Whales continue their Ethereum (ETH) buying frenzy despite the token struggling to rise above the $3,750 resistance level. A newly created wallet received nearly 25K ETH while another whale wallet received near 15.5K ETH. On chain analytics platform, Lookonchain tweeted, “Newly created wallet “0x86F9” received 24,294 $ETH($86.48M) from #FalconX over the past 6 hours.

Whale “0x40E9” received 15,627 $ETH($55.6M) from the Galaxy Digital OTC wallet over the past 2 hours.”

Apart from these two specific wallets, Sharplink Gaming has acquiring large amount of Ethereum in recent times. In the latest acquisition reported by Lookonchain, “SharpLink Gaming received another 15,822 $ETH($53.9M) 6 hours ago. They spent 108.57M $USDC to buy 30,755 $ETH in the past 2 days, with an average buying price of $3,530. SharpLink now holds a total of 480,031 $ETH($1.65B).”

On the 31st of July, the token was trading above $3,800, however, with the building bear pressure, the token lost its footing and fell to to almost $3,300. From 4th August, ETH gained some momentum and it has been gaining value. It has been making higher highs and higher lows. At press time Ethereum is trading at $3,678 after losing nearly 4% in the last 7 days.

Why are the ETH whales accumulating tokens

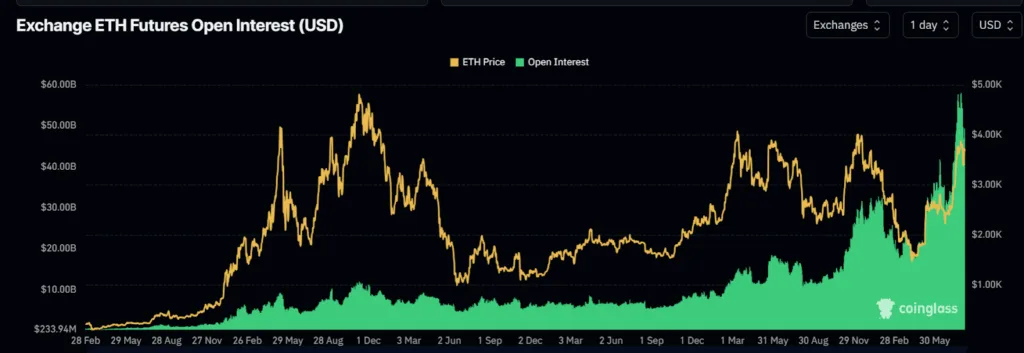

The ETH futures open interest have been rising exponentially. Increasing open interest means more outstanding futures or options contracts are being created—new money is entering the market rather than positions just being closed. The open interest consists of short and long positions, however, when scrutinizing on the long/short ratio, there is a positive number. This shows that there are more traders taking long positions, expecting the price of Ethereum to appreciate. The whales may be accumulating ETH tokens having understood this trend.

On the 4-hour chart, ETH is trading inside a broadening wedge making higher highs and lower lows. A broadening wedge signals rising uncertainty and emotional trading, as buyers push prices to higher highs while sellers drive them to lower lows, causing the price range to expand. This widening pattern reflects a lack of consensus on value, with fear and greed intensifying on both sides. As volatility grows and volume often increases, it suggests the market is unstable and building toward a decisive breakout once one side finally gains control. Once the bulls gains control ETH could break above $4,000.