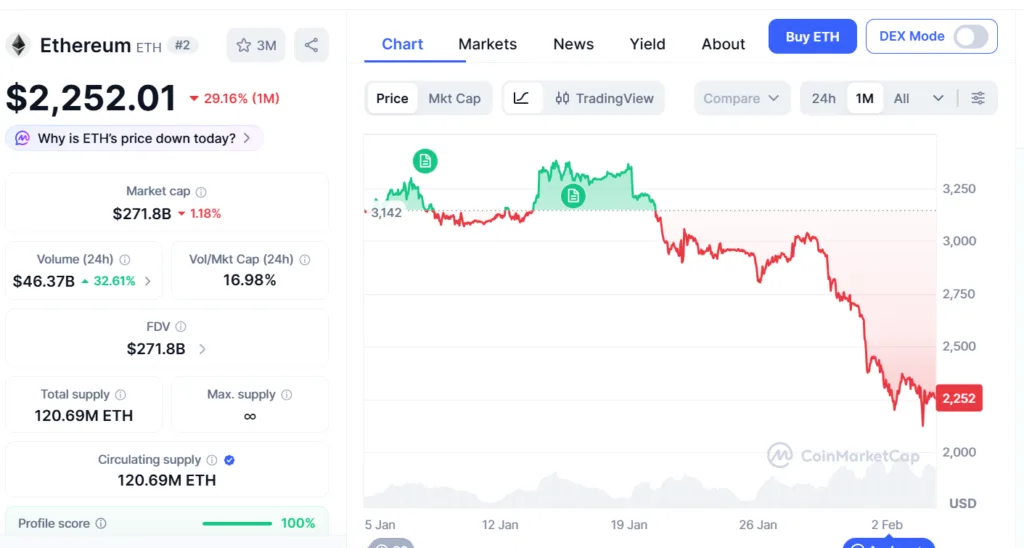

Ethereum crashed to a 7-month low despite the transaction on the network showing an increment in usage. According to a crypto netizen, ETH is currently undervalued, priced at $2,255.

The whole of last month has been very volatile for Ethereum. From reaching prices above the $3,250 level, the coin tumbled to the $2,200s as of the beginning of February.

Although the buyers tried to consolidate the prices above the $3,000 psychological level, the surrounding geopolitical tensions seeped into the coin, taking it close to the $2,200 level. During the past 30 days alone, the token lost 30% of its value.

Dusting increases after Fusaka upgrade

This devaluation comes just a few weeks after the implementation of the Fusaka upgrade, which made the transaction fee much lower. The upgrade increased the capacity of a block and also the blob capacity. With block limits raised, the network could accommodate more contract executions and transactions per block. With this upgrade, the transaction fee dropped significantly.

With lower transaction fees, there was a rise in dust transaction activity on the network, and 11% of transactions accounted for this activity. Dusting is a malicious practice where the bad actor sends a small amount of stablecoin from an address that is very similar to the address of the receiver.

The main idea is to trick the user into copying the look-alike address of the attacker and not the original one when the user sends it to receive funds.

ETH is undervalued at $2,250

Despite the increase in transactions happening on the network, the ETH price has fallen to a 7-month low. A crypto netizen stated that the ETH prices are currently undervalued.

As shown in the chart above, ETH has crashed below an important support level at $2,850 and landed on the 7-month low. However, as the netizen stated, Ethereum is undervalued, and the traders will start buying the dip, after which the price will skyrocket.