The crypto market witnessed the launch of two brand-new exchange-traded funds (ETFs) today. Notably, asset manager Grayscale’s Dogecoin (DOGE) and XRP spot ETFs were listed on the New York Stock Exchange (NYSE), providing institutional investors with easy access to the two major digital assets.

NYSE approves DOGE ETF

According to an official announcement by leading crypto asset management firm Grayscale, the top memecoin, DOGE, now has its own ETF on NYSE Arca. The Grayscale Dogecoin Trust ETF will trade on the exchange with the ticker GDOG.

Per sources close to the matter, the total assets under management in the Dogecoin ETF currently stand at slightly above $1.5 million, while the number of total DOGE tokens in the ETF is just above 11.13 million.

Each share of Grayscale’s spot Dogecoin ETF is redeemable for 117.59 DOGE. The ETF’s gross expense ratio will remain at 0% for the first three months, or until the fund hits $1 billion in assets, whichever comes first.

Following the 3-month waiver period ending February 24, 2026, the fund will charge a fee of 0.35%. However, brokerage fees and other expenses will still apply.

A flurry of XRP ETFs is hitting the market

Meanwhile, a series of XRP ETFs is expected to hit the market in the short term. Alongside their Dogecoin ETF, Grayscale has also launched a spot XRP ETF. The US Securities and Exchange Commission (SEC) gave the green light to the XRP ETF on November 21.

Besides Grayscale’s XRP ETF, another spot XRP ETF by Franklin Templeton has also been listed on the NYSE. In addition, an XRP ETF from WisdomTree is also expected to hit the market in the coming weeks.

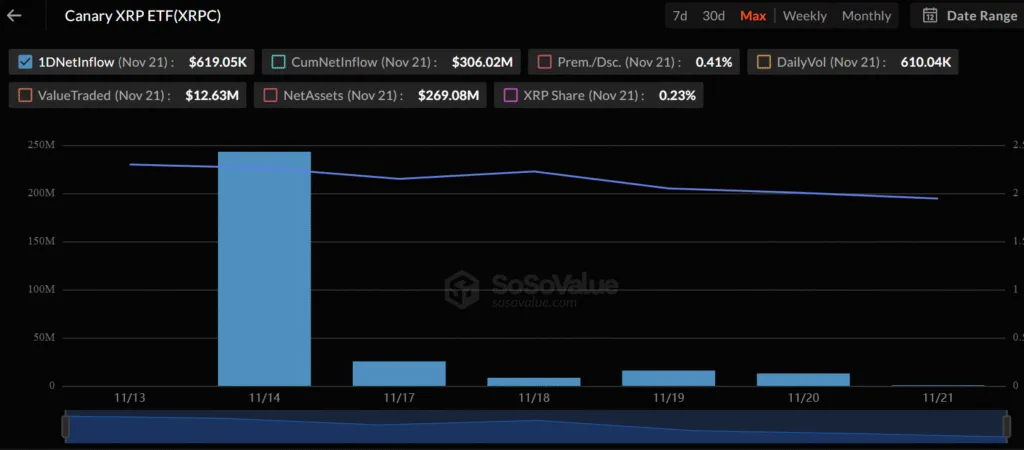

To recall, Canary Capital launched the first-ever spot XRP ETF in the US earlier this month, on November 13. According to data from SoSoValue, Canary Capital’s Nasdaq-listed XRPC ETF currently has Net Assets worth $269 million.

That said, the wider crypto market sentiment remains fragile at best. For the week ending November 21, $1.22 billion worth of funds exited Bitcoin (BTC) ETFs, while Ethereum (ETH) ETFs witnessed a net outflow of slightly more than $500 million.