Bitget Wallet recently announced its foray into the self-custodial staking space, starting with Solana. The crypto wallet provider is leveraging its own self-operator validator infrastructure to make it happen.

Bitget Wallet allows native Solana staking

In an announcement made yesterday, leading cryptocurrency wallet Bitget Wallet unveiled support for native Solana staking. The newly released feature aims to provide the product’s users a safer and more transparent SOL staking experience.

With this development, Solana has become the first digital asset to receive native staking support from Bitget Wallet. The users will now be able to stake their SOL coins with just a single tap on Bitget Wallet’s Earn section.

For the uninitiated, staking refers to the process where crypto holders deposit or ‘stake’ their coins on the network to secure it. In return, these stakers get rewards in the form of small periodic payments from the network.

Every blockchain has a pre-determined time period or an ‘epoch’ after which staking rewards are distributed among the validators. Every staker essentially delegates their coins to these validators, who, in turn, secure the network.

For Solana, the epoch ranges from somewhere between two to three days. In comparison, Ethereum has a relatively shorter epoch which lasts for about 6.4 minutes.

Per the announcement, SOL stakers can expect an annualized on-chain yield of more than 6%. These staking rewards will automatically compound within the stakers’ wallet accounts. Commenting on the development, Jamie Elkaleh, CMO of Bitget Wallet, remarked:

Users increasingly want straightforward, transparent access to protocol rewards. Launching our own validator — starting with Solana — allows us to deliver a safer, self-custodial staking experience while laying the foundation for a unified native staking ecosystem.

Solana staking to dry up the SOL supply?

Interested individuals can start staking their coins with as little as 0.01 SOL, worth $1.4 according to current market prices. As an increasing amount of SOL coins get staked, it is likely to create a scarcity of supply, which could be bullish for the digital asset.

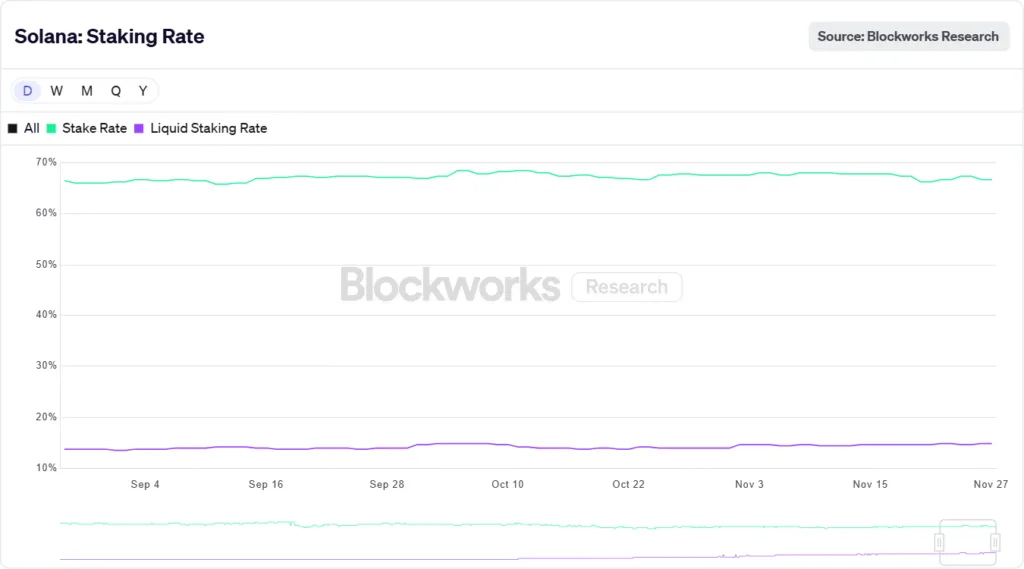

According to the latest data from Solana Metrics, currently 66.72% of total SOL is staked on the network. A total of 822 validators are securing the network, earning a net staking yield of 6.37%.

Besides the high proportion of supply locked up in staking, an increasing number of institutional investors getting exposure to SOL through exchange-traded funds (ETFs) will further deplete the coin’s active circulating supply.

That being said, there are some worrying signs that might derail SOL’s momentum. Recent Solana metrics suggest that the smart contract network’s active addresses recently fell to a 12-month low, signaling lukewarm activity on the blockchain.