If you have been around crypto long enough, you know GameFi is where optimism goes to get tested. For every flashy trailer and promise of virtual riches, there are ten abandoned games, empty servers, and tokens drifting quietly into irrelevance. That is why the race for the best GameFi crypto of 2026 looks very different from past cycles.

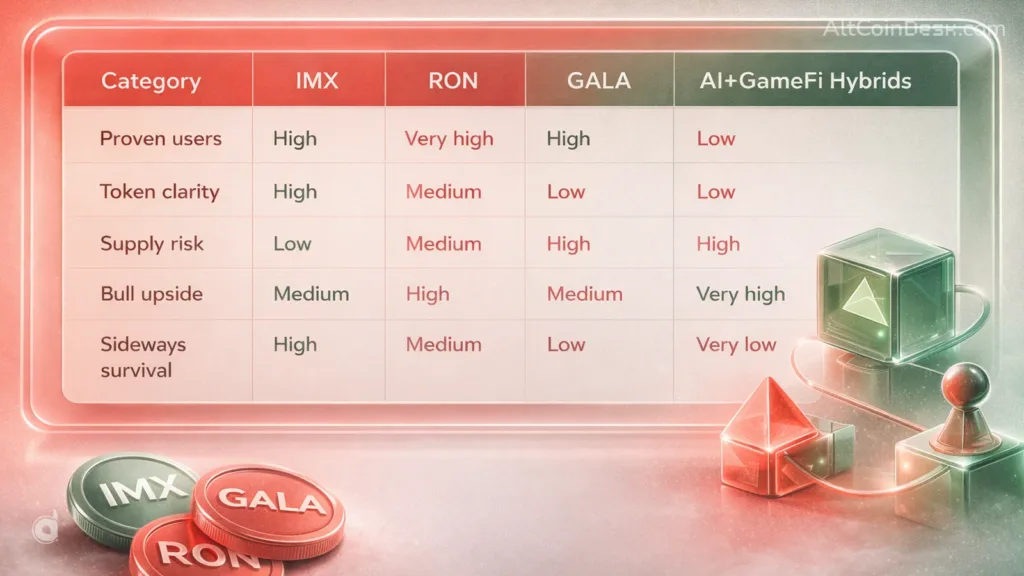

This list is not about the newest name on social media. It’s about projects that can be checked, are still useful after the excitement wears off, and can be sold. In January 2026, investors and analysts quietly watch three GameFi tokens: Immutable (IMX), Ronin (RON), and Gala Games (GALA). They don’t make a lot of noise, but they are still working.

1. Immutable (IMX), The quiet backbone of GameFi

If GameFi were a city, Immutable would be the roads, not the billboards. It does not depend on a one-hit game. It exists underneath dozens of them. Immutable provides gaming infrastructure built on Ethereum, including Immutable X and its zkEVM stack. Studios use it to scale games without drowning in fees or complexity. Players often do not even realize it is there, which is exactly the point.

Why Immutable tops every serious best GameFi crypto 2026 ranking is simple. When one game fails, the system does not collapse. Another studio keeps building. Another marketplace keeps running. That lowers risk in a sector famous for it.

Supply pressure also behaves better here. IMX has a fixed maximum supply, with a large portion already circulating and the rest released through structured, transparent schedules. Analysts like that. Institutions like that even more. Immutable makes money by enabling others to succeed. That is why it sits at the top of most GameFi portfolio allocation models.

2. Ronin (RON), proof that players matter

If Immutable is the backbone, Ronin is the arena. Ronin is a gaming-first blockchain that has already survived millions of players, multiple cycles, and plenty of stress tests. Built originally to support large-scale games, Ronin focuses on speed, low costs, and frictionless gameplay. It does not sell theory. It sells function.

What keeps Ronin near the top of the best GameFi crypto 2026 conversation is measurable activity. Wallet growth. Transactions. Games people actually log into. Charts increasingly reward this kind of evidence.

RON does have inflation tied to validator and ecosystem rewards. That creates moderate supply pressure, especially during quiet periods. But when gaming activity heats up, Ronin tends to move fast and hard. For investors, Ronin behaves like momentum with receipts. When players show up, the token responds. When they leave, it cools quickly. That honesty is rare in GameFi.

3. Gala Games (GALA), the veteran who refuses to leave

Many people wrote Gala Games off years ago. It did not disappear. Gala operates more like a publisher than a single game studio. Multiple live games. Music and film experiments. Its own chain direction. Support infrastructure that looks boring, which is often a good sign.

GALA ranks highly in the best GameFi crypto 2026 lists because it survived what killed others. Hype cycles. Restructures. Shifting narratives. It kept shipping.

The downside is supply pressure. Historically high emissions and node rewards created consistent sell pressure. Many holders treat GALA as income, not a long-term store of value. That caps upside during quiet markets.

Still, in bull markets, GALA can move sharply. Liquidity remains deep, visibility stays high, and retail participation never fully disappears. Think of Gala as the veteran boxer. Not always pretty. Still standing.

How GameFi is really ranked in 2026

Most people think charts rank hype. They do not. By 2026, GameFi rankings will quietly revolve around four things.

- Survivability. Did the project live through previous cycles?

- User activity. Are humans actually playing?

- Revenue paths. Is there a real way value flows back to the token?

- Infrastructure depth. Does it support more than one product?

Immutable scores high on almost all of them. Ronin dominates user activity. Gala survives through breadth and persistence. That is why flashier projects struggle. One game means one failure point. When rewards dry up, players leave. Charts punish that behavior fast.

How these tokens behave when markets change

In bull markets, Ronin often delivers the fastest upside when gaming narratives rotate back into focus. Immutable climbs more steadily, attracting larger capital looking for structure. Gala can spike hard, then cool quickly.

In sideways markets, Immutable holds up best. Ronin drifts unless new games drive traffic. Gala usually underperforms due to ongoing emissions. This is why professional GameFi portfolio allocation models tend to anchor with IMX, add RON for upside, and treat GALA as optional risk.

The bottom line for January 2026

The best GameFi crypto 2026 choices are no longer about promises. They are about proof. Immutable leads as infrastructure. Ronin leads with players. Gala leads by still existing. That may sound unromantic, but in GameFi, survival is the feature that pays the longest.