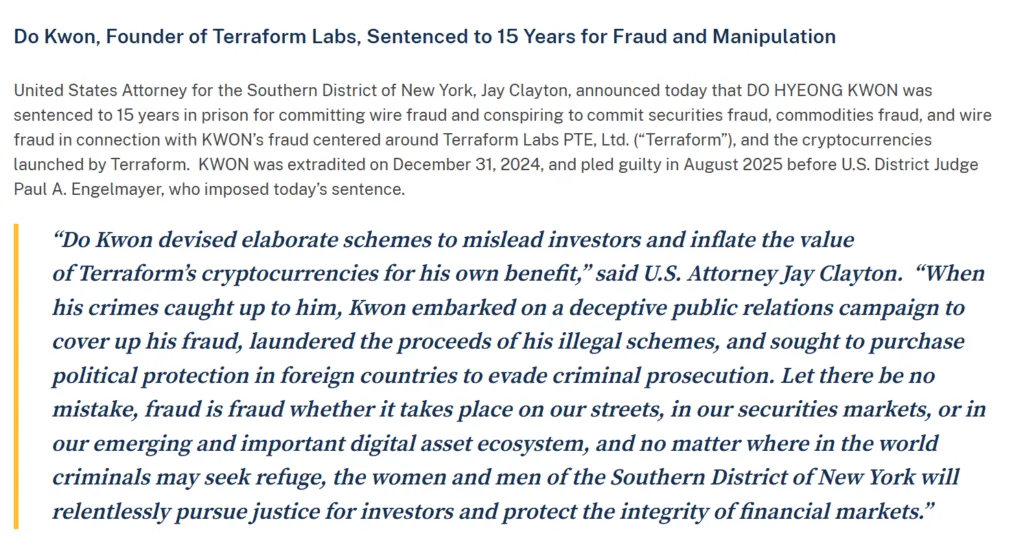

The Do Kwon sentencing to 15 years in federal prison marks a pivotal moment where the long-relied-upon “algorithm defense” collapsed under courtroom scrutiny. When U.S. District Judge Paul Engelmayer described the more than $40 billion TerraUSD and Luna implosion as “a fraud on an epic, generational scale,” he was doing more than sentencing a crypto founder. He was dismantling a dangerous industry myth: that complex code can excuse human deception and that invoking decentralization provides insulation from fraud charges.

For years, Do Kwon promoted a vision of financial order powered by an infallible algorithm. He sold investors on a self-contained ecosystem with its own stable money, TerraUSD, designed to hold a one-dollar value through automated protocol mechanics.

Both institutions and retail investors put tens of billions of dollars into the system, trusting that math, not people, would keep it stable. The Do Kwon sentencing shows that this story of technology being unavoidable was really a carefully hidden pattern of lying.

The lie at the heart of stablecoin

At the center of the prosecution’s case, and Kwon’s own guilty plea, was a fundamental falsehood. The Terra Protocol algorithm couldn’t keep TerraUSD’s peg in May 2021. The stablecoin fell below one dollar, which showed a serious flaw. Instead of admitting this mistake, Kwon worked with a high-frequency trading firm to quietly buy a lot of UST, which kept its price up.

Investors were told a different story in public. Kwon said that the algorithm had fixed the problem on its own. That claim changed the algorithm from a product into an excuse. Its complexity became a shield, hiding both the intervention and how weak the system was. The sentencing of Do Kwon shows that this first lie set off everything that happened next.

A house of cards built on interlocking deceptions

The secret support of UST was not an isolated lapse. According to the U.S. Attorney’s sentencing memorandum, Terraform’s ecosystem relied on multiple, reinforcing misrepresentations.

- First was the Luna Foundation Guard. Publicly presented as an independent reserve manager, it was in practice controlled by Kwon, with funds commingled and hundreds of millions of dollars misappropriated in ways prosecutors say concealed their origin and movement.

- Second was Mirror Protocol. Marketed as decentralized infrastructure for synthetic assets, it was allegedly manipulated through automated trading bots controlled by Terraform. Prosecutors also say user metrics were inflated to give a false impression of organic adoption.

- Third was the narrative around Chai, the South Korean payments app. Kwon cited Chai as proof of real-world usage on Terra. In reality, Chai processed payments through traditional rails. Terraform later mirrored that data onto the blockchain, creating the appearance of on-chain economic activity.

- Finally, prosecutors pointed to a pool of roughly one billion so-called Genesis stablecoins, embedded at launch. Their purpose shifted depending on the audience, but according to the government, they functioned as a discretionary funding source for market manipulation and false activity.

When the math finally caught up

By May 2022, the system could no longer be sustained. TerraUSD’s market had grown roughly ninefold from the prior year. The same tactics that masked instability in 2021 were ineffective at scale. The peg collapsed, and TerraUSD and Luna, which together had exceeded a $50 billion valuation, spiraled toward zero. More than $40 billion in value evaporated in days.

The Do Kwon sentencing was mostly about how it would affect people. Hundreds of letters from victims told how their money problems got worse. Ayyildiz Attila, one of the investors, said he lost between $400,000 and $500,000, which he had saved for years, almost right away.

What the Do Kwon sentencing establishes

The Do Kwon sentencing sends a clear legal signal to the digital asset industry. Judge Engelmayer imposed a term exceeding the prosecution’s minimum request, underscoring that claims of algorithmic design or decentralization do not dilute the obligation to disclose material facts.

The idea is simple. If a project says it is algorithmically stable but actually depends on market support that is not guaranteed, that is fraud. When users think they are in charge of a system but insiders change the results, that is fraud. Code does not nullify intent, and complexity does not justify concealment.

Terraform’s bankruptcy process is now what investors need to happen for their investments to recover. A claims portal is open, and the court is overseeing the sale of the remaining assets. The SEC settlement, which is worth more than $4.5 billion, will mostly be seen as an unsecured claim, which means that a full recovery is unlikely.

The Do Kwon sentencing closes one of crypto’s most consequential criminal cases. Its broader significance lies in what it clarifies. A scheme executed through code is still judged by human decisions. The algorithm may have been presented as the explanation, but in court, it became the evidence.