The cryptocurrency market has undergone a significant transformation since its inception. Since Bitcoin’s launch in 2009, followed by Ethereum’s entry into the industry in 2015, the industry’s market capitalization has increased significantly, currently standing at slightly above $3 trillion.

However, besides the increasing market cap, investor behavior toward the market has also experienced a grand shift. Instead of simply relying on exaggerated articles or social media posts, investors are now more informed and look beyond just the surface-level hype.

In 2026, investors and even small traders are increasingly relying on on-chain metrics, separating noise from signal to get real insights about an altcoin’s behavior and possible future price trajectory.

Platforms like Nansen, Arkem Intelligence, Dune Analytics, and Etherscan can offer tremendous insights into altcoin movements and help investors anticipate their next movement.

What exactly is on-chain data?

Before diving into on-chain analytics platforms like Nansen, Arkham Intelligence, Dune Analytics, and others, let us first understand the meaning of the word. Put simply, on-chain data means any data that is fed onto the blockchain network. This can be one of the many metrics, such as wallet balances, token transfers, token types, transaction hashes, smart contract interaction, transaction time, and others.

On-chain data offers more reliability and transparency compared to off-chain data that might come from exchanges or social media accounts that might or might not be accurate. On-chain data is blockchain-based data, so it is easily verifiable, immutable, and public.

Using Nansen to identify smart money activity

A leading premium on-chain analytics platform, Nansen combines blockchain with wallet labeling. Investors can use Nansen to track activities of the so-called large wallets or ‘crypto whales.’

The ‘smart money’ feature on Nansen allows investors to use several metrics to understand the movement of altcoins on a granular level. For example, users can tap the Whale Wallet Tracking feature to monitor the activities of certain wallets that hold the largest amount of a particular token.

By using Whale Wallet Tracking, investors can have a deeper understanding of when the whales are accumulating, selling, holding, or aggressively buying a particular token.

Further, users can also track token distribution among different wallets to get an idea about the concentration of held tokens. This metric can be used to make informed decisions, as highly concentrated holdings may increase manipulation risks, while a more distributed ownership could suggest organic demand.

Finally, Nansen users can also track decentralized finance (DeFi) activity, as the platform records interactions with DeFi protocols. This allows users to see which wallets are staking, lending, or providing liquidity on DeFi platforms. If the ‘smart wallets’ are providing liquidity on a protocol, it could be a worthwhile idea to also stake your tokens to benefit from yield farming.

Using Arkham to explore wallet intelligence

Arkham Intelligence is a powerful analytics service that can help investors better understand whale wallet behavior and develop valuable insights. Arkham differs from Nansen in that while the latter helps users identify smart money, Arkham helps you uncover connections and behavior across different wallets.

For example, Arkham Intelligence tags wallets associated with crypto exchanges, protocols, and other publicly known entities, including famous investors such as Arthur Hayes and others.

Arkham Intelligence also helps you map network activity that can teach you how tokens move across wallets and protocols. Investors can use this feature to identify and analyze patterns such as token transfers, staking, or high-volume trading.

Finally, Arkham also offers notifications for any major move made by a wallet that you are closely tracking, giving you the opportunity to react quickly to any significant on-chain moves.

Let’s go through an example. Imagine you are researching a non-fungible token (NFT), such as ApeCoin. By using Arkham Intelligence, you can see whether the token is just being traded among whale wallets to give the retail investors the illusion of high demand for the token or if it is actually being used in the Bored Ape Yacht Club ecosystem, driving its organic demand.

Leverage Dune Analytics for custom insights

Dune Analytics is one of the most powerful on-chain analytics tools out there. The best part about the platform is that it is completely free to use. While there is a paid package available, individual traders can use the free version and enjoy most of the platform’s benefits.

Dune Analytics differs from both Nansen and Arkham Intelligence in that it allows users to find the data they want using their inputs. Users must have a basic-level understanding of structured query language (SQL) to query the hundreds of thousands of datasets available on Dune Analytics and create their own custom dashboards.

Users can benefit from Dune Analytics by writing custom SQL queries to pull specific metrics, such as token transfers, trading volume over a given period, leading token holders, liquidity pool participation, and more. The ability to query data can be especially useful when trying to understand the mechanisms of a new altcoin.

