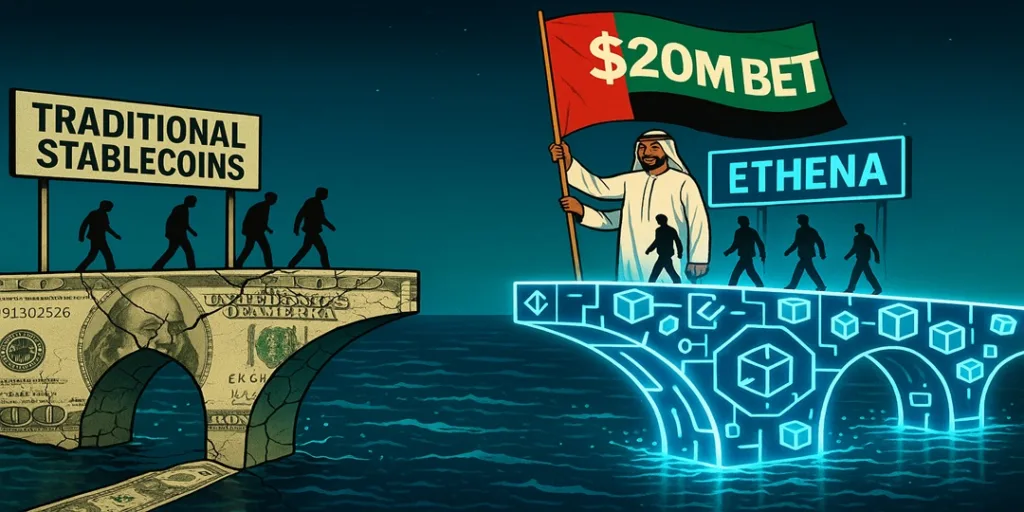

The UAE continues to prove it’s not just a spectator in the global crypto race. This week, M2 Capital invested $20 million into Ethena, a synthetic stablecoin protocol that promises to rethink how stability works in decentralized finance.

For a region that prides itself on being a fintech pioneer, this is a bold move. Synthetic stablecoins don’t have the same backing as traditional ones like USDT or USDC. Instead, they rely on innovative financial engineering, often blending crypto collateral and derivatives to stay pegged.

Why Ethena?

Ethena’s pitch is simple: build a more scalable, capital-efficient stablecoin. Instead of depending solely on fiat reserves, it uses hedging strategies to maintain its peg. It’s a fresh approach in a market dominated by Tether and Circle.

M2 Capital’s bet isn’t just financial. It’s symbolic. By backing Ethena, the UAE is showing it wants to shape the next wave of stablecoins, not just adopt what’s already mainstream.

The regional context

This investment is even more striking given the regulatory climate. The UAE Central Bank has been cautious about synthetic stablecoins, favoring asset-backed tokens instead. For M2 Capital to step into this space anyway signals confidence that synthetic models can coexist with or even challenge the giants.

For U.S. observers, the move highlights a growing divergence. While American regulators often stall crypto innovation, the UAE is writing its own playbook. And it’s working.

Impact of M2 Capital’s bet on Ethena

Stablecoins have proven to be pipes of the digital economy, other than just another crypto product. If Ethena succeeds, it could show that stability doesn’t need to come from a pile of U.S. dollars sitting in a bank. It could come from smart contracts, hedges, and innovation.

For investors, this opens new opportunities and risks. Synthetic models are powerful but complex. If they hold, they could scale faster than traditional stablecoins. If they break, the fallout could be brutal.

Closing thoughts

The UAE’s $20 million bet on Ethena is more about influence, not just about money. By backing a cutting-edge stablecoin protocol, the region is sending a clear message: it wants to lead in building the future of finance.

As synthetic stablecoins enter the spotlight, the world will be watching to see if this bold experiment pays off. Either way, the UAE has positioned itself at the center of the story.