Ethereum (ETH) is down 34.1% over the past month, trading at $1,961 at the time of writing. Due to the sustained selling pressure, ETH’s realized price (RP) of whale addresses has also seen a downward trend, raising fears of another breakdown in the ETH price.

Realized price shows ETH whales buying

According to CryptoQuant analyst CryptoMe, there are two possible explanations for ETH whale address RP trending downward. First, a whale with a higher average cost sold its holdings, causing the average price to go down.

The second possible reason is that there may be ETH whales that built their cost basis at a lower average price, which further pulled the cost basis downward. Both these reasons hint toward a potential looming price breakdown for the second largest cryptocurrency by market cap.

For the uninitiated, an asset’s RP is the average price at which all coins were last moved on-chain, calculated by dividing the realized cap by the current supply. It reflects the aggregate cost basis of holders, helping show whether the market is – on average – in profit or loss.

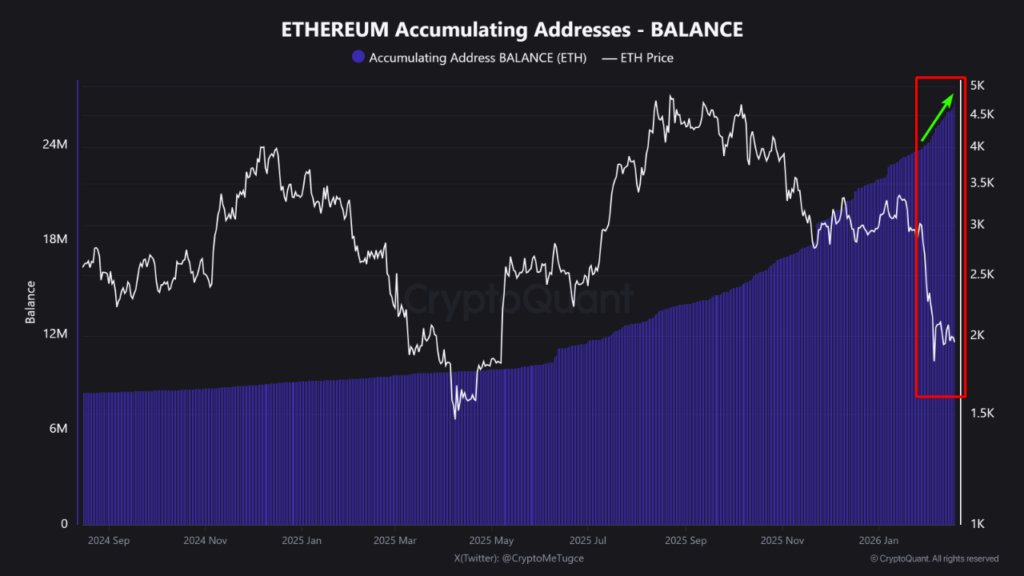

To understand which factor is at play, it is important to look at the Balance and Realized Cap data of the ETH accumulation whale addresses. The following chart shows just that.

In the above two charts, it can be seen that when the addresses’ RP trends lower, the wallet balance increases. At the same time, ETH’s Realized Cap also surges, confirming that the second possible reason is most likely the accurate one.

In simple words, the data confirms that ETH accumulation whales are not selling the cryptocurrency. Rather, these wallets are buying ETH at lower prices, leading to a downward movement in the digital asset’s RP.

Will Ethereum lose another support level?

On-chain data shows several positive signs for ETH, with close to 50% of the coin’s supply now locked up in the staking contract, removing a significant chunk of its active circulating supply.

Similarly, Harvard recently dumped its Bitcoin holdings for ETH, showing institutional interest in the leading altcoin. That said, the ETH taker ratio recently fell to a three-month low, signaling more downside ahead for the digital asset.