Although price-wise, 2025 was far from being the best year for Ethereum, the developer activity on the leading smart contract platform hit a new record high in Q4 2025. In the last quarter of 2025, Ethereum deployed 8.7 million smart contracts.

Ethereum developer activity hits a new high

In a recent X post, Leon Waidmann, the Head of Research at Onchain Foundation, stated that developer activity on Ethereum recently hit a record high. In total, 8.7 million smart contracts were deployed on the platform in Q4 2025.

Waidmann published the following chart, which shows the increase in Ethereum developer activity in Q4 2025 compared to previous quarters. The number of smart contracts deployed on Ethereum skyrocketed from 3 million in Q3 2025 to 8.7 million, an increase of 190%.

Waidmann highlighted that the spike in developer activity indicates that Ethereum builders are “shipping, not speculating.” He added that activity is accelerating going into 2026, with more decentralized applications (dApps), real-world assets (RWAs), and stablecoins to come this year.

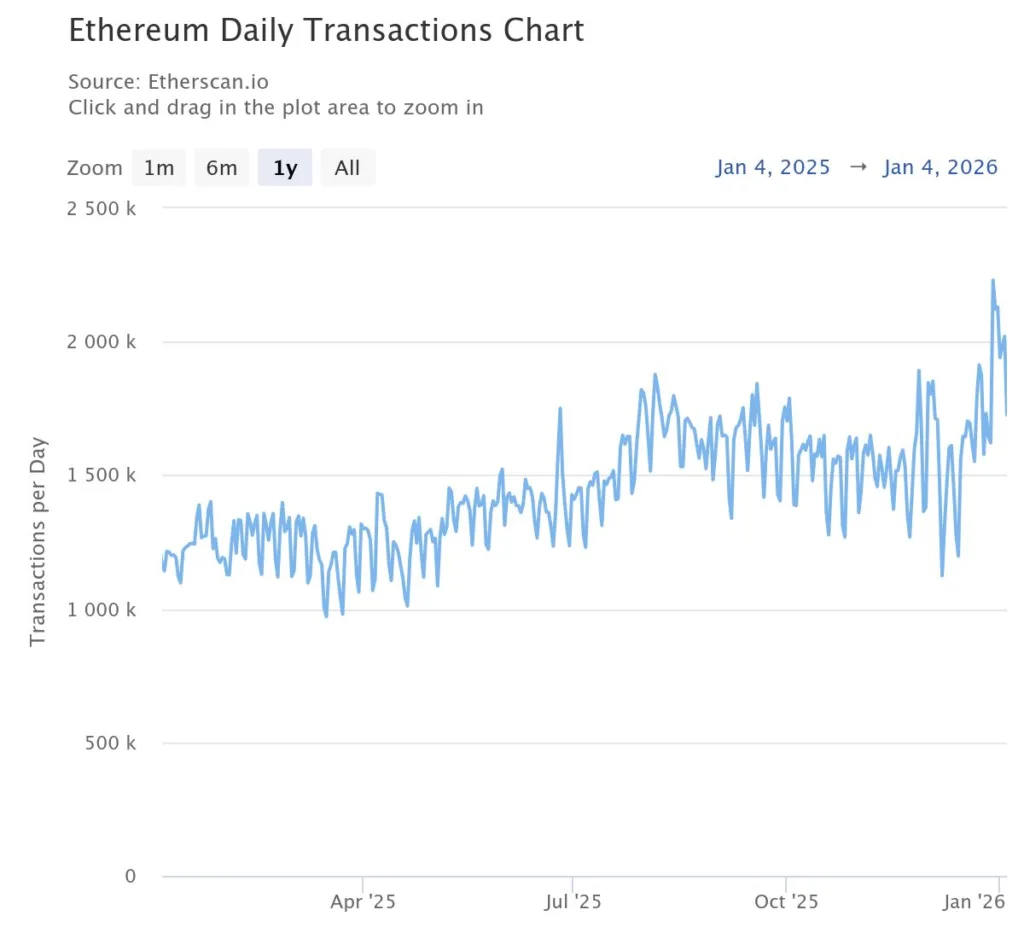

Besides the increase in developer activity, data from Etherscan shows that daily transactions on the blockchain also saw a surge toward year-end. On December 29, daily total transactions on Ethereum hit a yearly high of 2.23 million, suggesting heightened usage.

