Every time someone sends cryptocurrency, there is an invisible agreement taking place. No bank approves the transfer, no central server records it, and no authority decides whether it should go through. Yet, within minutes, the transaction is accepted, recorded, and reflected across the network. This situation raises a simple but important question: who is actually making these decisions? What happens behind the scenes?

In traditional finance, trust is placed with the banks. In this system, trust is based on rules that everyone must follow to send a transaction successfully; these rules determine who can send transactions, how a transaction is validated, and what occurs if one of the participants fails to comply. Together these rules are called the blockchain consensus algorithm.

How do consensus mechanisms work?

Although different blockchains rely on different consensus mechanisms, the underlying idea remains largely the same. The network requires a participant to demonstrate commitment in some form before allowing them to help update the blockchain. This commitment may involve locking up funds, spending computational power, or dedicating time and resources to maintain the network.

The rationale behind this design is clear. People who have put their money into something are much less prone to cheat. If they tried to change the blockchain, they would be putting their money in danger.

Consensus systems function in practice by striking a balance between incentives and penalties. Those who follow the rules are rewarded, while those who disobey are punished or kicked out. This system allows the blockchain to function effectively without requiring trust in any single individual.

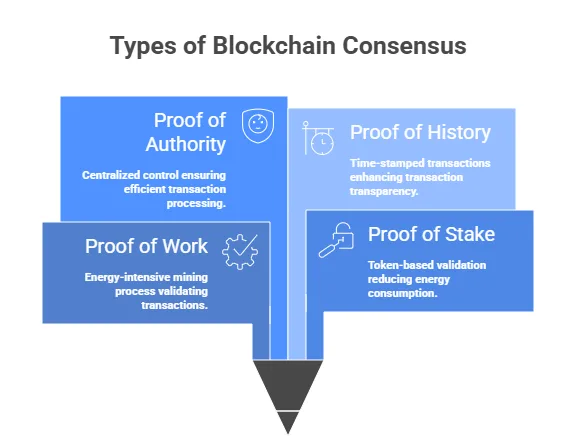

Major types of consensus algorithms

Since the launch of Bitcoin, blockchain networks have experimented with various techniques to establish consensus. The goal has always been the same: to keep the network safe, up-to-date, and hard to change. But the methods for reaching this goal have changed a lot over time.

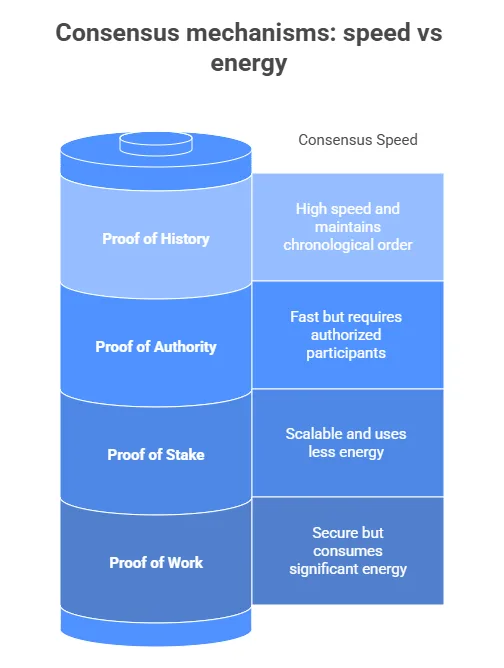

There is always a trade-off with consensus algorithms. Some people care more about safety, while others care more about speed, energy consumption, or ease of joining. It’s important to understand all these trade-offs, as they show why there are some blockchains in the crypto market that are slower but more decentralized and others that are faster and rely on fewer people.

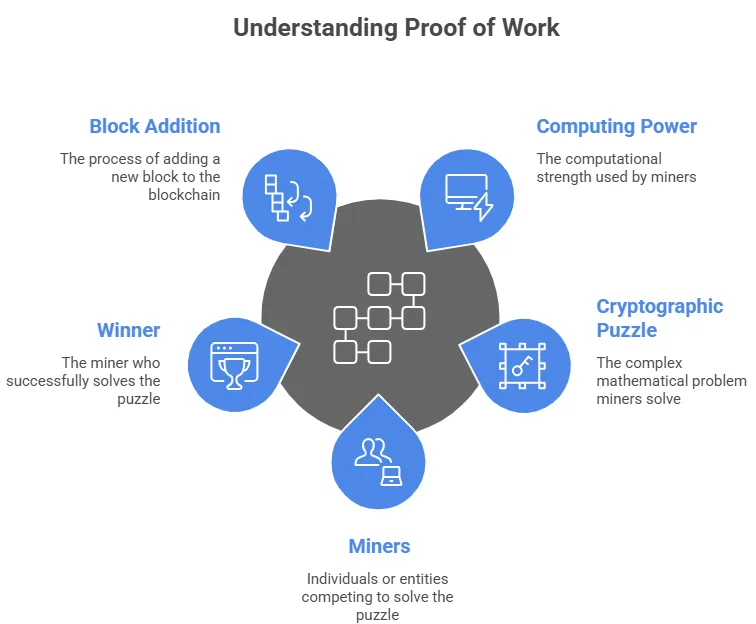

Proof of Work (PoW)

