As London draws new guardrails, Washington restores stability, and Trump courts momentum, crypto news today reads like a quiet tug of war between central authority and a decentralized future.

The rhythm of crypto news today feels almost cinematic. One act begins in London, another in Washington, and the third unfolds in the theater of American politics. These events do not arrive loudly. Instead, they simmer, shaping liquidity, regulation, and investor confidence in ways that define the next chapter of digital finance.

London’s bid for monetary order

In London, the Bank of England opened a new chapter by unveiling a consultation that seeks to regulate sterling-backed stablecoins by the second half of 2026. The United Kingdom is no stranger to financial innovation, yet this move feels unusually precise. Issuers would need to guarantee at least forty percent of liabilities in Bank of England deposits, with the remainder in short-term UK government debt.

This is less a clampdown and more a civil invitation into the formal banking arena. A holding cap of twenty thousand pounds per individual reflects caution without closing doors. For a nation that built centuries of trust in its financial ecosystem, the message is clear. Crypto can innovate, but it must grow inside the scaffolding of accountability.

The timing matters. While investors watch America wrestle with fiscal politics, Britain presents itself as a steady jurisdiction, ready to welcome digital finance under structured guidance. Here in crypto news today, regulation is not a threat. It is a maturing milestone.

Washington breathes, markets exhale

Across the Atlantic, the tension that dominated crypto news today eased when the United States Senate reached an agreement to end a shutdown that lasted forty days. That uncertainty weighed heavily on Bitcoin and the broader digital asset market. Bitcoin enjoyed a momentary burst above one hundred twenty-six thousand dollars before falling seventeen percent amid budget limbo and tariff shockwaves.

Relief brings oxygen. Policy clarity restores confidence. In digital markets governed by psychology as much as charts, stability is stimulus. The shutdown resolution signals renewed institutional function and, for investors, an invitation to re-enter risk with measured optimism. Policy shapes the ground upon which all narratives stand. Even in decentralized systems, the mood of the state still matters.

Trump’s tariff dividend and the liquidity question

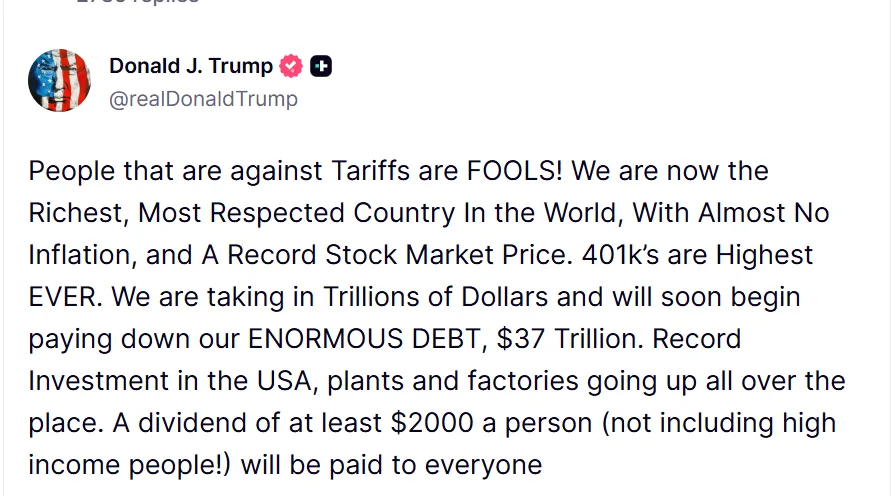

Then, in a move only American politics could produce, Donald Trump proposed the idea of a two-thousand-dollar tariff-funded dividend for most citizens, should legal review support it. Critics debate the economics, and supporters celebrate the populism.

But in terms of crypto news today, a liquidity injection means capital movement. Some of that money, if released, will inevitably find its way into speculative markets. Traders understand this reflex. Economists warn of inflationary pressure. Voters see direct benefit.

Whether or not the proposal succeeds, it reinforces a narrative that defines modern wealth: when traditional money strains under political weight, digital assets begin to look like shelter. Fresh liquidity often fuels crypto entry, and inflation concerns often accelerate Bitcoin positioning as a hedge. Two forces collide. Optimism in the short term, caution with money in the long term.

Key takeaway from the crypto news today

These three storylines converge into one truth. Governments are no longer battling crypto; they are shaping around it. When London embraces structured oversight, when the United States government restores fiscal continuity, and when Trump hints at liquidity that could ripple through every asset class, each event speaks to a world where digital finance is no longer fringe. It is foundational.

The result, as seen through crypto news today, is neither frenzy nor collapse. It is evolution. Policy is the new price signal. Trust is the new yield. And confidence is becoming the currency that decides who leads the next chapter of global finance. The market does not wait for a resolution. It responds to direction, and today, that direction points to maturity rather than mayhem.