Experienced analysts at Dune Analytics share dashboards publicly, enabling casual users to get quick access to important data to make informed decisions. This helps individuals who don’t possess strong SQL skills to query the databases.

Assume you are trying to estimate the demand for a newly launched project’s governance token. By using Dune Analytics, you can identify the top wallets that frequently participate and vote in governance proposals. If an increasing number of wallets are frequently voting in governance proposals, it may indicate an active community and long-term growth.

Use Etherscan to understand Ethereum transactions

While not quite as advanced as Dune Analytics or Nansen, Etherscan is indispensable to the crypto ecosystem, as it allows users to check and verify Ethereum and the Ethereum Request for Comment (ERC-20) token transactions as soon as they are posted on the blockchain.

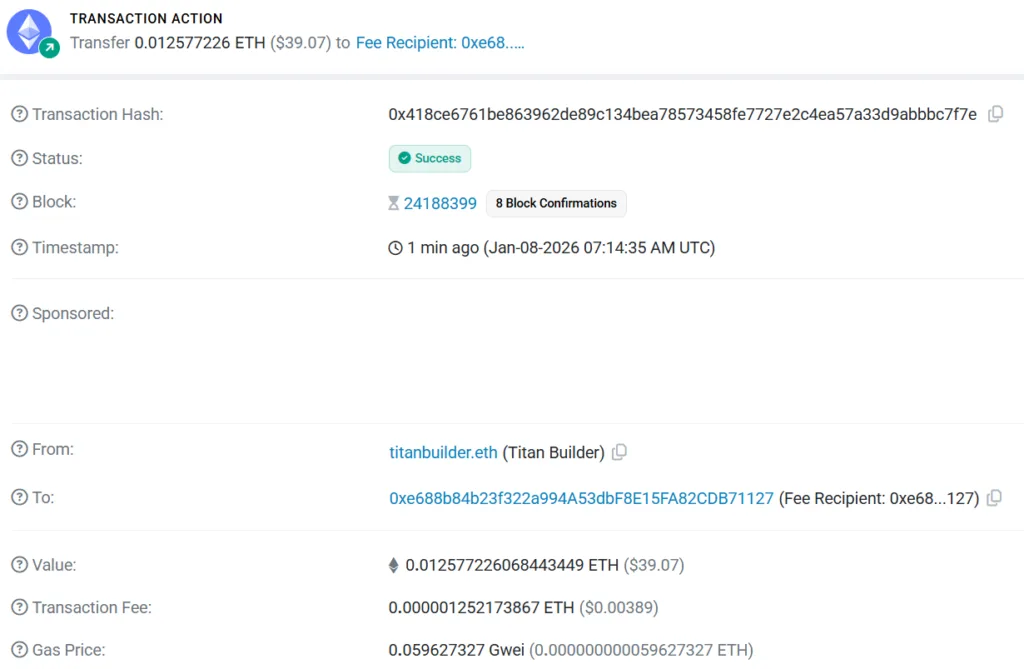

The following screenshot from Etherscan of a recent transaction shows several important details. It shows the ‘sender,’ the ‘receiver,’ the block on the Ethereum blockchain in which the transaction was included, a unique transaction hash that works as a primary ID for every transaction, the ‘status’ of the transaction, the value, the transaction fee, the gas fee, and more.

If you explore Etherscan, there are tons of other features that are available to better understand ETH transactions. For example, there is a separate section only for charts and statistics about Ethereum transactions, top NFTs, developer tools, and a lot more.

Consider the following example, which can help an investor better understand the tokenomics of a newly launched token on the Ethereum blockchain. For a new project, you can check the project’s smart contract to ensure that the code used is legitimate and doesn’t have any hidden functions that can lead to unlimited token minting or any rug pulls.

Key on-chain metrics to watch

To conclude, while there are plenty of platforms to analyze blockchains, wallets, token movements, and other metrics, it’s important to actually focus on the numbers that matter and not fall into analysis paralysis.

Some key metrics to gauge the health of a token include active addresses, token volume, token concentration, exchange inflows and outflows, and interaction with DeFi protocols. A decision made after analyzing these metrics is more likely to work in your favor than not.