Proof of Work (PoW) was used to reach consensus on the Bitcoin blockchain at first. Miners use their computers to solve hard math problems to compete with each other. The first miner to solve the puzzle gets to validate transactions and add a new block to the blockchain. Because PoW relies on physical resources, it works well. Mining need

specialized equipment, electricity, and ever-rising costs. Such a structure makes it difficult to attack the network since changing the transaction history would require a large amount of CPU power.

The blockchain definition remains the same. It hasn’t been easy to change the way people think about blockchain over the years. But this level of safety comes with certain costs.

This design is meant to prioritize security over speed. PoW makes it very hard for one person to take over the network by linking the cost of making blocks to real-world costs. Over time, this trade-off has shaped how people view blockchains like Bitcoin as systems built to last, not systems built to move fast.

This design intentionally favors security over speed. By tying block creation to real-world costs, PoW makes it extremely expensive for any single party to gain control of the network. Over time, this trade-off has shaped how people view blockchains like Bitcoin as systems built to last, not systems built to move fast.

PoW networks are slow and consume a significant amount of energy when processing transactions. As more individuals use blockchain, these anxieties have led developers to look at other ways to do things.

How Bitcoin and PoW in real life

Bitcoin still uses PoW since its main goal is security and immutability. The Bitcoin network’s main goal is to be very hard to change, not to be quick or inexpensive. There are miners all across the world, and no one group is in charge of checking transactions.

Because of this design, Bitcoin is very hard to censor and attack. This is why many people see it as a digital store of wealth instead of a fast payment network. Bitcoin is willing to accept slower transaction times and increased energy use in exchange for long-term stability.

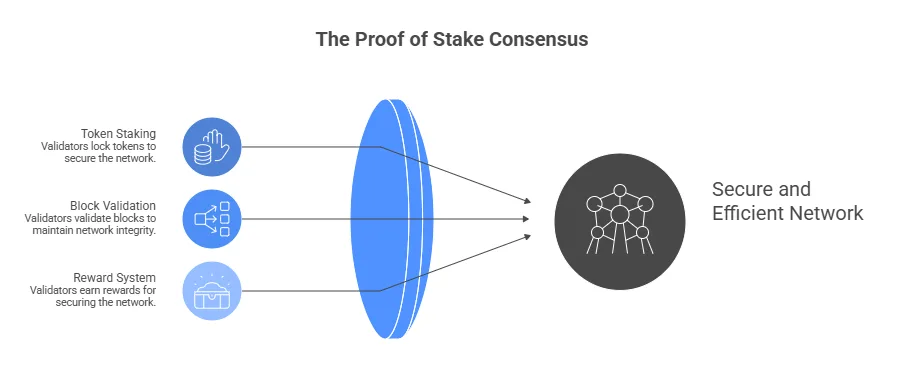

Proof of Stake (PoS)

Proof of Stake (PoS) was made to consume less power than PoW. Validators don’t try to beat computers; instead, they “stake” their tokens to help keep the network safe.

Validators are chosen to suggest and check new blocks based on how much they have staked and other rules that are exclusive for that network. A validator may lose some of the money they invested if they act dishonestly. This feature gives people a compelling reason to follow the rules and do what’s best for the network.

PoS doesn’t need mining, which uses a lot of energy; hence, it speeds up transactions and uses less power. It is the greatest solution for both new blockchain networks and changes to old ones because of these properties.

Ethereum’s move to PoS

Like Bitcoin, Ethereum once used PoW but eventually switched to PoS to make it easier to scale and use less energy. By switching to PoS, Ethereum used a lot less energy. This made it better able to support decentralized apps, smart contracts, and decentralized finance platforms.

Staking helps people to maintain the network safe without having to buy expensive mining equipment. This change illustrates that Ethereum wants to be more than just a safe place to keep money; it wants to be a blockchain that can do a lot of different things.

Proof of Staked Authority (PoSA)

Proof of Staked Authority (PoSA) is a combination of PoS and a better way to check transactions. This way, only a small number of validators are chosen. It depends on how much they put in and how well-known they are in the network.

