Ethereum layer-2 (L2s) do not have the same security and decentralization as Ethereum.

Solana co-founder Anatoly Yakovenko stated that Layer 2s (L2s) built on the Ethereum network do not possess the same level of security and decentralization as the parent chain. In a heated argument on Sunday, Yakovenko mentioned, “The claim that L2s inherit eth security is erroneous.”

Explaining himself further, the cofounder stated that the code required for a full layer 2 is so large and complex that it would be literally impossible to declare the network bug-free and fully functional. “Because of this, L2s currently all have an upgrade multisig, which renders all the security guarantees moot. They all have the exact same worst-case risks as wormhole.”

The multisig or multisignature is a process where a transaction needs more than one private key for the transaction to be approved, which was developed to counter bugs. However, despite this upgrade, the L2s seem to have the same risk as on a wormhole or bridge, where two different blockchains interact.

The multisig is like a kill switch that could be used, given that there is a bug or an attack. For instance, 4-of-7 multisig means 7 people hold keys, and at least 4 must agree to make a change. If a bug, exploit, or attack is discovered (e.g., a faulty bridge contract), the multisig can: pause withdrawals, freeze contracts, or revert upgrades.

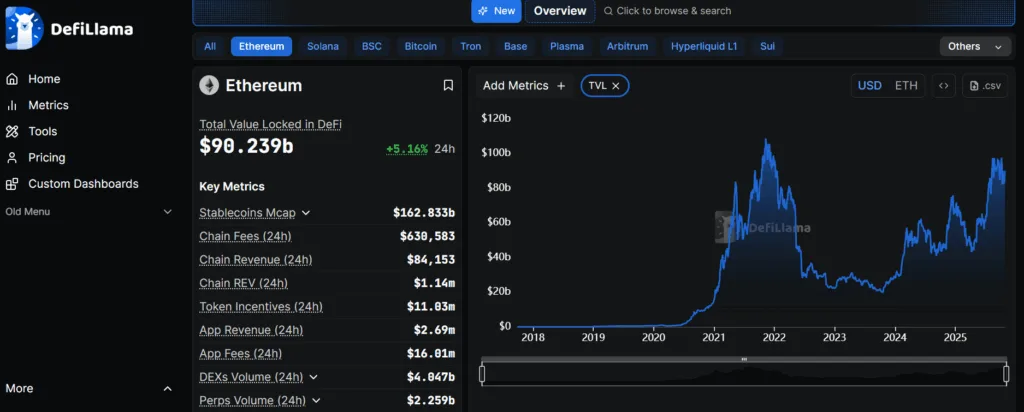

In addition, the total value locked on Ethereum has doubled during the past 6 months. In April of 2025, the TVL was around $45 billion; however, as of today, the TVL is more than $90 billion.

The TVL of Ethereum

The increase in TVL means more investors are depositing funds because they trust the protocol or expect returns (like yield farming, staking rewards, or airdrops). More funds locked = deeper liquidity pools. This makes trading smoother, slippage lower, and interest rates more stable in lending protocols. It suggests market optimism and risk-on sentiment.