After tumbling more than 25% over the past month, XRP is beginning to show signs of an upcoming big move that could determine its medium-term price action. Historical data shows that strong XRP inflows to exchanges have typically preceded strong price rallies.

Is XRP preparing for supply pressure?

Recent analyst by CryptoQuant analyst The Alchemist studied three separate metrics – Binance Exchange Inflow, Liquidity USD (MAG-XRP), and Liquidity XRP (MAG-XRP).

By studying these three factors together, analysts can determine exchange supply of the underlying asset and on-chain liquidity conditions have historically aligned with XRP price movements.

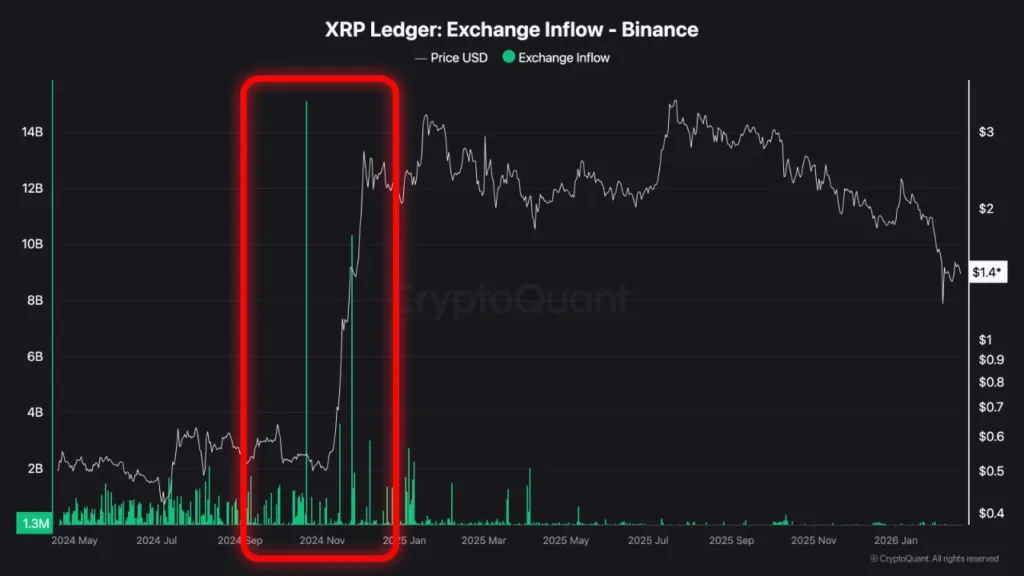

As can be seen in the following chart, exchange inflows to Binance platform tend to spike during the highlighted period, preceding a strong rally. Large token inflows to exchanges typically mean investors want to liquidate their holdings. That said, inflows don’t always necessarily mean immediate selling.

In the current scenario, the rise in exchange inflows coincided with increasing volatility and preceded a major price expansion. In the same vein, Liquidity USD measures the capital depth supporting XRP markets.

Typically, during a rally phase, the USD liquidity expands sharply, enabling the asset’s price to sustain upward momentum. However, recent market action shows USD liquidity on a downtrend, indicating thinner market depth compared to the expansion phase.

Similarly, Liquidity XRP indicates token-side availability. The below chart shows that before the breakout, the XRP liquid compressed significantly – confirming reduced active supply. At the time, the compression phase aligned with the start of the strong upward move.

At present, XRP liquidity is trending lower once again – reflecting earlier pre-expansion conditions. While exchange inflows remain moderate, both USD and XRP liquidity are contracting.

Where is XRP headed?

While compressed liquidity points toward a potential big movement for XRP, other factors point toward a looming ‘supply crunch’ for the digital asset. Recent exchange data shows that XRP reserves have plunged to the lowest level since 2024.

Similarly, XRP’s Z-score points toward a potential incoming big movement. That said, investors should be cautious of not getting too greedy, as recently, late XRP buyers got caught off guard in multi-million liquidation events.