When there are fewer validators, the validation is fast and easy, although this efficiency comes at a cost. The system is less decentralized because it depends on a smaller group of validators.

In practice, this approach works best in environments where participants are already known or vetted in some way. Instead of relying on open competition or large validator pools, these networks prioritize predictability and coordination. in turn, the consensus process becomes more streamlined, paving the way for models that rely entirely on trusted validators rather than staking or mining.

The network don’t need miners or stakers to work. Instead, it uses a set of trusted validators to check transactions and agree in order which they process.

These validators talk to each other all the time until they reach an agreement, which usually happens in a few seconds. This design lets the network process transactions rapidly and cheaply.

RPCA works quickly and well, but it needs a properly chosen group of validators to do so. The technology isn’t as decentralized as permissionless blockchain networks because it depends on people who can be trusted.

Proof of Staked Authority-using networks

Blockchains that wish to conduct transactions quickly and affordably, typically for commercial or application objectives, frequently use Proof of Staked Authority. Binance Smart Chain is a prime example, where block creation is handled by a small number of validators.

For consumers of decentralized apps, this structure maintains the network’s affordability and efficiency, although it does so at the expense of some decentralization. These networks prioritize performance and usability over minimizing trust.

Ripple and validator-based consensus

Banks and payment processors are primarily responsible for building Ripple’s network. Instead of allowing everyone to join, it makes use of a predetermined list of validators that the network is familiar with and trusts.

This makes it possible for transactions to settle in seconds with very cheap fees, which makes it good for payments between countries and moving money around.But this method makes the network more like a permissioned system, where decentralization isn’t as strong as it is in Bitcoin or Ethereum.

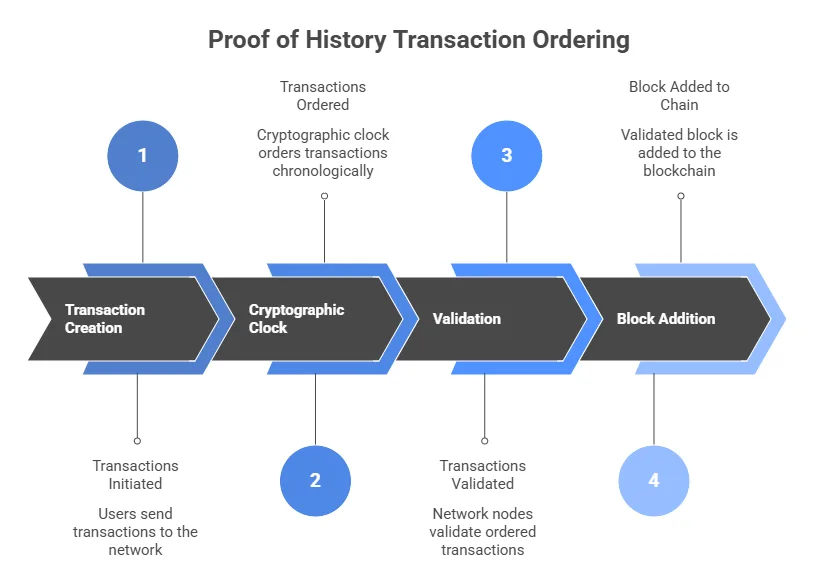

Proof of History (PoH)

Proof of History (PoH) is different from other blockchain consensus methods because it relies on time. PoH lets the system prove that a certain amount of time passed between two events using cryptography. They don’t need to keep talking to each other to agree on the order in which the transactions should happen.

Everyone can see the network’s schedule, which makes it easier for people to work together and get things done. If transactions are in the right order and are processed quickly, a blockchain can handle a lot more things on the network without any problems.

PoS and PoH are often used together to make this work in real life. One focuses on safety and economic incentives, while the other brings structure and timing to the network, keeping it safe and organized.

PoH and Solana

PoH and PoS work together on Solana to make transactions move faster. PoH is like a built-in clock that tells the network what order to process transactions in, When validators are working on more than one transaction at a time, they don’t have to talk to each other all the time because they already know what order the transactions are in.

Solana is a great choice for apps that need to be fast, like games, real-time trading platforms, and decentralized apps that put users first. But this level of performance comes at a price. You need powerful hardware to run a validator, so it’s harder for smaller operators to take part.

As blockchain technology gets more efficient, it’s unlikely that one way of reaching consensus will work for everyone. Different algorithms will still be around, but each one will be better at achieving certain goals, such as speed, efficiency, or security.

If you know how these systems work, it will be easier to understand how blockchains work. This is why agreement is still one of the most important parts of any blockchain network.