There are moments in history when legacy meets innovation, and this week, Western Union may have crossed that invisible line.

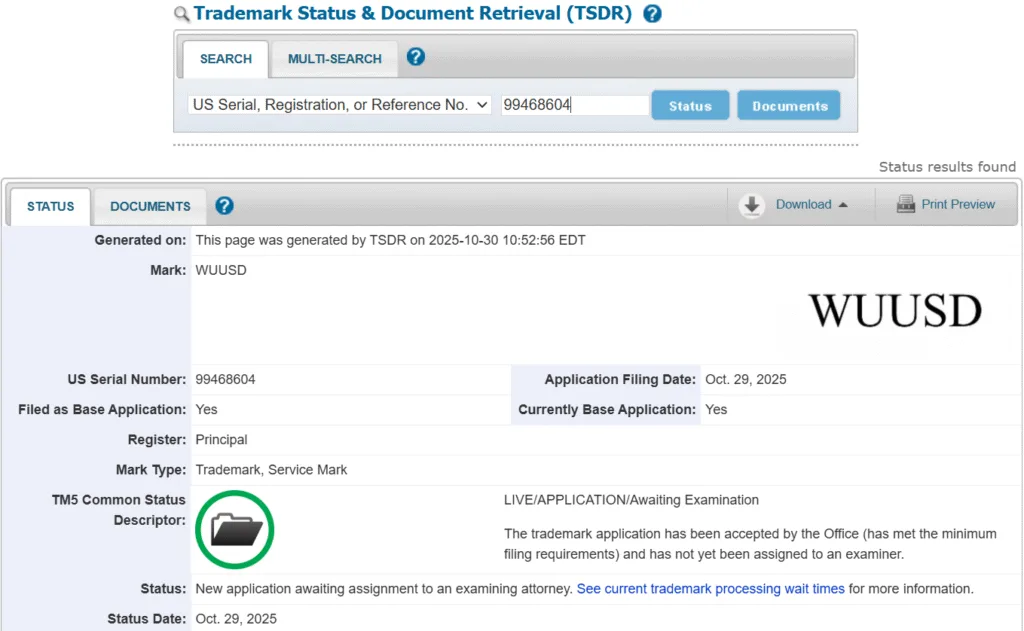

Just twenty-four hours after unveiling USDPT, its Solana-powered stablecoin set to launch in early 2026, the century-old remittance giant filed a new trademark for “WUUSD” with the U.S. Patent and Trademark Office.

The filing, dated October 29, 2025, lists wallet software, crypto payments, trading, and exchange services, all under the Western Union Holdings umbrella. It’s still waiting for examination, but the message is loud and clear: the company that once relied on telegrams and paper transfers is stepping deeper into the blockchain world.

So, what is WUUSD really? A second stablecoin? A rebrand? Or perhaps a signal of something bigger in motion, a full transformation of Western Union’s global network into a digital-asset powerhouse?

A tale of two tokens: Western Union’s WUUSD vs. USDPT

Right now, the details are scarce. Western Union has not commented publicly on whether WUUSD and USDPT will coexist or eventually merge. But the timing of this filing feels deliberate, almost strategic.

Imagine USDPT as the back-end engine, the stablecoin infrastructure powered by Anchorage Digital Bank, while WUUSD could become the sleek, customer-facing brand inside Western Union’s app ecosystem. Think of it as the difference between the processor chip and the smartphone; one does the heavy lifting, the other builds trust and usability.

In simpler terms, WUUSD might just be Western Union’s way of making stablecoins feel familiar, friendly, and easy to use for the millions of people who depend on its services every day.

To understand why this matters, it helps to remember who we’re talking about. Western Union is not a crypto startup chasing headlines. It’s a 170-year-old financial institution with deep roots in cross-border remittances. From sending telegrams in the 19th century to wiring funds across continents in the 20th, the company has always existed to move value, just through different mediums.

Now, with Solana’s blockchain in the mix, Western Union is signaling that value transfer in the 21st century will no longer depend on bank corridors or correspondent networks. It will depend on code, speed, and trust, three things traditional finance has struggled to balance.

For millions of families in regions like Latin America and Africa, this could be the difference between preserving value and losing it overnight.

More than just a coin

Beyond the headlines, this move hints at something deeper, a corporate identity shift. Western Union isn’t just testing blockchain anymore; it’s designing a digital asset network that could redefine how money moves globally.

The trademark filing also covers trading and wallet software, clues that Western Union could eventually compete with fintech players like PayPal and Revolut. The company may be building a future where users can send money, store stablecoins, and exchange currencies, all within a single Western Union-branded ecosystem.

If that’s true, WUUSD might not just be a stablecoin. It could be the face of a new digital era for a company that has outlived empires, wars, and banking revolutions.

A measured leap into the future

Still, Western Union’s leadership remains cautious. Chair and CEO Devin McGranahan has said repeatedly that the company’s goal is to “modernize without abandoning its global mission.” That means stability first, innovation second.

So while other firms chase hype, Western Union is taking a measured approach, layering technology onto trust, rather than replacing it.

And that’s what makes WUUSD so intriguing. It’s not just another token or a flashy crypto experiment. It’s the quiet hum of transformation inside a 170-year-old machine that refuses to become obsolete.

In the end, whether WUUSD and USDPT turn out to be two stablecoins or one rebrand in progress, one truth stands out: Western Union is no longer just delivering money; it’s delivering the future of money itself.