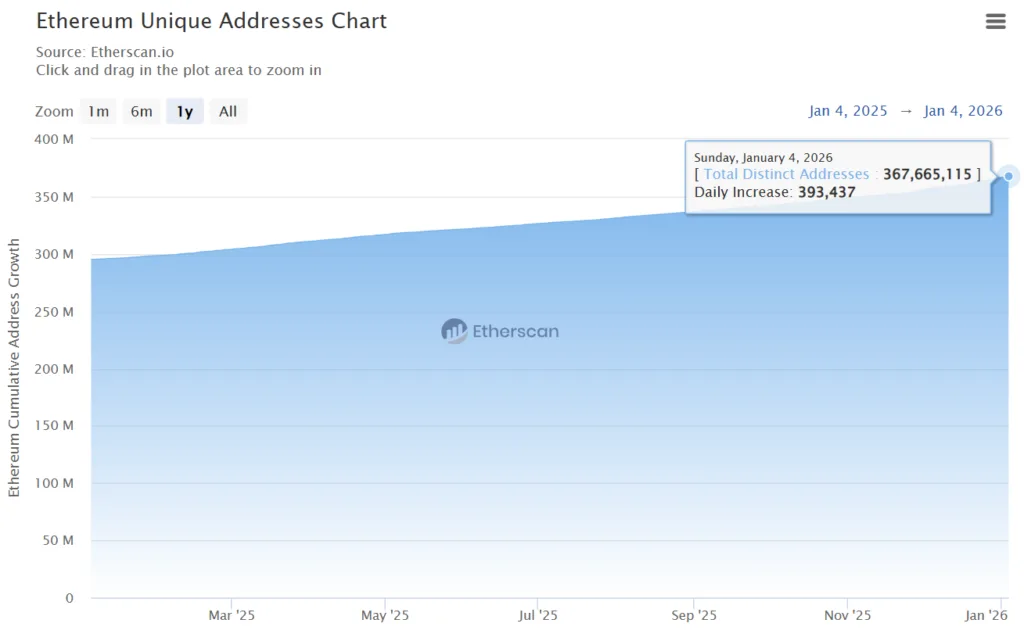

The Ethereum unique addresses chart also shows an uptrend, with the number of distinct wallet addresses reaching as high as 367.67 million as of January 4. It shows an increase of 393,437 addresses from January 3.

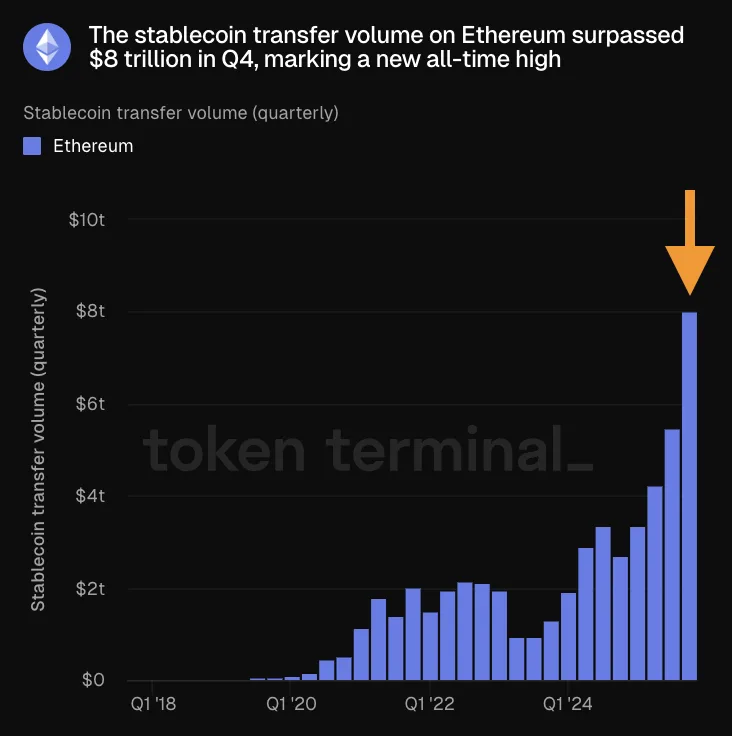

Ethereum powers stablecoin transactions worth $8 trillion

Apart from the high amount of unique wallet address creation and developer activity, Ethereum also saw stablecoin transactions worth $8 trillion in Q4 2025. The chart by Token Terminal below shows that stablecoin transactions rose from $5.5 trillion in Q3 2025.

From a technical point of view, 2025 was an important year for the second-largest digital asset by market capitalization. Ethereum had two major upgrades last year, Pectra and Fusaka, aimed toward making it more scalable, secure, and affordable.

However, despite the highly anticipated Fusaka upgrade, Ethereum’s price failed to make any substantial gains. The digital asset ended the year on a lukewarm note, trading just below $3,000 on December 31.

That said, ETH permabulls like Fundstrat’s Tom Lee are still optimistic about the cryptocurrency’s future. Lee predicted last year that ETH may rise to as high as $62,000 if it records quick gains on the ETH/BTC chart.