Ethereum failed to clear a major resistance level on the daily charts despite the open interest increasing. However, on the weekly charts the bullish momentum is building, and ETH could surge.

Ethereum was making good progress on the daily chart before stumbling upon the resistance level at the 50-day Moving Average ($3,300). The coin tested the level, but it was not able to push past this level and head higher, as the bulls were not strong enough. The Relative Strength Index (RSI) line, which was making higher highs, changed its upward direction to horizontal, showing the waning strength of the bulls.

What happened?

The futures open interest, or the number of leveraged open positions has been increasing since the last week of November. The number increased from $33 billion to almost $41 billion within just a few weeks. An increasing open interest (OI) shows that new futures positions are being opened, meaning fresh capital and leverage are entering the market.

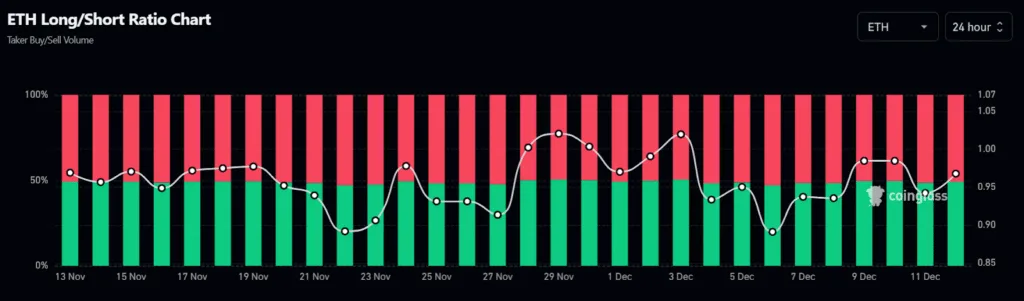

However, when open interest increases, the price doesn’t need to increase along with it, as the newly opened contracts could be short positions. When considering the long/short ratio of the open contracts, the short position has increased slightly and reached 50%. Although this could be a contributing factor, it may not have stopped an ETH breaking the resistance level at $3,300. So there should have been something else as well.

Buyers sell the Fed rate cut news

The Fed cut interest rates on December 10th, and Ethereum had already absorbed the impact of the cut, even before the announcement. Ahead of the Fed decision, ETH already gained 7% in 24 hours with options implying a 4.6% daily move, futures open interest climbing 8% to 12.4 million ETH (its highest since early December), and CME ETH futures open interest topping 2 million ETH.

Buyers had no upside to look for after the Fed meeting; as such, they started to sell ETH. With a major sell-off happening, ETH could not break above the $3,300 level. Although ETH was rejected at this level on the daily chart, the weekly chart has a better view.

As shown in the chart above, ETH is currently on its way towards touching the upper trendline of the ascending triangle pattern. However, just like on the daily chart, the 50-day MA is obstructing ETH on the weekly chart as well. But, the Moving Average Convergence and Divergence line (MACD) is about to make a turn to the upside. This shows that the bullish momentum is just about to arrive and ETH is going to surge.