Citing a few coins outperforming Bitcoin over the past 60 days, a crypto market intelligence platform generalized that alts are overpowering Bitcoin. Bitcoin dominance is showing classic behavior of altseason during the past altseason.

However, the analyst states that cherry-picking a narrow sample and framing thin liquidity chases into legacy laggards, as altcoin season is a stretch.

AXS, CHS, and Atom outperform BTC

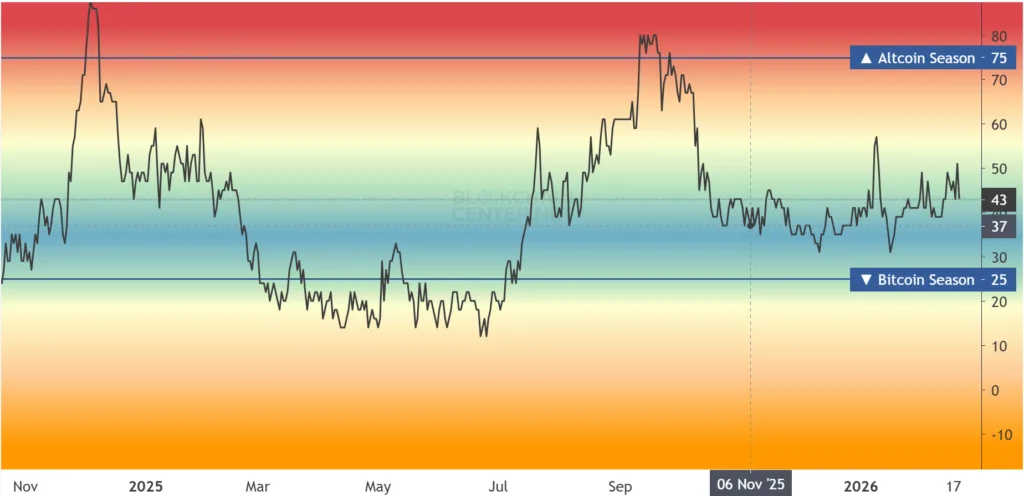

Some altcoins have delivered stronger performance than BTC over the past 60 days, including AXS, CHZ, ATOM, and PEPE. This comes in the wake of the Altcoin Season Index (ASI) maintaining an uptrend. Currently, showing a value of 43 on its scale, the ASI is heading into the altseason territory. The ASI indicator has risen from 31 in mid-January to 43 as of the time of writing.

The ASI indicator takes into account the top 50 tokens, excluding Bitcoin, and if 75% of the top 50 tokens outperform Bitcoin, ASI moves into altseason territory.

Altcoin market cap bound to spike

Meanwhile, the altcoin market cap has been trading inside a rising wedge, making higher lows and higher highs. Now that the alt market cap is close to the lower trendline, it should technically rebound and head towards the upper trendline as shown below.

Bitcoin dominance supposed to crash

The Bitcoin dominance has fallen in typical style, reciprocating the previous altseason in 2021. As shown in the chart, the BTC dominance made a new lower high, and now the pattern is destined to crash. This means Bitcoin’s market cap compared to the altcoins’ market cap will reduce.

However, analyst Lavneet Bansal stated that calling this the start of “altcoin season” is a stretch.

Fifteen out of 55 tokens outperforming a Bitcoin that’s down 24% isn’t broad rotation; it’s thin liquidity chasing high-beta names like PEPE and legacy laggards like AXS and ATOM. When leadership comes from meme coins and long-term underperformers rather than protocols with real revenue and durable fundamentals, it signals volatility, not strength.

Analyst Lavneet Bansal

He mentioned that framing this as a regime shift is effectively cherry-picking a narrow sample to manufacture a narrative.