Traders are taking bigger bets on the Cardano (ADA) futures market as the discussion around the launch of Grayscale’s Cardano spot exchange-traded fund (ETF) has risen. Despite the excitement revolving around the launch of the ETF, ADA failed to break through an important resistance level. Weakening fundamentals are the main cause of the failure, says the analyst.

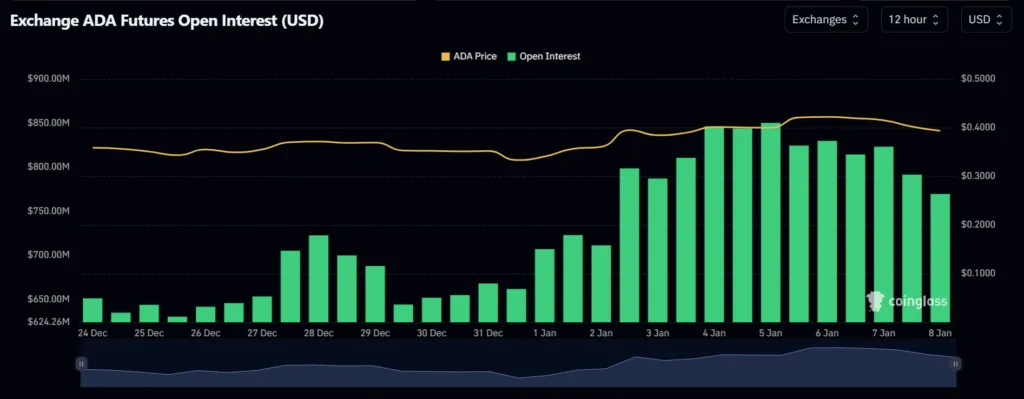

The ADA futures open interest (OI) spiked, and traders showed a greater appetite for risk as the discussion about the launch of Grayscale’s ADA ETF spread widely. The open interest, which represents the aggregate of futures open contracts, increased from $660 million on January 1 to nearly $850 million, its highest level this week.

The spot ADA prices move up and down based on the futures market. The futures market and the spot market are interconnected through pricing, arbitrage, and settlement mechanics. Spots represent the current price of an asset, while futures reflect expectations of its future price. If futures drift too far from spot, arbitrageurs step in—buying one and selling the other – which pulls the prices back together.

Although ADA’s price appreciated, it was not enough for the coin to push past the 50-day moving average, which is at $0.42. The token hit this level and retraced, but it still managed to hold the uptrend.

Cardano’s fundamentals have continued to weaken even as narratives resurface. The chain’s TVL has fallen sharply from around $700 million in December 2024 to roughly $190 million today, which points to capital leaving and not returning. There have been no meaningful adoption-led announcements over this period to explain or reverse that trend.

Lavneet Bansal, Analyst, 0xThree

Bansal further mentioned that what remains is a loud but insular community narrative that doesn’t match on-chain reality. As such, the recent ETF chatter around Grayscale shouldn’t be mistaken for validation.

He added, “Grayscale is a seller of financial products, not a judge of protocol health.” So in that context, Cardano’s current valuation looks disconnected from actual usage and economic activity on the chain.”