Let’s be honest. For years, if you wanted serious exposure to Ethereum, you were on your own. Navigating exchanges, safeguarding private keys, and the constant, low-grade anxiety of self-custody kept millions of traditional investors on the sidelines. They watched Bitcoin get its shiny, Wall Street-approved ETF, while ETH, the backbone of the entire digital economy, waited patiently in the wings.

No more. The game has changed. The arrival of the Spot Ethereum ETF isn’t just another financial product; it’s a fundamental shift in how the world accesses the second-largest cryptocurrency. As someone who has watched this market evolve for two decades, I can tell you: this is the moment Ethereum grew up.

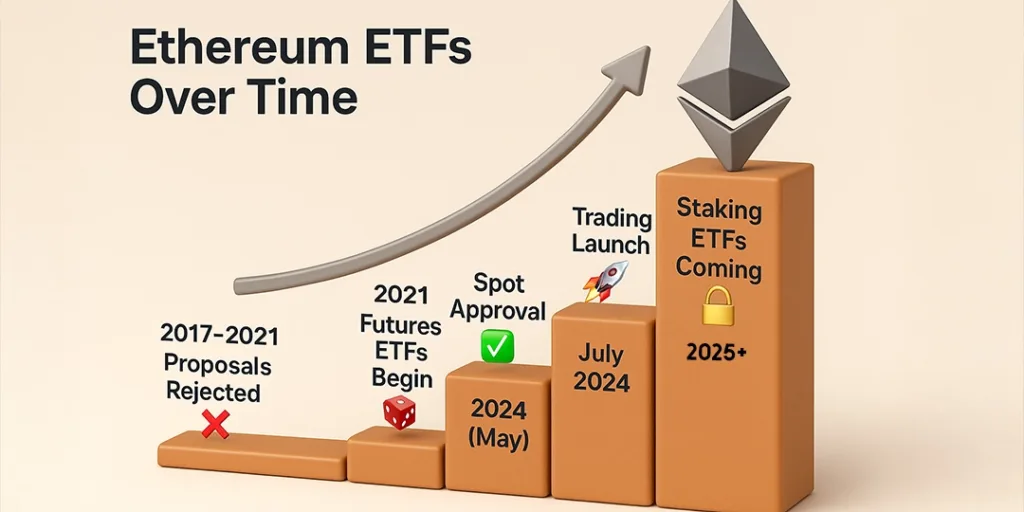

The long road to approval: A timeline of persistence

This didn’t happen overnight. The journey to a Spot Ethereum ETF was a marathon of regulatory hurdles and industry persuasion.

- The Early Days (2017-2021): The first attempts were filed, and frankly, they were dead on arrival. The U.S. Securities and Exchange Commission (SEC) was deeply skeptical. The idea of a fund directly holding Ethereum was a bridge too far for regulators still wrapping their heads around Bitcoin.

- The Compromise (2021-2023): We saw the first crack in the door with futures-based ETFs. These funds didn’t hold actual ETH; they bet on its future price through contracts. It was a start, but a flawed one. These funds often suffered from “tracking error,” meaning their price didn’t perfectly match ETH’s real-time value, and they came with higher fees. It was like watching a shadow of the real thing.

- The Breakthrough (May 2024): After months of intense speculation and behind-the-scenes work, the SEC finally blinked. The approval of the Spot Ethereum ETF was the watershed moment. This meant funds could now hold, actually purchase, and safeguard real Ethereum.

- The Launch (July 2024): The giants entered the arena. BlackRock, Fidelity, and VanEck, household names with trillions in assets, began trading their versions. This institutional stamp of approval is something you cannot overstate. It sends a powerful message of legitimacy.

Why Spot Ethereum ETF matters more than futures

You might be wondering, “What’s the big difference?” Think of it this way:

A futures ETF is like buying a voucher for a future holiday, with the price and dates locked in now. You don’t own the holiday; you own a promise about it. It can be complicated and expensive.

A Spot Ethereum ETF is like buying a direct ticket to your destination. The fund holds the actual asset, Ethereum, in a secure vault. When you buy a share, you own a piece of that real ETH. It’s straightforward, transparent, and designed for the long haul.

What this truly means for your portfolio

This is more than just convenience. This is about opening the floodgates.

- Unprecedented Access: Now, anyone with a standard brokerage account—the same one holding your stocks and bonds—can add Ethereum to their portfolio with a few clicks. No tech hurdles. It’s democratizing finance in real time.

- Institutional Validation: Pension funds, endowments, and major wealth managers operate under strict rules. They couldn’t touch direct crypto. Now, they have a regulated, familiar vehicle to allocate billions. This incoming tide of capital is a powerful, long-term bullish signal.

- The Next Frontier—Staking: The conversation is already evolving. The next logical step is a staking-enabled Spot Ethereum ETF. Imagine your ETF shares not only tracking the price of ETH but also generating a yield for you, just by sitting in your account. That’s not science fiction; it’s the next battlefront.

A word to the wise investor

Of course, nothing is perfect. ETFs come with management fees, which, over time, can slightly erode returns compared to holding ETH directly yourself. And while they are designed to track the price perfectly, there can be tiny, occasional discrepancies.

But for the vast majority of people? The trade-off is more than worth it. The security, convenience, and regulatory oversight provided by these financial titans remove the single biggest barrier to entry.

The bottom line? The Spot Ethereum ETF has successfully brought the revolutionary potential of Ethereum onto the same platform as your retirement fund. It’s a monumental step for crypto’s maturity. Some may say it makes Ethereum a little less rebellious. I say it makes it infinitely more powerful. The future of finance is being built, and now, everyone has a front-row seat.