At a time when tokenization is rapidly leaping into different sectors, Mubadala Capital, Abu Dhabi’s leading global asset manager, is delving into real-world asset (RWA) tokenization. This move comes following a partnership with KAIO, a decentralized finance (DeFi) protocol focused on tokenizing assets.

KAIO’s RWA Infrastructure provides a legal tokenization framework to Mubadala Capital, where the asset manager is exploring ways to offer tokenized access to its private market investment strategies. In other words, the firm intends to introduce tokenized access to private market investments for qualified institutional and accredited investors.

Mubadal Capital is a subsidiary of Mubadala Investment Company, an Abu Dhabi government-based sovereign wealth fund.

KAIO-Mubadala collab comes amid increasing RWA tokenization

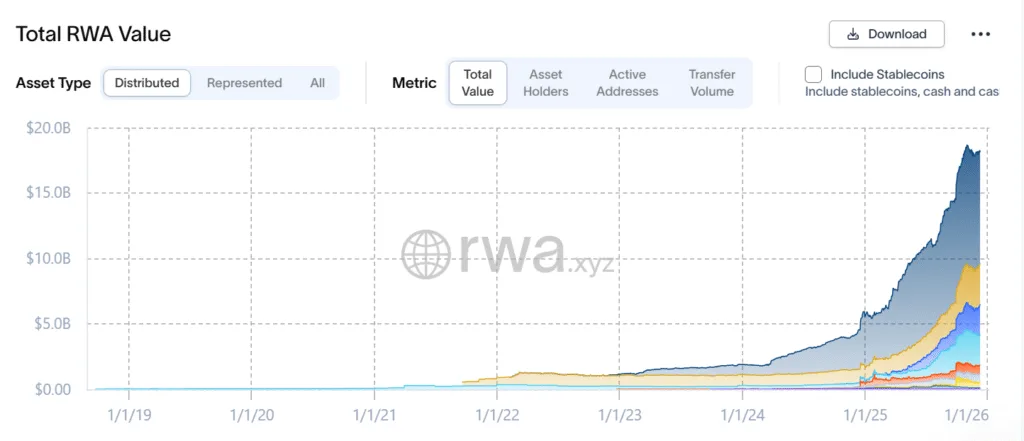

According to RWA.xyz, the total value of tokenized RWAs has peaked from $5.9 billion in 2024 to over $18 billion in 2025. This is a huge difference driven by multiple real estate tokenization, commodities, treasuries, and equities on Ethereum, Polygon, Ondo, Solana, Arbitrum, Avalanche, and more.

It is amid this tokenization boom, Mubadala Capital partnered with KAIO to explore how it can allow qualified investors to access private-market finds through tokenization.

A chart showing a rise in RWA tokenization volume

Mubadala’s move also marks its passion and efforts to bring innovation in fintech that enhances investor experience in private financial markets.

KAIO has been a prominent name in the RWA tokenization niche, and it is built on the Solana blockchain, where over $418 million worth of tokenized assets exist, ranging from stocks, institutional funds, to US Treasuries, and stablecoins.

Following the partnership, Fatima Al Noaimi and Max Franzetti, Co-Heads of Mubadala Capital Solutions, said: “The partnership reflects Mubadala Capital’s continued commitment to broadening access to institutional investment strategies through secure and innovative financial infrastructure.”

Mubadala’s crypto footsteps have already echoed in the UAE with a recent investment in a blockchain-focused fund. In 2024, the Abu Dhabi-based company invested in the blockchain-specialized fund of RW3 Ventures, a startup venture capital firm.

In October 2025, Mubadala Investment Company, the parent company of Mubadala Capital, invested a huge $534 million in BlackRock’s iShares Bitcoin Trust (IBIT).