Solana is looking bearish on both the long- and short-term charts; however, inflows into Solana ETFs could renew its lost hope.

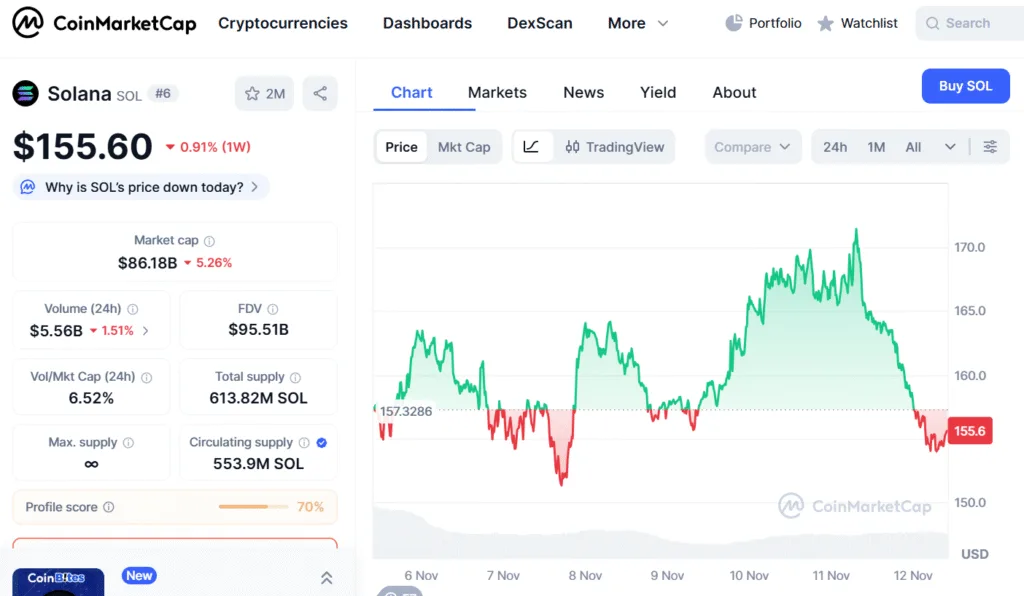

Solana is now priced at $155 after losing more than 1% during the past week. The last seven days have been a bumpy ride for Solana, as the token fluctuated wildly between $150 and $170, level. When observing the chart below, the token kicked off the week with a spike, crossing above $160. However, the very next day, the bears started to infect the healthy spike. SOL crashed from then and reached its weekly low of $151 on November 7.

Nonetheless, the traders started to buy the dip, and SOL got back up on its feet and once again crossed above its weekly opening market price of $157. This time, the bulls kept their foot on the pedal, accelerating the prices past the $170 psychological level. With SOL above this level, traders started to take profits, and SOL is back to square one at $155.

Although on the short-term time frame, Solana is beaten and battered, we can only make a better judgment by considering the longer timeframe.

Solana veers from bullish pattern

The above chart shows Solana’s price behavior since September. The first thing to note is that the token has crashed below the lower trendline of the bullish falling wedge. The lower trendline, which was supporting the prices, is now acting as a resistance level ($173).

The 50-day Moving Average (MA) is converging with the 200-day MA below it. If these two intersect, there will be a bearish death cross, which will further crash the prices.

Solana steers off 5 5-month beaten path

Let’s zoom out a bit more than a month’s price action and see what’s happening. The chart below shows Solana’s price action since April 2025. During the last five months, the token was inside the ascending triangle, which, if continued, would have broken to the upside, but it wasn’t to be.

Instead of continuing the trend of making higher highs and higher lows inside the channel, SOL suddenly made a lower low, dismantling the whole ascending channel pattern. So, even in the bigger picture, Solana is bearish.

Solana ETF, the last savior

However, the Solana spot and futures ETF markets are seeing an increase in volume. Both charts are almost going parabolic. With funds flowing into the ETF, the underlying Solana still has a chance of getting back into the ascending channel.